Biweekly budget template planning often feels tricky because most budgeting tools focus on monthly pay cycles. For people paid every two weeks, this mismatch can make it difficult to cover bills, set aside savings, and still have money left for everyday expenses. Without the right system, it’s easy to overspend or feel stressed while waiting for the next paycheck.

That’s where biweekly budget templates come in. These templates are designed to match your actual income schedule, making it easier to track expenses, plan savings, and stay organized. In this post, you’ll discover 5 of the best biweekly budget templates that are simple, practical, and ready to use.

Why Choose a Biweekly Budget Template?

Managing money isn’t always simple, especially if you’re paid every two weeks. A biweekly budget template takes away the confusion by matching your income schedule, making it easier to plan how every dollar is used. Unlike monthly budgets, where paychecks don’t always align with due dates, a biweekly system lets you map out income and expenses in real time. This means you’re budgeting based on when money actually arrives, not just when bills are due.

One of the biggest advantages of a biweekly budget template is that it helps prevent overspending. Many people run into trouble when they try to stretch money across a full month, only to realize halfway through that funds are running low. With a two-week cycle, you’re less likely to drain your account too early. Each paycheck gets its own plan, which makes day-to-day spending easier to control.

Consistency is another reason people choose this method. Saving for the future or paying down debt becomes more manageable when you break it into smaller amounts every two weeks. For example, instead of setting aside $400 in one chunk for savings, you could add $200 from each paycheck. The same works for paying off credit cards or loans. Smaller contributions add up quickly, making financial goals feel less overwhelming.

Finally, a biweekly budget template reduces stress. By dividing expenses into bite-sized pieces, you no longer have to juggle an entire month’s worth of bills all at once. Fixed costs, variable expenses, and even fun money can be planned in a balanced way. Knowing that your money is organized and tied to your pay schedule brings peace of mind. It creates a sense of control, which is especially helpful if you’ve struggled with budgeting before.

What to Look For in a Biweekly Budget Template?

Not all templates are created equal. If you’re searching for the best biweekly budget template, you’ll want one that is simple and effective. A budget that’s overly complicated won’t last long because it’s frustrating to use. Look for something straightforward where you can enter income, list expenses, and track progress without getting lost in too many details. Simplicity is the key to sticking with it.

A good biweekly budget template should have clear sections for your income, fixed costs, variable costs, and savings. This structure helps you quickly see where your money is going every two weeks. Fixed costs include things like rent, insurance, or loan payments, while variable costs may be groceries, gas, or entertainment. By dividing them, you’ll notice patterns in your spending and can adjust when needed. The savings section is equally important—it ensures you pay yourself first instead of saving “whatever is left.”

Flexibility is another feature to look for. Life doesn’t always go as planned, and unexpected expenses will pop up. Whether it’s a car repair, a doctor’s bill, or a last-minute school fee, your template should leave room for adjustments. A rigid budget may cause frustration, while a flexible one keeps you in control. Some templates even have a “miscellaneous” or “buffer” category built in, which is perfect for covering those surprises.

You’ll also want to consider format. Some people prefer printable templates they can fill in by hand and keep in a binder, while others lean toward digital spreadsheets or apps that auto-calculate. A printable biweekly budget template is great for those who enjoy writing things down and reviewing their budget visually. On the other hand, a digital format can save time with automatic formulas and charts. The best choice comes down to your personal style and what keeps you consistent.

Ultimately, the best biweekly budget template is one that matches your lifestyle. It should be simple, organized, flexible, and available in the format you’ll actually use. Once you find the right fit, you’ll be able to track income and expenses with confidence, stay on top of bills, and reach your financial goals more easily.

