Blockchain banking is changing the way digital transactions are processed by making them more secure, transparent, and efficient. Traditional banking systems rely on centralized databases, which can be slow and vulnerable to fraud or cyberattacks. Blockchain banking uses distributed ledger technology to record transactions across multiple systems, reducing risk and improving trust. In this guide, we explain how blockchain banking is reshaping secure digital transactions for individuals and businesses.

How Blockchain Technology Works in Banking?

Blockchain banking is changing how financial institutions process, record, and secure transactions. At its core, blockchain technology is a distributed digital ledger that records transactions across multiple computers instead of one central system. In banking, this means transaction data is shared across a secure network rather than stored in a single database controlled by one authority.

When a transaction occurs in blockchain banking, it is first verified by network participants called nodes. These nodes follow predefined rules to confirm whether the transaction is valid. Once approved, the transaction is grouped with others into a “block.” This block is then added to a chain of previous blocks, creating a permanent transaction history. Because each block is connected to the previous one, altering past records becomes extremely difficult.

Traditional banking systems rely heavily on intermediaries such as clearinghouses and payment processors. Blockchain banking reduces this dependency by allowing peer-to-peer transactions. This not only speeds up transactions but also lowers operational costs. Banks can process payments, settlements, and transfers more efficiently without relying on multiple middle layers.

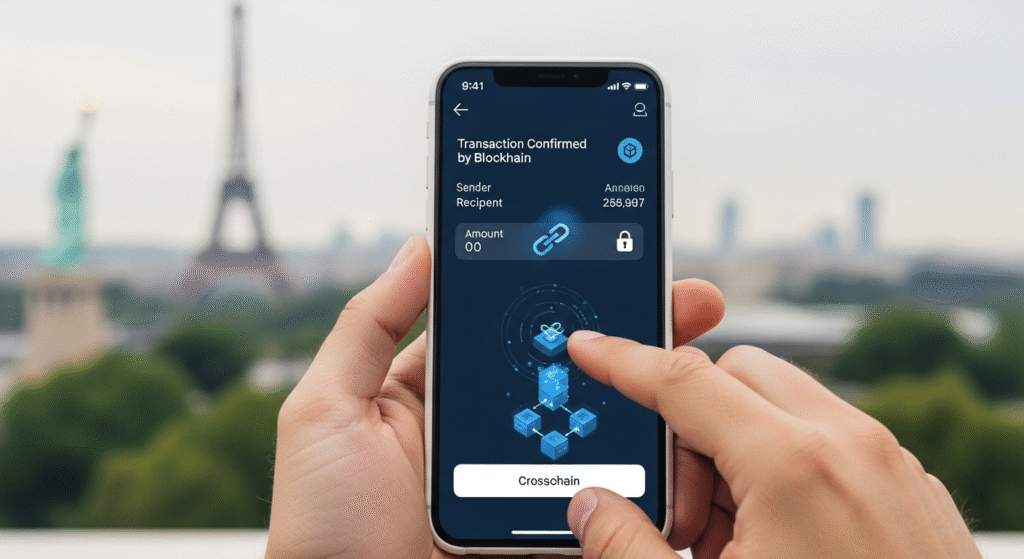

Another key feature of blockchain banking is real-time transaction visibility. Authorized parties can view transaction status instantly, reducing delays and disputes. This is especially useful for cross-border payments, where traditional banking systems often take several days to complete transfers.

Decentralization and Its Impact on Transaction Security

Decentralization is one of the most important features of blockchain banking. Unlike traditional banking systems that rely on centralized servers, blockchain banking distributes data across a network of computers. This structure significantly improves transaction security.

In centralized systems, a single point of failure can lead to major security breaches. If a central server is hacked, attackers can access sensitive financial data or manipulate transaction records. Blockchain banking eliminates this risk by spreading data across multiple nodes. To compromise the system, hackers would need to control a majority of the network, which is extremely difficult and costly.

Decentralization also reduces the risk of internal fraud. Since no single authority controls the entire system, unauthorized changes are easily detected. Every transaction must be validated by the network, making fraudulent activity more visible and harder to execute.

Another advantage is improved system resilience. Even if one node fails or goes offline, the network continues to operate smoothly. This ensures uninterrupted banking services and enhances reliability for customers and institutions.

In blockchain banking, decentralization also promotes fairness and trust. Transactions follow transparent rules enforced by technology rather than human intervention. This minimizes bias, errors, and manipulation, making the banking system more secure and dependable.

