Freelance Income Tracker is an essential tool for every freelancer who wants to stay organized, manage projects smoothly, and maintain financial stability. It helps you record client payments, monitor project earnings, and track expenses effortlessly. In this guide, you’ll learn how to set up your tracker, manage multiple clients, and review your income effectively each month to stay financially confident.

With a Freelance Income Tracker, you gain control over your cash flow, stay on top of invoices, and avoid missed payments. It allows you to make smarter business decisions, plan ahead for taxes, and achieve your financial goals with confidence. Staying consistent with tracking ensures a clearer path toward long-term freelance success.

Setting Up Your Freelance Income Tracker

A Freelance Income Tracker is your foundation for managing clients, projects, and income effectively. The first step is choosing the right format that suits your workflow. You can use spreadsheets like Google Sheets or Excel for full control and customization, or opt for ready-made apps such as Notion, Bonsai, or Wave for automation. Digital templates can also save time if you prefer a structured layout with formulas and visuals already built in.

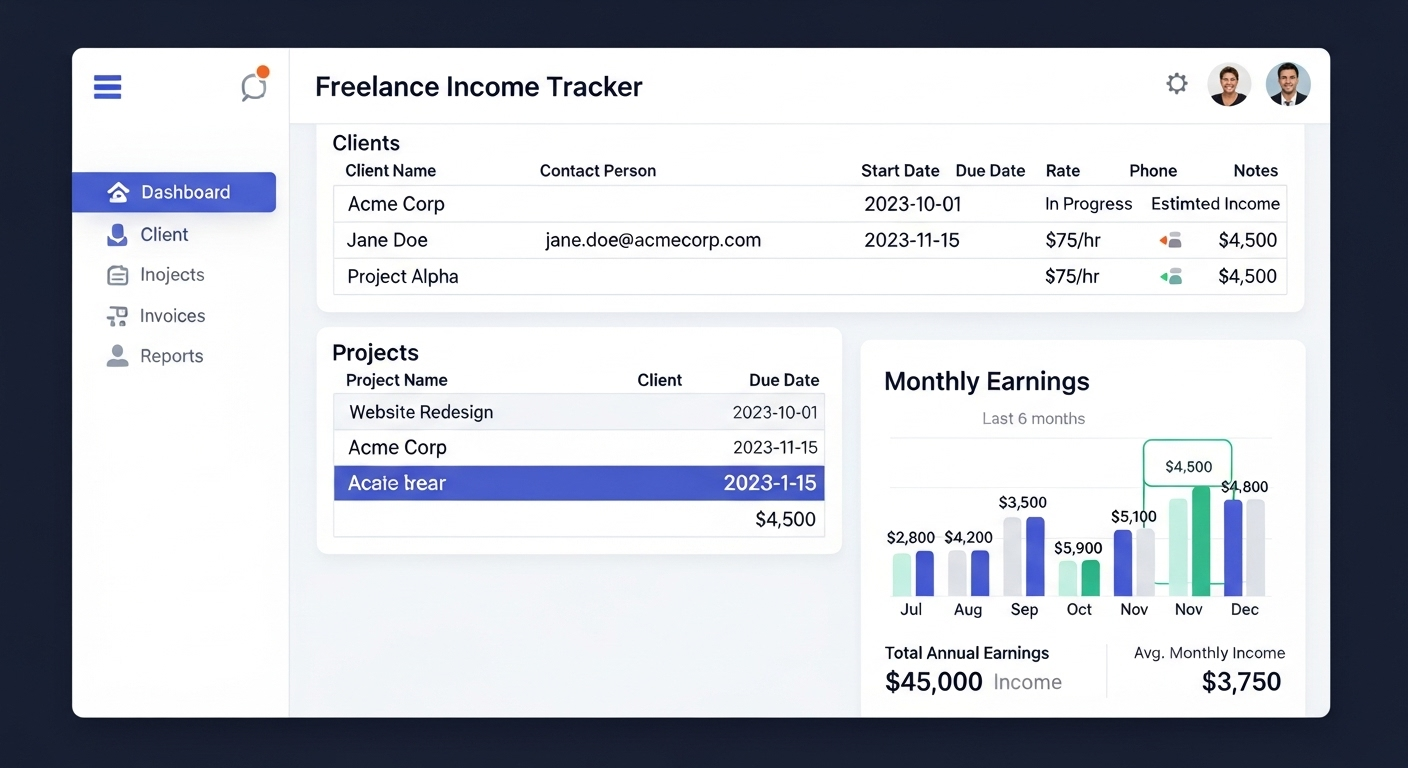

Your Freelance Income Tracker should include key data points such as client name, project title, payment amount, due date, invoice number, and payment status. Including details like project type or service category helps you identify which areas of your business bring in the most revenue. Organizing your tracker by month, client, or project type ensures quick access to financial insights whenever needed.