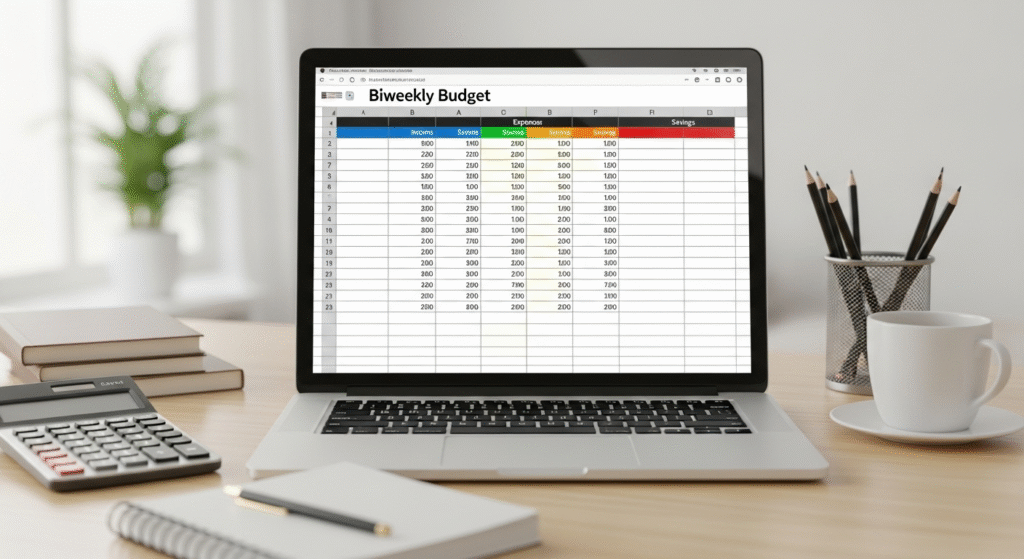

Template 1: Simple Spreadsheet Template (Excel/Google Sheets)

A biweekly budget template in spreadsheet form is one of the most practical tools available. Whether you use Excel or Google Sheets, this option gives you a clear, no-frills way to track income and expenses every two weeks. The structure is usually simple: one column for income, another for fixed costs, one for variable spending, and a savings section. Since it’s a spreadsheet, you can customize it however you like, from adding extra categories to inserting formulas that calculate totals automatically.

The biggest advantage of this template is flexibility. You can tweak it to match your paycheck dates, set up automatic calculations for totals, and even create charts to visualize your money flow. Google Sheets has the added bonus of being cloud-based, so you can access your budget on any device, anytime.

However, this option does have a learning curve. If you’re not comfortable with spreadsheets, it may feel intimidating at first. On the plus side, there are plenty of free pre-made biweekly budget templates you can download and adapt, which takes away most of the setup work.

This template is best for people who want control and customization. If you’re detail-oriented and like having the ability to build or adjust categories as needed, a spreadsheet will serve you well. It’s also great for anyone who wants a free solution since many templates online don’t cost a dime.

Template 2: Printable Planner Template

A printable biweekly budget template is perfect for those who prefer writing things down by hand. These templates are usually available as PDFs that you can print and keep in a binder or planner. The layout often includes sections for pay periods, income, expenses, and savings, all neatly organized so you can track your budget with pen and paper.

The main benefit of this style is its simplicity. There’s no tech involved—just print, fill in, and review. Many people find that writing down their budget helps them stay more mindful of their spending. A printable template also works well if you like to physically check things off or highlight important areas, such as bills due before your next paycheck.

On the downside, printable templates require you to do the math yourself. You won’t get the convenience of automatic calculations like in spreadsheets or apps. But if you’re comfortable with basic addition and subtraction, this isn’t a big obstacle.

This option is best for visual learners and paper planners who enjoy the process of writing. If you already use a planner for daily tasks or goals, adding a printable biweekly budget template can help you stay organized and motivated.

Template 3: Canva Aesthetic Template

If you love visuals and want your budget to look stylish, a Canva biweekly budget template may be your best pick. Canva offers beautifully designed templates with colors, icons, and creative layouts that make budgeting less boring. You can choose from minimalist designs, pastel themes, or bold modern styles—whatever fits your personality.

The advantage of Canva templates is how customizable they are. You can edit text, move elements, and personalize the look before downloading or printing it. If you prefer working digitally, you can even fill it out online within Canva itself. This makes it easy to create a budget that feels personal and motivating, rather than plain and technical.

One drawback is that Canva doesn’t do calculations automatically like a spreadsheet. You’ll need to enter numbers manually and do the math outside Canva, unless you print the template and fill it in by hand. Still, the attractive design often motivates people to actually use their budget regularly.

This template is best for creative personalities who want budgeting to feel fun. If you’re someone who gets discouraged by plain formats, using a stylish Canva biweekly budget template may keep you engaged and consistent.

Template 4: App-Based Template (for Mobile Tracking)

An app-based biweekly budget template is a smart choice for people who prefer mobile tracking. Budgeting apps often include features where you can set your income schedule to biweekly, and the app automatically organizes expenses and savings around it. Some apps even connect to your bank account for real-time updates.

The biggest benefit is convenience. Since your phone is always with you, you can check your budget anytime, track spending instantly, and set reminders for bills. Many apps also include graphs and charts that help you see patterns in your financial habits, which makes improving them much easier.

The downside is cost. While some apps are free, many of the best ones require a monthly subscription. Also, connecting your bank account may not feel comfortable for everyone due to privacy concerns.

This option is best for tech-savvy users who want automation and real-time tracking. If you don’t like sitting down with spreadsheets or paper, an app will help you stay consistent with your biweekly budget template wherever you go.