Transparency and Immutability of Blockchain Records

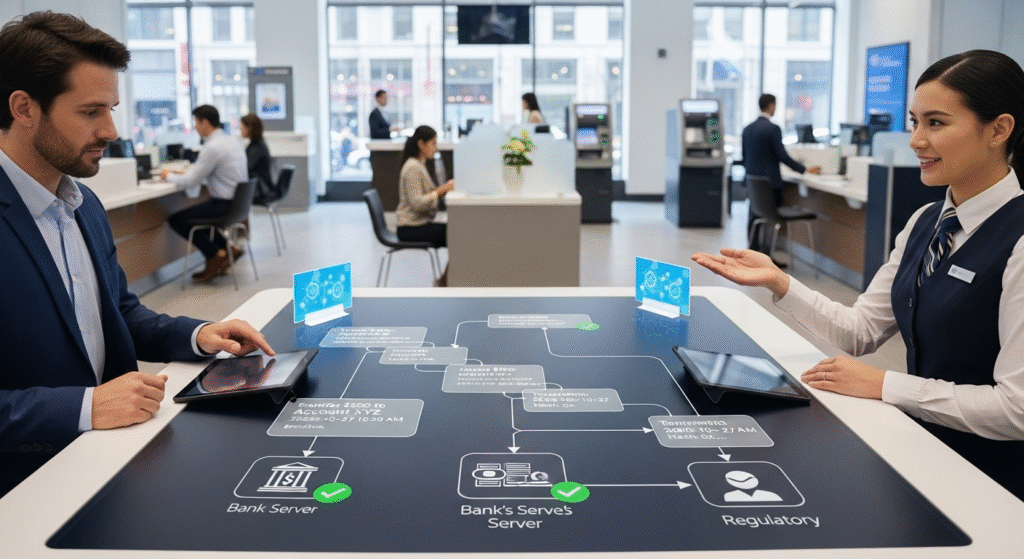

Transparency and immutability are key reasons why blockchain banking is gaining global attention. Transparency means that all authorized participants can view transaction records, while immutability ensures that once data is recorded, it cannot be altered or deleted.

In blockchain banking, every transaction is permanently recorded on the ledger. Each record includes details such as transaction amount, date, and participating parties. This level of transparency helps banks, regulators, and customers track financial activity in real time.

Immutability is achieved through cryptographic linking of blocks. Each block contains a unique digital fingerprint, known as a hash, which connects it to the previous block. If someone attempts to change a transaction, the hash would change, immediately alerting the network. This makes unauthorized modifications nearly impossible.

For banks, transparent and immutable records reduce disputes and reconciliation issues. Auditors can easily verify transaction histories without relying on multiple data sources. This simplifies compliance reporting and improves regulatory oversight.

Customers also benefit from transparency. They gain confidence knowing that their transactions are accurately recorded and cannot be secretly altered. This builds trust between banks and users, which is essential in financial services.

Role of Cryptography in Blockchain Banking

Cryptography plays a vital role in ensuring the security and reliability of blockchain banking. It protects transaction data, verifies identities, and prevents unauthorized access.

In blockchain banking, cryptographic techniques such as hashing and public-key encryption are widely used. Hashing converts transaction data into a fixed-length code, making it impossible to reverse-engineer sensitive information. This ensures data integrity and protects against tampering.

Public-key cryptography uses two keys: a public key and a private key. The public key acts like an account number, while the private key functions as a secure digital signature. When users initiate transactions, they sign them using their private keys. The network verifies the signature using the public key, ensuring that only authorized users can approve transactions.

Cryptography also supports secure identity verification. Blockchain banking systems can confirm user identities without revealing personal information. This reduces the risk of identity theft and enhances privacy.

Another important cryptographic feature is consensus mechanisms, which ensure agreement among network participants. These mechanisms rely on cryptographic algorithms to validate transactions and maintain system integrity.

Additionally, cryptography protects blockchain banking systems from cyberattacks. Encrypted data is extremely difficult to breach, even if attackers gain network access. This level of security is critical for handling sensitive financial information.

Role of Cryptography in Blockchain Banking

Cryptography is the backbone of blockchain banking and plays a critical role in keeping digital financial transactions secure. In simple terms, cryptography is the practice of protecting information by converting it into a coded format that only authorized users can access. In blockchain banking, cryptography ensures confidentiality, authenticity, and integrity of financial data.

Every transaction in blockchain banking is protected using cryptographic algorithms. When a user sends money or initiates a transaction, the data is encrypted and digitally signed. This digital signature proves that the transaction is genuine and authorized by the rightful owner. Without the correct private key, no one can alter or approve a transaction.

Another important cryptographic element is hashing. Hashing converts transaction data into a fixed-length code. Even a small change in data produces a completely different hash, making tampering instantly detectable. This makes blockchain banking highly resistant to fraud and data manipulation.

Cryptography also helps protect user identities. Instead of sharing personal details, blockchain banking systems use cryptographic keys to verify users. This reduces the risk of identity theft and unauthorized access. Sensitive financial information remains hidden while still allowing secure verification.

Smart Contracts and Automated Secure Transactions

Smart contracts are one of the most powerful features of blockchain banking. A smart contract is a self-executing digital agreement where terms and conditions are written directly into code. Once predefined conditions are met, the contract automatically executes without human intervention.

In blockchain banking, smart contracts automate many financial processes such as loan approvals, interest payments, insurance claims, and account settlements. For example, a loan smart contract can automatically release funds when conditions like credit approval are met and deduct repayments on scheduled dates. This reduces delays and manual processing.

Security is another major advantage. Smart contracts operate on blockchain networks protected by cryptography. Once deployed, they cannot be altered, which prevents manipulation or unauthorized changes. This ensures fairness and trust between parties.

