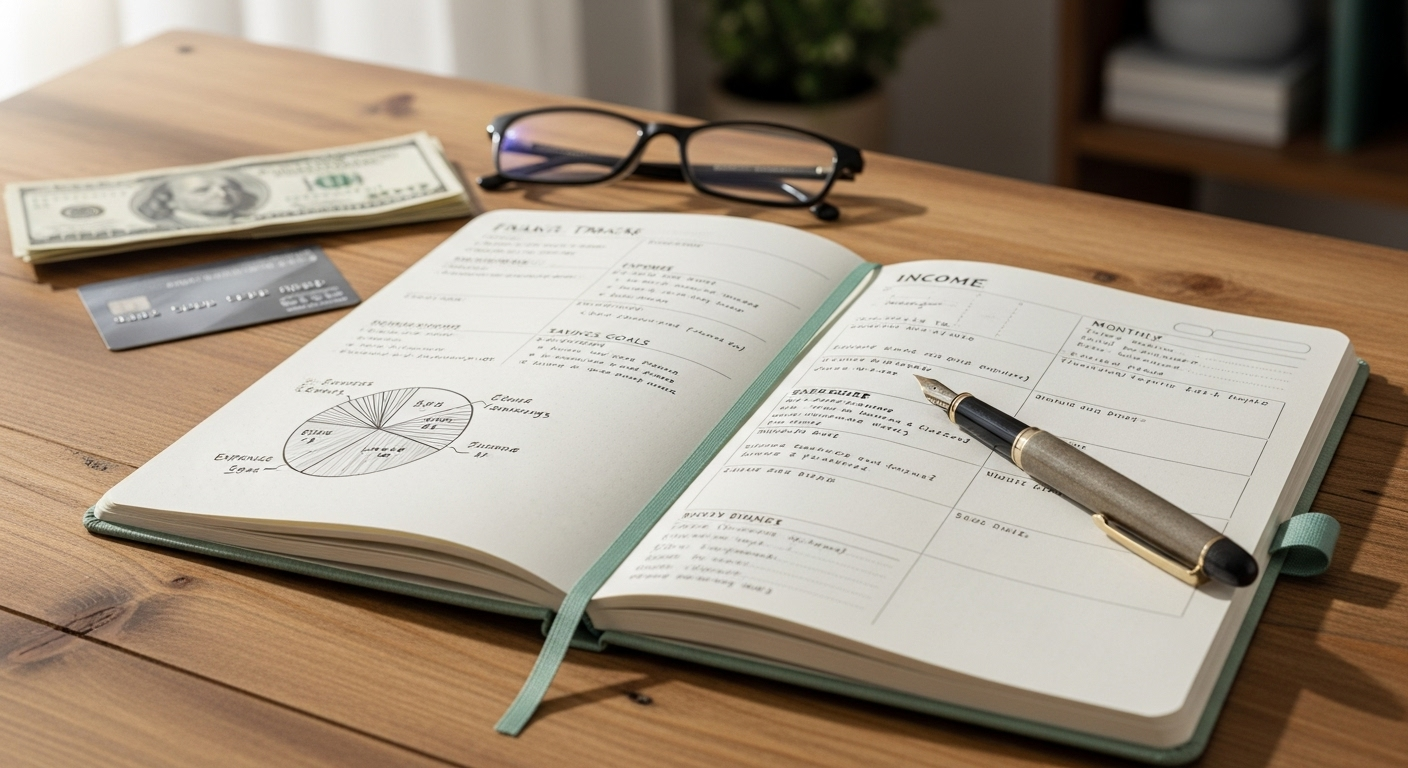

Planning Finances After Marriage for a Strong Financial Foundation

Planning Finances After Marriage is one of the most important steps for building a strong financial foundation together. Managing money as a couple requires clear communication, shared goals, and smart budgeting. By understanding each other’s income, debts, and spending habits, couples can create a financial plan that supports both short-term needs and long-term ambitions. This … Read more