Template 5: Cute/Creative Template (Motivational & Fun Design)

Not all budgets need to be serious and plain. A cute biweekly budget template with motivational quotes, playful fonts, or creative illustrations can make the process more enjoyable. These templates often come in colorful designs that add a touch of fun to money management.

The benefit of this template is the motivation factor. If you find budgeting stressful or boring, using a cute or creative design can turn it into something you look forward to. For example, some templates use trackers shaped like jars or progress bars, making saving money feel like a fun challenge.

The drawback is that these templates may not be as professional or structured as spreadsheet or app-based options. They’re often better suited for personal use rather than business or detailed financial planning.

This template is best for people who want budgeting to feel lighthearted and motivating. If you’re easily discouraged by numbers, a creative biweekly budget template can keep you engaged and help you stick with your money goals over the long term.

How to Use These Templates Effectively?

Finding the right biweekly budget template is only the first step—the real power comes from using it correctly. Customizing a template to match your personal needs ensures it actually works for you, not against you. Start by adjusting categories to reflect your lifestyle. For example, if you spend more on childcare or commuting than eating out, make sure those categories are front and center. A good template should bend to fit your reality, not the other way around.

Another important step is setting realistic spending categories. It’s tempting to create strict limits that look good on paper but don’t reflect how you actually live. If you usually spend $200 on groceries every two weeks, don’t slash it to $120 just to force savings. Instead, work with honest numbers and trim gradually where possible. A biweekly budget template works best when it’s realistic and sustainable over time.

Consistency is also key. Simply filling out your budget once won’t help much. Make a habit of tracking every expense, even small ones like coffee or snacks. Over time, these little costs add up, and a template helps you see the bigger picture. Using digital options, such as apps or spreadsheets, can make this easier by automating totals and keeping things neat.

Finally, don’t forget about “third paycheck months.” Since biweekly pay schedules often give you two extra paychecks each year, treat those months as a bonus. Instead of overspending, use them for savings, debt repayment, or building an emergency fund. This small strategy can create a big impact on your financial stability.

Conclusion

Managing money doesn’t have to be overwhelming, especially when you’re paid every two weeks. A biweekly budget template simplifies the process by aligning directly with your paycheck schedule. Instead of juggling monthly tools that never seem to fit, these templates help you organize expenses, savings, and goals in a way that makes sense. We’ve explored five effective options from simple spreadsheets and printable planners to Canva designs, mobile apps, and even fun, creative templates. Each one has unique features, so there’s something for every personality and lifestyle. No matter which option you choose, the key is to start using a template and stay consistent.

The biggest takeaway is that budgeting works best when it’s simple, realistic, and motivating. A biweekly budget template takes away the guesswork, reduces stress, and ensures you always know where your money is going. Whether you want to pay off debt, grow savings, or just feel more in control of your finances, using the right template makes it achievable. Now it’s your turn. Pick one of the five templates we discussed and try it out. Don’t wait for the “perfect” time; start today with the paycheck you have. The sooner you begin, the sooner you’ll feel the relief of stress-free budgeting.

FAQs

Which is better: monthly or biweekly budgeting?

Monthly budgeting works well for people paid once a month, but it can feel mismatched for biweekly paychecks. A biweekly budget template aligns directly with how you’re paid, making it easier to plan. It helps you track expenses more accurately since it matches the timing of your income. Monthly budgets sometimes cause overspending before the next paycheck arrives. Biweekly budgeting is often better for anyone on a two-week pay cycle.

Are biweekly budget templates good for families?

Yes, families can benefit a lot from using a biweekly budget template. It breaks down household expenses into smaller, manageable periods. Parents can plan grocery shopping, childcare, and bills around each paycheck. This method also helps prevent running short before the month ends. Families often find biweekly budgeting less stressful and more realistic than monthly plans.

Can I use a biweekly budget if I have irregular income?

You can still use a biweekly budget template with irregular income, but it requires flexibility. Start by budgeting only with your guaranteed income. Then, add extra earnings as they come in, and assign them to savings or debt repayment. This method prevents overspending while still giving you control. A flexible biweekly system works better than no plan at all.

How do I track savings with a biweekly budget template?

A biweekly budget template makes savings easier by dividing goals into smaller amounts. Instead of saving $400 monthly, you set aside $200 every two weeks. This helps savings grow consistently without feeling overwhelming. Many templates include a dedicated savings section to keep you on track. Over time, this steady approach builds real financial progress.

Are there free options for biweekly budget templates?

Yes, there are many free biweekly budget template options available. You can find them as Excel spreadsheets, Google Sheets, or printable planners. Free templates cover the basics of income, expenses, and savings. They’re a great starting point if you don’t want to invest in paid versions yet. With a little customization, free templates can be just as effective as premium ones.