Finance Tracker Journal is the ultimate tool to help you organize, save, and build wealth daily. Keeping track of your income, expenses, and savings in one place makes managing your money easier and more effective. By recording your financial activities regularly, you can identify spending patterns, set clear goals, and make smarter decisions to grow your wealth.

Whether you prefer a digital app, spreadsheet, or physical journal, a finance tracker journal provides a structured way to monitor progress and stay accountable. It’s not just about tracking money. It’s about creating habits, improving financial awareness, and taking control of your financial future.

Setting Up Your Finance Tracker Journal

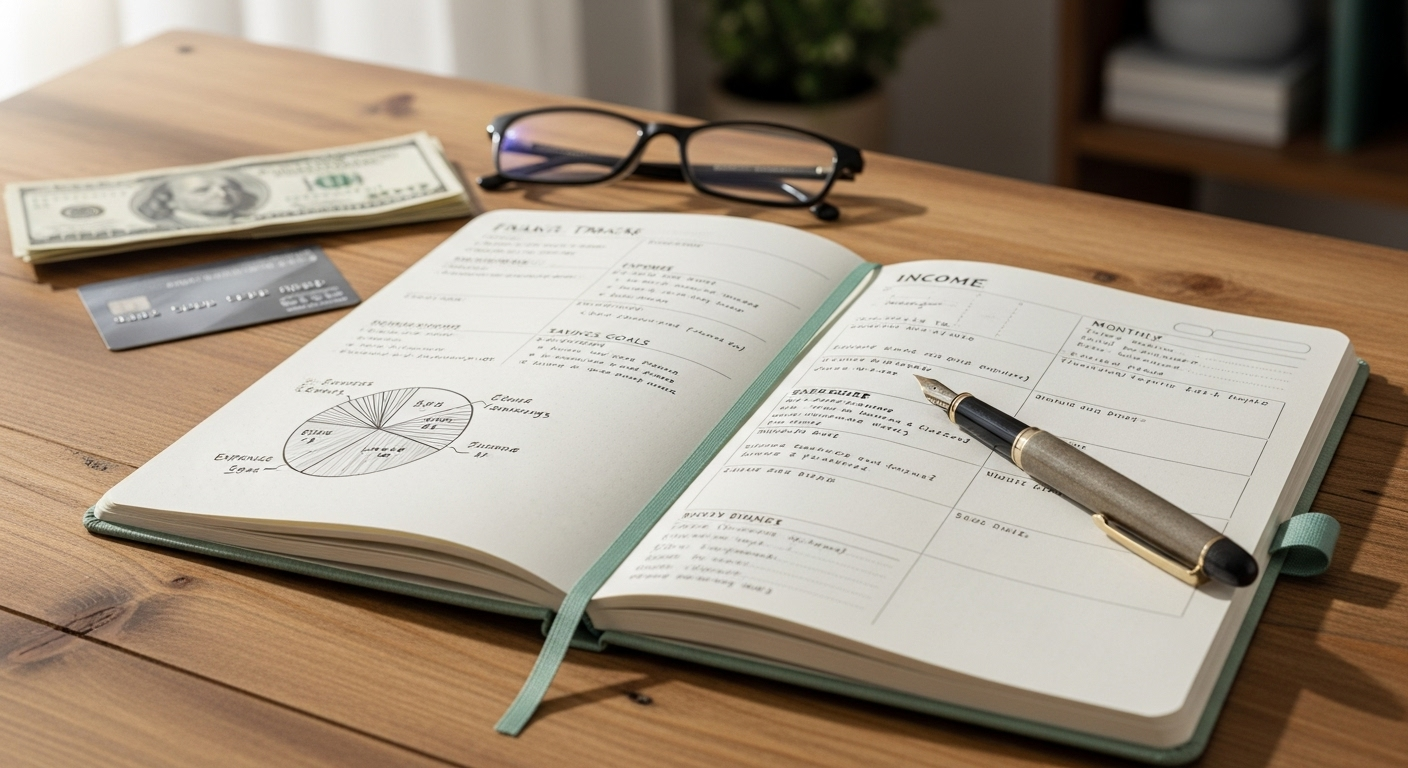

Setting up your Finance Tracker Journal is the first step toward taking control of your finances. The key is to choose a format that fits your lifestyle. You can use digital apps, spreadsheets, or a physical journal depending on your preferences. Digital apps are great for automation, easy calculations, and syncing across devices. Spreadsheets allow customization, formulas, and clear organization. Physical journals provide a tangible experience and can make tracking more personal.