To make tracking easy, set aside time weekly or biweekly to update your records. This keeps your tracker accurate and helps you avoid surprises during tax season. Whether you choose manual entry or automation tools, the goal is to have a system that shows your financial position clearly and helps you make informed business decisions. A well-structured Freelance Income Tracker turns your finances from chaos into clarity, letting you focus more on creativity and client work.

Tracking Client Payments and Invoices

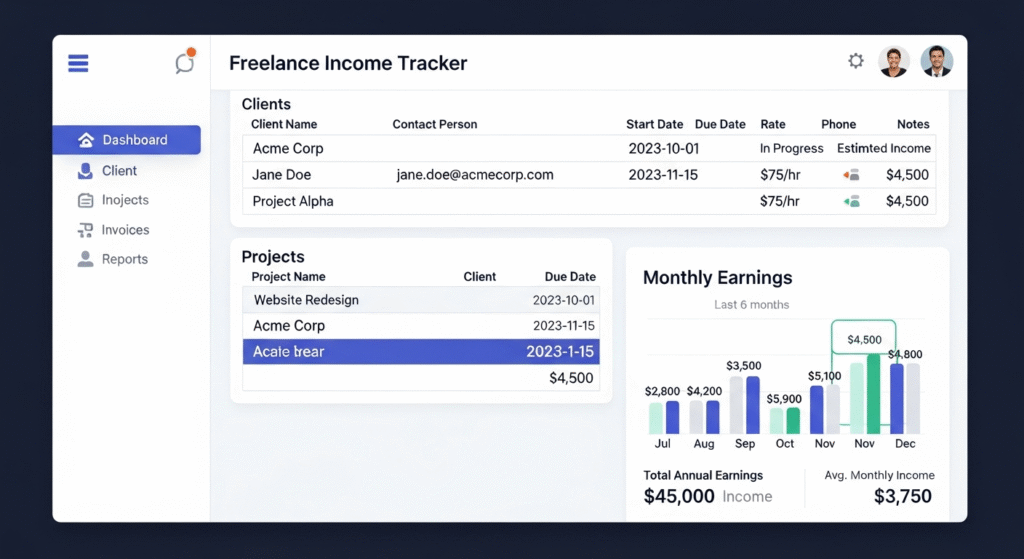

Once your system is in place, use your Freelance Income Tracker to manage invoices and payment schedules efficiently. Start by recording each invoice immediately after sending it to a client. Include the invoice date, amount, due date, and payment method. This ensures you can easily follow up and maintain a steady cash flow.

For freelancers handling multiple clients, missed payments can become a serious issue. Use your tracker to flag overdue or partial payments. Many apps allow you to automate payment reminders so clients receive gentle follow-ups without manual effort. This not only saves time but also ensures you maintain a professional relationship while getting paid promptly.

Consistency is key—update your Freelance Income Tracker every time a payment is received. Doing so helps you see which clients pay on time, which projects are most profitable, and where delays occur. Over time, these insights guide you to refine your client list and improve payment terms. By keeping your tracker current, you’ll reduce stress, avoid missed income, and strengthen your financial reliability as a freelancer.

Managing Multiple Projects and Income Streams

Freelancers often juggle several projects from different clients or platforms. A Freelance Income Tracker helps you stay organized and track all your earnings in one place. Start by categorizing income based on its source—retainer clients, one-time gigs, affiliate partnerships, or passive income. This structure helps you identify your most consistent income streams.

When using a Freelance Income Tracker, assign separate sections or color codes to each client or project type. This makes it easier to monitor deadlines, payments, and profitability at a glance. If you work with international clients, include currency conversion columns to see accurate totals in your preferred currency.

For freelancers with multiple income streams, automation tools like QuickBooks or Notion templates can simplify tracking. These tools can import payment data directly from platforms like PayPal or Stripe, ensuring accuracy. The key is to maintain clarity—when you know where every dollar comes from, you can plan better and scale your business strategically.