Smart contracts also reduce errors caused by manual handling. Since transactions are automated, there is less chance of incorrect data entry or processing mistakes. This improves accuracy and operational efficiency in blockchain banking systems.

Reducing Fraud and Cyber Risks in Banking

Fraud and cyber risks are major challenges in traditional banking systems. Blockchain banking addresses these issues by using decentralized architecture, cryptography, and transparent transaction records.

In traditional systems, centralized databases are common targets for hackers. A single breach can expose millions of customer records. Blockchain banking eliminates this single point of failure by distributing data across multiple nodes. Even if one node is compromised, the overall system remains secure.

Each transaction in blockchain banking is permanently recorded and time-stamped. Once added to the blockchain, it cannot be changed or deleted. This immutability makes fraud extremely difficult because unauthorized changes are immediately detected by the network.

Blockchain banking also reduces identity fraud. Users are verified through cryptographic keys rather than passwords or personal details. This makes phishing attacks and identity theft less effective.

Cyber risks are further minimized through real-time monitoring and consensus validation. Transactions must be approved by multiple network participants before being confirmed. This prevents fake or duplicate transactions.

Faster Transaction Processing with Blockchain Banking

Speed is one of the biggest advantages of blockchain banking. Traditional banking transactions, especially international transfers, can take several days due to multiple intermediaries and manual verification steps. Blockchain banking simplifies this process.

Transactions on blockchain networks are processed directly between parties using peer-to-peer technology. Once validated, transactions are recorded almost instantly. This reduces settlement times from days to minutes or even seconds.

Blockchain banking operates 24/7, unlike traditional banks that follow business hours. This allows users to send and receive payments anytime without delays caused by weekends or holidays.

Automation through smart contracts further speeds up processing. Tasks such as verification, approval, and settlement are handled automatically. This removes paperwork and manual intervention, improving efficiency.

Faster transaction processing also benefits businesses by improving cash flow and reducing waiting times. Customers enjoy quicker payments, refunds, and transfers.

Cost Efficiency and Reduced Intermediaries

Blockchain banking significantly reduces operational costs by eliminating intermediaries such as clearinghouses, payment processors, and third-party verifiers. Traditional banking systems rely on multiple middlemen, each adding fees and delays.

With blockchain banking, transactions are verified and recorded directly on the network. This reduces administrative expenses, processing fees, and infrastructure costs. Banks can operate more efficiently with fewer resources.

Smart contracts also contribute to cost savings. Automated processes reduce the need for manual labor, paperwork, and reconciliation efforts. This lowers staffing and operational expenses.

Reduced errors and fraud further save costs associated with dispute resolution and compliance penalties. Transparent records simplify audits and regulatory reporting.

Blockchain Banking in Cross-Border Payments

Cross-border payments are one of the most impactful use cases of blockchain banking. Traditional international transfers are slow, expensive, and complex due to currency conversions and multiple banks involved.

Blockchain banking simplifies cross-border payments by enabling direct transactions between parties in different countries. Payments are settled quickly without relying on correspondent banks.

Cryptocurrencies and blockchain-based tokens allow seamless currency exchange, reducing conversion costs. Transaction fees are significantly lower compared to traditional methods.

Transparency is another major advantage. Senders and receivers can track payment status in real time. This reduces uncertainty and improves trust.

Blockchain banking also improves compliance by providing clear transaction records. Regulators can easily monitor cross-border flows without compromising privacy.

For businesses, faster cross-border payments improve global trade efficiency. Individuals benefit from affordable remittances and quicker access to funds.

Conclusion

Blockchain banking is transforming the way digital transactions are handled by making them more secure, fast, and cost-effective. By using cryptography, automation, and decentralized systems, blockchain banking reduces fraud, removes unnecessary intermediaries, and improves transparency. It also supports faster payments, especially for international transfers, and lowers operational costs for banks and businesses. As financial institutions continue to adopt this technology, blockchain banking will play a key role in building trust and efficiency in modern financial systems. Understanding its benefits helps individuals and businesses prepare for the future of digital finance.

FAQs

Is blockchain banking safe for everyday users?

Yes, blockchain banking is considered very safe for everyday users because it uses strong security measures like encryption and distributed networks. Transactions are verified by multiple participants, which reduces the risk of fraud or hacking. User identities are protected through digital keys instead of personal data. This makes unauthorized access difficult and helps users feel more confident when making digital financial transactions.

How does blockchain banking benefit small businesses?

Small businesses benefit from blockchain banking through faster payments, lower transaction fees, and better transparency. It helps reduce delays in receiving funds, especially from international clients. Automated processes also save time and reduce paperwork. With improved security and clear transaction records, small businesses can manage cash flow more effectively and reduce financial risks.

How are disputes handled in automated financial systems?

Disputes in automated financial systems are usually handled through predefined rules and digital records. Since all transactions are recorded clearly, it is easier to track issues and verify details. Some platforms include manual review processes or arbitration options to resolve disagreements. Clear records help reduce misunderstandings and speed up dispute resolution.