Top digital lending platforms are transforming the way individuals and businesses access loans. Unlike traditional banks, these platforms use technology to simplify borrowing, reduce paperwork, and provide faster approvals. With online applications and automated credit assessments, borrowers can receive funds quickly while lenders efficiently manage risk.

These digital lending platforms include peer-to-peer networks, online bank portals, fintech lenders, and marketplace platforms. They offer flexible loan options for personal, business, and emergency needs.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer lending platforms are digital lending platforms that directly connect borrowers with individual investors instead of traditional banks. These platforms remove the middleman, allowing borrowers to access funds more easily while investors earn returns by lending money.

Popular P2P digital lending platforms include LendingClub, Prosper, Upstart, Kiva, and Funding Circle.

LendingClub is one of the largest P2P platforms, offering personal loans, small business loans, and debt consolidation options. Borrowers benefit from competitive interest rates, while investors can choose loans based on risk level.

Prosper focuses mainly on personal loans and allows borrowers with fair credit scores to apply online and receive funding quickly.

Upstart uses artificial intelligence to assess borrower risk based on education, employment, and income, making it suitable for people with limited credit history.

Kiva operates globally and supports entrepreneurs by offering interest-free micro-loans funded by individual lenders.

Funding Circle specializes in small business P2P loans, helping companies grow through fast digital approvals.

One of the biggest advantages of P2P digital lending platforms is flexibility. Borrowers often receive lower interest rates compared to banks, especially if they have strong income potential. Loan applications are fully online, paperwork is minimal, and approval times are faster.

For investors, these digital lending platforms offer diversification opportunities by spreading investments across multiple borrowers. However, risks include borrower default and limited investor protection. Despite these risks, P2P digital lending platforms remain popular for personal loans and small business funding when bank loans are hard to obtain.

Online Bank Lending Platforms

Online bank lending platforms are digital lending platforms operated by traditional banks that offer loans through fully digital channels. These platforms combine the trust of established banks with the speed and convenience of online technology.

Well-known online bank digital lending platforms include Chase, Bank of America, Wells Fargo, HSBC, and Citibank.

Chase Bank offers personal loans, home loans, and business financing through online applications and digital account management tools.

Bank of America provides digital loan services with integrated budgeting tools and strong customer support.

Wells Fargo offers personal and small business loans with online applications and secure processing systems.

HSBC focuses on digital lending for personal and international banking needs, including mortgages and business loans.

Citibank delivers digital loan services with global reach, making it ideal for international borrowers.

Online bank digital lending platforms are known for security and reliability. They use advanced encryption, identity verification, and regulatory compliance to protect customers. Borrowers can apply online, upload documents digitally, and track loan status in real time.

These platforms are ideal for borrowers who prefer stability and long-term relationships with banks. However, approval criteria are often stricter, and processing times may be slightly longer than fintech platforms. Even so, online bank digital lending platforms remain a trusted choice for large loans such as mortgages and business financing.

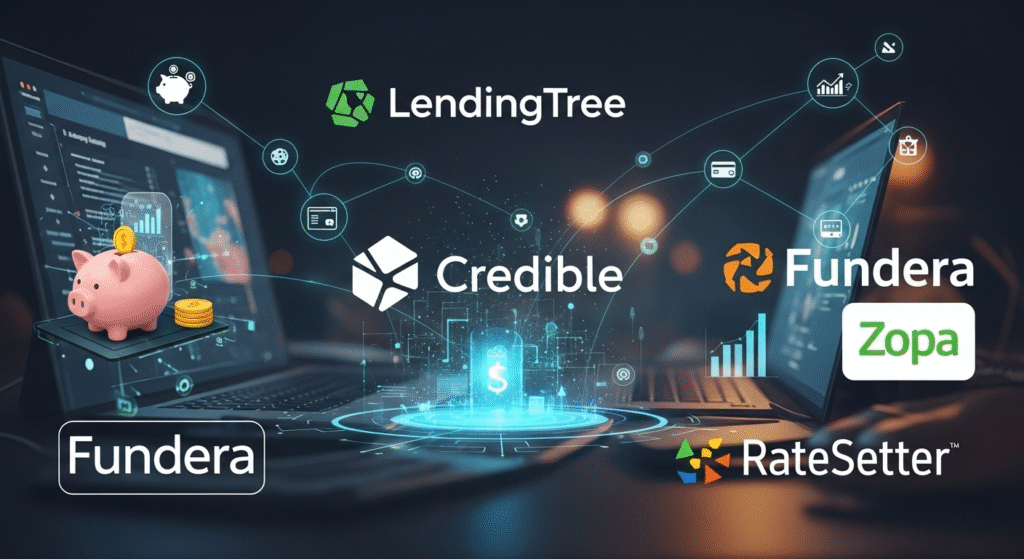

Marketplace Lending Platforms

Marketplace lending platforms are digital lending platforms that act as intermediaries between borrowers and multiple lenders. Instead of lending money themselves, these platforms allow borrowers to compare loan offers from different lenders and choose the best option.