Budgeting and Expense Management for Freelancers

Budgeting is crucial for freelancers who often face irregular income. A Freelance Income Tracker makes it easier to plan expenses and maintain financial stability. Start by listing all your business-related expenses—tools, software subscriptions, internet, marketing costs, and workspace rent. Include both fixed and variable expenses to get a complete overview.

Set aside a portion of every payment you receive for taxes, savings, and emergency funds. Many freelancers follow the 30-30-40 rule: 30% for taxes, 30% for business costs, and 40% for personal spending. You can customize this formula in your Freelance Income Tracker to match your situation.

Track recurring and one-time expenses separately. This distinction helps you identify which costs are necessary and which can be reduced or replaced. Expense-tracking features in your Freelance Income Tracker can also highlight spending patterns and reveal where you’re overspending.

Monthly and Annual Income Review

Your Freelance Income Tracker becomes most valuable when you use it for monthly and yearly reviews. At the end of each month, analyze your total income, expenses, and profit. Compare the data with your previous months to identify trends—like which months are busiest or which clients contribute most to your earnings.

For annual reviews, summarize your total income, categorize expenses, and calculate savings or tax obligations. These insights can help you prepare financial reports for tax filing and identify areas for growth. Your Freelance Income Tracker should include visual charts or graphs to make this process quick and motivating.

Adjust your pricing or workload based on what you learn. If one type of project consistently earns more, consider focusing your marketing efforts there. If some clients cause delays in payments, refine your contracts and terms. By using your Freelance Income Tracker as a guide, you stay proactive instead of reactive, ensuring that each year becomes more profitable than the last.

Using Your Income Tracker to Plan for Long-Term Success

A Freelance Income Tracker is not just a record-keeping tool—it’s your roadmap to long-term financial freedom. When you track your income regularly, you gain confidence in your financial decisions. You can set clear income goals, plan savings targets, and monitor progress with ease.

To build stability, review your tracker every month and set quarterly goals for income growth. Use your data to identify which projects bring the most satisfaction and profit, and align your business direction accordingly. Over time, you’ll notice patterns that help refine your strategy and pricing structure.

A consistent Freelance Income Tracker habit builds trust in your numbers, giving you control over your business. You can confidently plan for investments, courses, or expansions without financial uncertainty. The key is commitment, by tracking diligently, you transform numbers into knowledge and knowledge into success.

Conclusion

A Freelance Income Tracker is your best ally in mastering freelance finances. It simplifies tracking, improves organization, and gives you the clarity needed to grow with confidence. From managing client payments to reviewing yearly progress, every step strengthens your financial foundation. By committing to regular updates and smart analysis, you turn chaos into control and uncertainty into opportunity. Freelancers who embrace a Freelance Income Tracker don’t just manage money—they master it. With consistent use, you’ll gain peace of mind, build financial discipline, and move closer to lasting business success.

FAQs

Which is better: spreadsheet or app for income tracking?

Both options have their strengths. A spreadsheet-based Freelance Income Tracker offers flexibility and customization, making it ideal for freelancers who prefer manual control. On the other hand, income-tracking apps provide automation features such as invoice reminders, payment tracking, and visual dashboards. The best choice depends on your workflow — if you manage multiple clients and need automation, apps are great. If you want simplicity and full control, spreadsheets work well.

How often should I update my Freelance Income Tracker?

You should update your Freelance Income Tracker every time you complete a project, send an invoice, or receive payment. Regular updates ideally weekly keep your records accurate and prevent confusion. Consistent tracking helps you identify trends, predict cash flow, and prepare for taxes. By staying disciplined, you’ll always know your current earnings, pending payments, and overall financial progress, making goal-setting and business planning much easier throughout the year.

Can a Freelance Income Tracker help during tax season?

Yes, a Freelance Income Tracker is a lifesaver during tax season. It keeps all your income and expense records organized, reducing stress when filing taxes. You can quickly generate income summaries, find deductible business expenses, and ensure every payment is documented. Whether you use it manually or through an app, having detailed financial data ready helps avoid last-minute errors and ensures compliance with tax requirements, saving both time and effort.

What should I include in my Freelance Income Tracker?

A complete Freelance Income Tracker should include client names, project titles, invoice dates, payment amounts, payment status, and expense categories. Adding columns for due dates, payment methods, and notes helps you stay organized. It’s also helpful to include monthly totals and summaries for better analysis. The more detailed your tracker, the easier it becomes to monitor cash flow, plan budgets, and make informed business decisions that improve your freelance income management.