When setting up your Finance Tracker Journal, include essential sections. Track your income to know exactly how much money comes in each month. Record all expenses, including fixed bills like rent and variable spending like groceries or entertainment. Include a savings section to monitor money set aside for goals. If you invest, a section for tracking investments and returns is important. This structure ensures you have a complete picture of your finances.

Organizing entries in your Finance Tracker Journal is crucial for clarity. Use separate pages or sheets for each category. Consider color coding expenses, marking income sources, and creating tables for investments. Keep entries consistent daily or weekly to avoid confusion. Clear organization helps you quickly identify areas to save and monitor financial growth. A well set up Finance Tracker Journal is not just a record. It’s a tool that guides your financial decisions, improves awareness, and encourages consistent money management habits.

Daily Expense Tracking for Better Money Management

Daily tracking is essential when using your Finance Tracker Journal. Start by recording all spending, even small purchases. Include cash, card, and online transactions to get an accurate picture. Daily tracking makes you aware of how your money is going and highlights unnecessary expenses.

Categorizing expenses in your Finance Tracker Journal helps manage your money effectively. Separate fixed expenses like rent, utilities, and subscriptions from variable ones like groceries, dining out, and entertainment. Label essential spending versus non essential purchases. This approach allows you to see where money can be saved without affecting important needs.

Regularly reviewing your Finance Tracker Journal helps identify patterns in spending. You may notice that small, repeated purchases add up or that certain months require higher budgets for specific categories. Spotting these patterns allows you to adjust future spending. Daily expense tracking encourages accountability, reduces overspending, and builds awareness about financial habits. A well-maintained Finance Tracker Journal ensures that you stay in control of your money while gradually improving saving and budgeting skills.

Saving and Investment Tracking

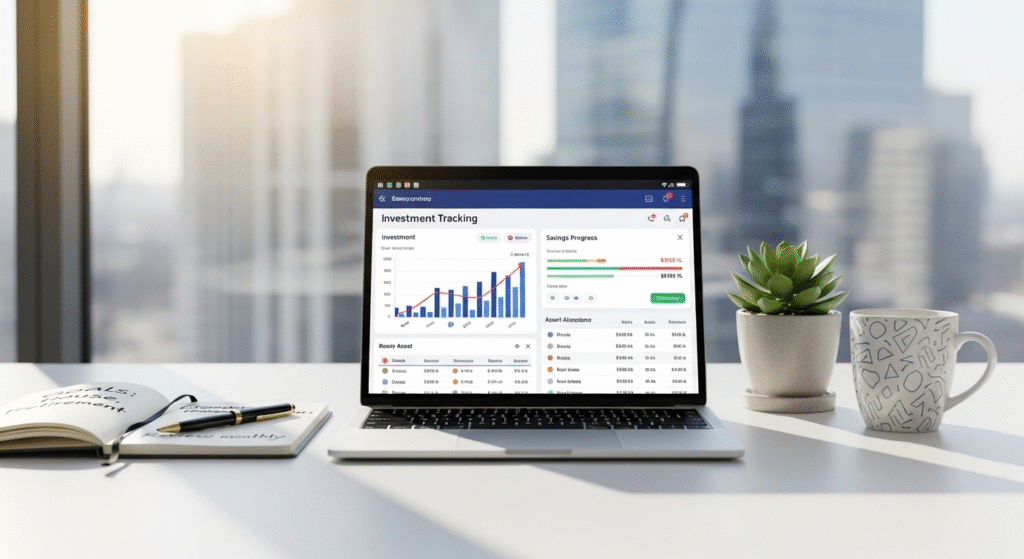

Using your Finance Tracker Journal for saving and investment tracking is a smart way to grow wealth. Start by setting clear savings goals. Include emergency funds, travel goals, home down payments, or other priorities. Record the amount saved, target, and progress regularly to stay motivated.

Track investments in your Finance Tracker Journal. Include purchase price, current value, returns, and overall growth. Keep notes on dividends, interest, or other income streams. This helps you understand which investments are performing well and which need reevaluation.

Your Finance Tracker Journal is also useful for short- and long-term financial planning. Plan monthly contributions to savings, monitor progress, and adjust strategies if needed. Investment tracking ensures you make informed decisions, avoid unnecessary risks, and maximize returns. Regularly updating your Finance Tracker Journal transforms it into a roadmap for financial success, combining disciplined saving with smart investment growth.

Budget Planning and Monthly Reviews

A Finance Tracker Journal is an essential tool for planning your budget and reviewing your finances every month. Budget planning starts with listing all sources of income, including salaries, freelance earnings, side hustles, or passive income. Once you know your total income, write down all expected expenses. Divide them into categories like essentials (rent, groceries, bills), savings, and discretionary spending (entertainment, dining, shopping). Using your Finance Tracker Journal, allocate realistic amounts for each category to ensure you don’t overspend and can save consistently.