Popular marketplace digital lending platforms include LendingTree, Credible, Fundera, Zopa, and RateSetter.

LendingTree allows borrowers to compare personal, home, auto, and business loan offers from multiple lenders in one place.

Credible focuses on personal loans and student loan refinancing with transparent comparisons and fixed-rate options.

Fundera helps small businesses find suitable loan products by connecting them with various lenders.

Zopa is a UK-based platform offering competitive personal loans through a transparent marketplace model.

RateSetter allows borrowers and investors to set loan rates within a controlled digital environment.

Marketplace digital lending platforms improve transparency and competition. Borrowers can compare interest rates, repayment terms, and fees before making a decision. This helps users save money and choose loans that match their financial needs.

These digital lending platforms are especially useful for borrowers who want choices without applying to multiple lenders separately. The main limitation is that final approval depends on individual lenders, not the platform itself. Still, marketplace digital lending platforms play a major role in making loan markets more competitive and borrower-friendly.

Fintech Lending Platforms

Fintech lending platforms are modern digital lending platforms that use advanced technologies such as artificial intelligence, machine learning, and big data analytics to provide faster and smarter loans. These platforms focus on automation, speed, and user experience, making borrowing easier for tech-savvy users.

Popular fintech digital lending platforms include Upstart, SoFi, LendingClub, and Avant.

Upstart uses AI and alternative data such as education, job history, and income potential to assess borrowers. This helps people with limited credit history access loans more easily.

SoFi offers personal loans, student loan refinancing, and mortgages through a fully digital process. It is known for competitive rates and member benefits.

LendingClub combines fintech innovation with marketplace lending, offering personal and business loans using automated credit evaluation.

Avant focuses on borrowers with average credit scores, providing quick approvals and simple online applications.

A major advantage of fintech digital lending platforms is fast approval. Many applications are reviewed within minutes, and funds can be released within one business day. These platforms also offer customized loan options, flexible repayment plans, and clear digital dashboards for tracking payments.

Security is another strong point. Fintech digital lending platforms use encryption, secure login systems, and fraud detection tools to protect user data. Overall, fintech platforms are transforming lending by making it faster, more inclusive, and more personalized.

Small Business and Micro-Lending Platforms

Small business and micro-lending platforms are digital lending platforms designed to support startups, freelancers, and small enterprises. These platforms provide smaller loan amounts with simpler requirements, helping businesses that may not qualify for traditional bank loans.

Well-known small business and micro digital lending platforms include Kiva, Funding Circle, BlueVine, Tala, and PayPal Working Capital.

Kiva is a global micro-lending platform that provides interest-free loans to entrepreneurs and small businesses, often funded by individual lenders.

Funding Circle focuses on small businesses, offering term loans through a digital application process with transparent terms.

BlueVine provides lines of credit and invoice financing to small businesses, making it easier to manage cash flow.

Tala specializes in micro-loans for individuals and small entrepreneurs using mobile data to assess creditworthiness.

PayPal Working Capital offers fast funding to merchants based on PayPal sales history, with automatic repayment from future sales.

These digital lending platforms are popular because they require minimal paperwork and offer quick approvals. Many small businesses receive funds within 24 hours, helping them cover inventory costs, payroll, marketing, or emergency expenses.

Small business digital lending platforms also promote financial inclusion. They provide access to credit for entrepreneurs in developing markets and underserved communities. Flexible repayment options and revenue-based payments reduce pressure during slow business periods.

Conclusion

Digital lending platforms have transformed the way people and businesses access loans by making the process faster, easier, and more transparent. From peer-to-peer platforms to online banks and marketplace models, these solutions offer flexible options for different financial needs. Borrowers can compare rates, apply online, and receive funds quickly without lengthy paperwork. As technology continues to evolve, digital lending platforms will play an even bigger role in improving financial access, supporting small businesses, and shaping the future of modern lending systems.

FAQs

Are digital loans safer than cash loans?

Digital loans are generally safer than cash loans because transactions are recorded and secured online. Most platforms use encryption, secure logins, and identity verification to protect users. Cash loans carry risks like theft, loss, or untraceable transactions. Digital lending platforms also provide automated records and reminders, helping borrowers manage repayments. However, users must ensure they use reputable platforms to avoid scams or fraudulent services.

Can I apply for a loan from multiple platforms at the same time?

Yes, you can apply on multiple platforms, but each application may trigger a credit check. Some platforms perform soft checks that don’t affect credit scores, while others do. Applying on several platforms increases your chances of approval, but borrowers should compare terms carefully. Too many hard inquiries in a short time may lower your credit score. Always keep track of applications to avoid over-borrowing.

Do digital lending platforms accept borrowers with no credit history?

Many digital lending platforms now accept borrowers with little or no credit history. They use alternative data such as income, employment, and digital behavior to assess creditworthiness. This helps students, freelancers, or first-time borrowers access loans. However, the interest rates may be higher due to perceived risk. Borrowers should start with smaller amounts and repay on time to build a strong digital credit profile for future loans.