Debt Avalanche Method is one of the smartest ways to take control of your finances and pay off debt efficiently. Instead of focusing on small wins, this strategy helps you tackle the debts with the highest interest rates first, saving you more money in the long run. It’s a practical and results-driven approach for anyone serious about becoming debt-free faster.

In this guide, you’ll learn how the Debt Avalanche Method works, why it’s more cost-effective than other repayment strategies, and how you can use it to crush your debt without unnecessary stress. With discipline and planning, this method can turn your financial goals into real, lasting success.

Understanding the Debt Avalanche Method

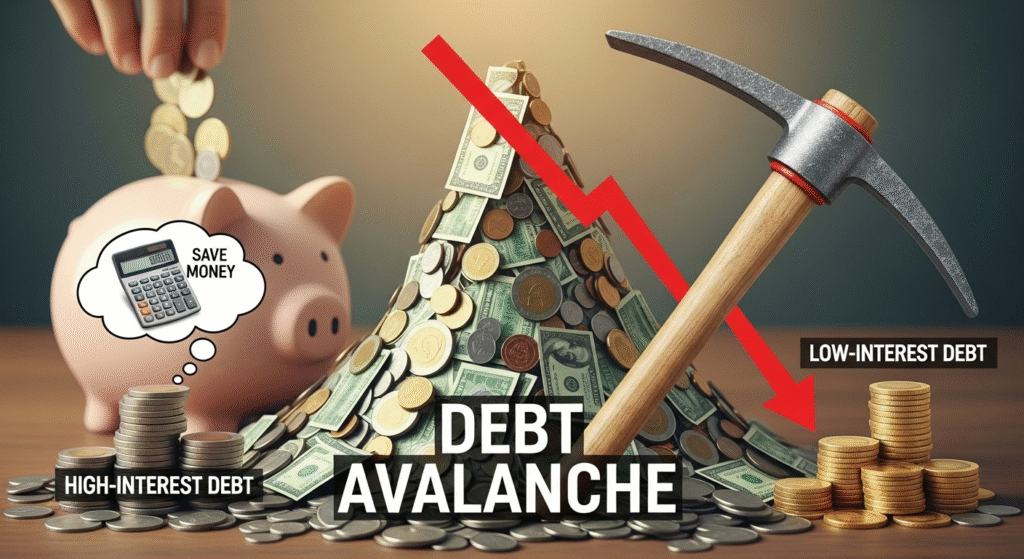

The Debt Avalanche Method is a repayment strategy designed to help individuals pay off debt in the most cost-efficient way possible. It focuses on eliminating high-interest debts first while maintaining minimum payments on the rest. This approach minimizes the total amount of interest paid over time, allowing you to become debt-free faster. The core idea behind the Debt Avalanche Method is prioritizing financial logic over emotional motivation—by attacking the costliest debt first, you save more in the long run.

When compared to the Debt Snowball Method, which emphasizes paying off the smallest debts first for quick wins, the Debt Avalanche Method takes a more analytical route. Instead of celebrating small victories early, this method rewards you with long-term financial benefits and faster debt elimination. For instance, if you have three debts with varying interest rates—credit card A at 20%, loan B at 10%, and credit card C at 5%—you would first pay off credit card A while making minimum payments on the others. Once that’s cleared, you move to loan B, then credit card C.

Steps to Start the Debt Avalanche Method

To successfully apply the Debt Avalanche Method, start by listing all your debts in order of their interest rates, from highest to lowest. Include credit cards, personal loans, car loans, or any other outstanding balances. Next, identify which debt carries the highest interest rate—this will be your primary target. While you continue making minimum payments on your other debts, direct all extra funds toward this high-interest debt.

Once the highest-interest debt is fully paid off, move to the next one on the list. Repeat the same process—pay minimums on the rest while directing additional payments toward the new target. This cascading approach continues until all your debts are cleared. The Debt Avalanche Method ensures that each payment brings you closer to financial freedom while minimizing wasted money on interest charges.

For example, if you owe $3,000 on a credit card at 18% interest, $5,000 on a loan at 10%, and $2,000 on another card at 5%, focus your extra payments on the 18% debt first. Once it’s gone, roll those funds into the next highest debt. This step-by-step system keeps your repayment structured and consistent.

Benefits of the Debt Avalanche Method

The Debt Avalanche Method offers multiple advantages that make it one of the most effective ways to eliminate debt. First, it saves you the most money in interest payments over time. By prioritizing high-interest debts, you reduce how much extra you pay to lenders, freeing up more money for your future goals. This results in faster progress toward becoming debt-free and achieving long-term financial stability.