After setting your monthly budget, it’s important to track actual spending. Record daily or weekly expenses in your Finance Tracker Journal to see where money is going. Compare your actual spending with the planned budget to identify areas where you might be overspending. For example, if dining out is consistently higher than budgeted, you can adjust next month’s plan or find ways to reduce costs. Regular tracking in your Finance Tracker Journal helps you stay accountable and make informed decisions about your money.

Monthly reviews are a crucial part of using a Finance Tracker Journal effectively. At the end of each month, analyze your spending patterns, savings progress, and any unexpected expenses. Review which categories are performing well and which need improvement. Use this information to adjust your budget for the next month. For example, you might increase your savings contribution if you underspent in another area or reduce discretionary spending to meet a financial goal.

Building Wealth Through Financial Habits

Using a Finance Tracker Journal consistently is one of the best ways to build wealth over time. The key is developing a daily or weekly habit of recording all income, expenses, savings, and investments. By logging your financial activities regularly, you stay aware of where your money is going and can make better decisions to grow your wealth. Consistency turns tracking into a natural part of your routine, helping you identify patterns and areas where you can improve.

Your Finance Tracker Journal is also a tool to reinforce smart financial decisions. When you see your spending habits clearly, you are less likely to make impulsive purchases. The journal helps you stick to budgets, save for goals, and make informed investment choices. Over time, these decisions compound into long-term financial growth and stability.

Integrating goal setting and rewards into your Finance Tracker Journal can motivate you to stay on track. Set short-term goals like saving for a vacation, and long-term goals like building an emergency fund or investing in stocks. Track progress and celebrate milestones to maintain momentum. Adding accountability, such as sharing your progress with a trusted friend or financial mentor, can further reinforce positive habits.

Tips and Tools to Maximize Your Finance Tracker Journal

To get the most out of your Finance Tracker Journal, it’s important to combine practical strategies with helpful tools. Start by choosing a system that matches your lifestyle. Some people prefer paper journals for their tactile experience, while others use apps for convenience and automation. Popular apps like PocketGuard, Goodbudget, or spreadsheets can streamline tracking and reduce manual calculations. A Finance Tracker Journal works best when it’s easy to use, accessible, and consistently updated.

Next, create a structure within your journal that supports your financial goals. Divide sections for daily spending, monthly bills, savings targets, and investment tracking. Using categories, tables, or charts makes it easier to visualize patterns and quickly spot areas for improvement. A well-organized Finance Tracker Journal helps you avoid clutter and ensures your financial information is actionable.

Leverage digital tools to simplify repetitive tasks. Automate bill reminders, savings transfers, and alerts for overspending. Integrating your Finance Tracker Journal with banking apps or payment platforms can save time and ensure accurate records. Some apps even provide visual graphs and monthly summaries, which can help you assess progress and adjust strategies without stress.

Conclusion

A Finance Tracker Journal is more than just a record of your money, It is a powerful tool to organize, save, and build wealth. By consistently tracking income, expenses, savings, and investments, you gain clarity and control over your finances. Using your Finance Tracker Journal helps develop positive money habits, reinforces smart decisions, and creates a roadmap for financial growth. With goal-setting, automation, and regular reviews, you can stay motivated and make informed choices. Whether digital or physical, a Finance Tracker Journal empowers you to improve spending habits, maximize savings, and achieve long-term financial stability with confidence.

FAQs

What is a Finance Tracker Journal and why should I use it?

A Finance Tracker Journal is a tool to record income, expenses, savings, and investments. It helps you understand where your money goes and keeps track of financial goals. Using a Finance Tracker Journal increases awareness, encourages better spending habits, and helps you make smarter decisions. Over time, this consistent tracking builds money confidence, improves savings, and supports long-term financial growth.

How often should I update my Finance Tracker Journal?

You should update your Finance Tracker Journal daily or weekly. Regular updates make sure your records are accurate and help you track your spending and savings clearly. This consistency allows you to spot trends, prevent overspending, and make better financial decisions. Using your Finance Tracker Journal often also reinforces positive money habits and ensures that you stay on track with your financial goals without stress or confusion.

Can I use the same Finance Tracker Journal for multiple income sources?

Yes, a Finance Tracker Journal can track multiple income sources like salaries, freelance work, and side jobs. Record each source separately, track related expenses, and monitor savings. This approach in your Finance Tracker Journal gives a clear picture of total earnings and spending. Over time, it helps you manage all income streams efficiently, make informed decisions, and plan for growth and financial stability.