Another major benefit of the Debt Avalanche Method is that it shortens the overall repayment period. Because less money goes toward interest, a larger portion of each payment reduces your principal balance. Over time, this snowballs into accelerated debt elimination. Moreover, the method promotes financial discipline and smarter budgeting, as you’re required to manage your payments methodically and stay consistent.

This approach also helps cultivate a forward-thinking financial mindset. While it may not offer instant emotional rewards like the Debt Snowball Method, the long-term satisfaction of saving thousands in interest and achieving true financial freedom is far greater. People who stick with the Debt Avalanche Method often develop better money habits—such as tracking spending, avoiding high-interest credit, and maintaining strong budgeting routines.

Common Mistakes to Avoid

While the Debt Avalanche Method is highly effective, many people make mistakes that can slow their progress. One of the most common errors is losing motivation because smaller debts take longer to disappear. Since this method prioritizes high-interest balances, it may take months before you see a full account closed. Staying consistent and focusing on long-term gains rather than short-term wins is essential.

Another common mistake when using the Debt Avalanche Method is ignoring variable interest rates. Some loans or credit cards have fluctuating rates, which can change your repayment priorities. Always monitor your interest rates regularly and adjust your plan if needed. Additionally, some people make the mistake of neglecting emergency savings. It’s important to keep at least a small emergency fund aside so unexpected expenses don’t force you to rely on credit again.

Lastly, avoid the trap of continuing to use credit cards during repayment. The Debt Avalanche Method only works if you stop accumulating new debt while paying off existing balances. Using your cards before clearing previous debts can undo your progress. Stay disciplined, track your spending, and celebrate milestones responsibly.

Tools and Resources to Stay on Track

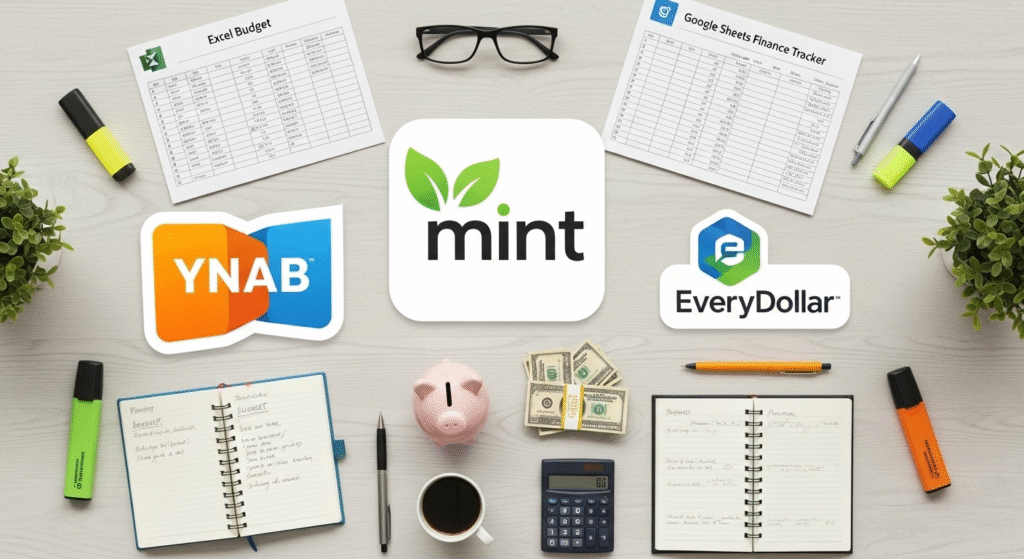

Staying organized is crucial when applying the Debt Avalanche Method, and using the right tools can make a huge difference in maintaining consistency and motivation. Budgeting apps and debt calculators are great starting points. Apps like Mint, YNAB (You Need a Budget), or EveryDollar help you track spending, categorize expenses, and monitor how much you can allocate toward debt payments each month. Meanwhile, online Debt Avalanche Method calculators let you input your debts, balances, and interest rates to visualize your repayment timeline and interest savings.

For those who prefer manual tracking, spreadsheets can be a simple but powerful tool. Creating a custom Excel or Google Sheets file allows you to list debts, update payments, and watch your progress over time. This visual representation keeps you accountable and motivated. Another helpful resource is financial coaching—working with a certified financial advisor or joining online communities dedicated to debt repayment can provide personalized advice and encouragement.

Consistency is key when using the Debt Avalanche Method, and one way to stay consistent is by automating payments. Setting up automatic transfers ensures you never miss due dates, protecting your credit score and reducing stress. Some lenders even offer small interest discounts for borrowers who use autopay.

Combining the Avalanche with Other Strategies

While the Debt Avalanche Method is highly effective, combining it with other repayment strategies can boost both motivation and efficiency. Many people blend the Debt Avalanche Method with the Debt Snowball approach to strike a balance between saving money and staying inspired. The Avalanche focuses on logic—paying off high-interest debts first—while the Snowball builds emotional momentum by eliminating smaller debts quickly. By combining them, you can save on interest while still enjoying early victories that keep you motivated.

You can also adjust your plan based on income fluctuations or lifestyle changes. For example, if your income increases temporarily due to a bonus or side hustle, apply those extra funds toward your highest-interest debt. On the other hand, if your income decreases, focus on maintaining minimum payments to avoid penalties and interest hikes. The Debt Avalanche Method is flexible enough to adapt to your financial situation as long as you remain consistent.

Another strategy is to refinance or consolidate debts when appropriate. Refinancing allows you to secure lower interest rates, making your Avalanche payments more effective. However, ensure you understand the terms—sometimes refinancing can extend repayment periods and increase long-term costs. Debt consolidation can also simplify multiple payments into one, making it easier to manage while still applying the Avalanche principle.

Real Life Success Stories

Many individuals have achieved remarkable financial freedom using the Debt Avalanche Method, proving that with discipline and persistence, debt can be conquered efficiently. For instance, one couple with over $50,000 in credit card and student loan debt managed to pay it off in under four years. By targeting their highest-interest balances first and automating extra payments, they saved nearly $8,000 in interest that would have otherwise gone to lenders.

Another inspiring story involves a single parent who applied the Debt Avalanche Method after struggling with multiple credit cards. By focusing on her card with a 22% interest rate first and making consistent minimum payments on the others, she paid off over $15,000 in just two years. She credits her success to using budgeting apps, staying consistent, and rewarding herself modestly for hitting milestones.

These real-life examples show how effective the Debt Avalanche Method can be, regardless of income level or debt amount. The common themes among successful users are patience, consistency, and smart financial planning. Most people found that once they made their first few large payments, momentum built naturally.

Mindset and Motivation Tips

The Debt Avalanche Method requires patience and mental strength because visible progress can take time. It’s easy to get discouraged when smaller debts linger, but maintaining the right mindset is key to long-term success. Focus on the bigger picture—every payment, no matter how small, is a step closer to financial freedom. Tracking your progress visually through charts or milestone checklists helps make the journey feel more rewarding.

Celebrate small wins without overspending. When you pay off a major portion of your high-interest debt, reward yourself with a simple, low-cost treat such as a nice meal or a day off to reflect on your progress. These moments of recognition reinforce positive habits and keep your energy high.

Staying motivated with the Debt Avalanche Method also involves turning repayment into a lifestyle habit. Revisit your goals often and remind yourself why you started—whether it’s to gain peace of mind, buy a home, or achieve financial independence. Joining online debt-free communities or following personal finance influencers can also help you stay inspired by seeing others’ progress.

Conclusion

The Debt Avalanche Method is one of the smartest ways to pay off debt efficiently while saving money on interest. It focuses on tackling high-interest debts first, helping you clear balances faster and build lasting financial discipline. Though progress may feel slow at the start, the long-term results are worth it. By staying consistent, tracking your progress, and maintaining a positive mindset, you can achieve financial freedom with less stress. With patience and smart planning, the Debt Avalanche Method can turn your debt repayment journey into a path toward true financial confidence and stability.

FAQs

How does the Debt Avalanche Method differ from the Debt Snowball Method?

The Debt Avalanche Method focuses on paying off debts with the highest interest rates first, saving more money in the long run. In contrast, the Debt Snowball Method targets the smallest balances first to create quick motivational wins. While the Avalanche saves more on interest, the Snowball can feel more rewarding emotionally, especially for beginners who need early encouragement to stay consistent.

Can the Debt Avalanche Method work for credit card debt?

Yes, the Debt Avalanche Method works especially well for credit card debt because credit cards often carry high interest rates. By paying down the card with the highest rate first, you minimize total interest costs and reduce debt faster. It’s important to keep making minimum payments on other cards to avoid penalties and continue progress toward becoming debt-free efficiently.

Can I combine the Debt Avalanche Method with refinancing?

Yes, combining the Debt Avalanche Method with refinancing can make repayment even more effective. Refinancing helps lower your interest rates, which reduces the total cost of debt. Once rates are reduced, you can continue using the Avalanche strategy to focus on the new highest-interest balance. This blend maximizes savings and speeds up debt elimination.

What tools can help manage the Debt Avalanche Method?

Several tools can simplify the Debt Avalanche Method. Budgeting apps like Mint or You Need a Budget (YNAB) help track spending, while spreadsheets or debt calculators show how payments impact interest over time. Automatic payments also ensure consistency. Using these tools helps you stay motivated, organized, and fully aware of your financial progress throughout the repayment journey.