A loan EMI calculator is an online or software tool that helps borrowers estimate their monthly loan payments, known as EMIs (Equated Monthly Installments). By entering the loan amount, interest rate, and loan tenure, the calculator quickly provides an accurate monthly payment figure. The purpose of a loan EMI calculator is to make loan planning easier, allowing borrowers to budget effectively and compare different loan options. It helps users understand how changes in interest rates, loan amounts, or tenure affect monthly payments.

In this guide, we will explain how a loan EMI calculator works, its benefits, and how it can help with personal, home, and car loan planning, simplifying financial decisions for borrowers.

Top Loan EMI Calculators for Personal Loans

Personal loans are one of the most common types of loans, used for purposes like education, travel, medical expenses, or debt consolidation. A loan EMI calculator makes it easier for individuals to plan their monthly payments and manage their finances efficiently. By entering the loan amount, interest rate, and tenure, borrowers can quickly estimate how much they need to pay each month, helping them budget effectively.

Popular Personal Loan EMI Calculators

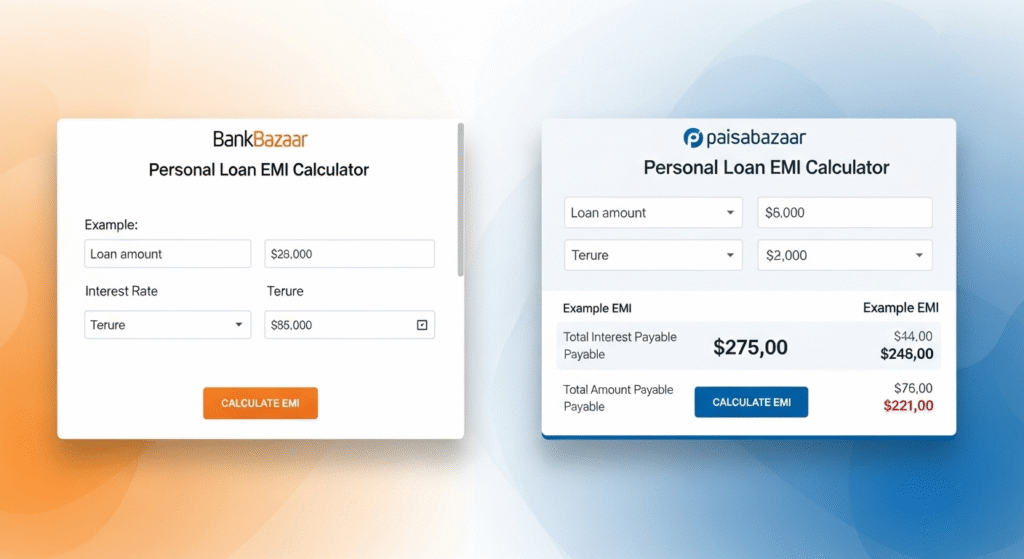

- BankBazaar Personal Loan EMI Calculator

BankBazaar offers a user-friendly loan EMI calculator for personal loans. It allows users to input loan amount, interest rate, and tenure to get accurate monthly EMI estimates.

Features:

- Simple input for loan details

- Real-time EMI calculation

- Graphical representation of principal vs interest

Pros:

- Free to use

- Easy to understand for beginners

- Helps compare multiple loan offers

Cons:

- Limited advanced features for complex loan scenarios

- Only covers loans from partner banks

Suitability: Ideal for salaried individuals and small business owners seeking a quick estimate of monthly payments.

- Paisabazaar Personal Loan EMI Calculator

Paisabazaar provides another popular loan EMI calculator for personal loans. It is designed to help users quickly evaluate EMI options before applying for a loan.

Features:

- EMI calculations for different banks

- Loan comparison options

- Interactive slider for adjusting loan amount and tenure

Pros:

- Free and fast

- Provides multiple loan options

- Suitable for planning and budgeting

Cons:

- May not consider prepayment or part-payment scenarios

- Limited guidance on loan eligibility

Suitability: Best for individuals with standard income sources and simple personal loan needs.

Benefits for Different Income Levels

Using a loan EMI calculator helps people with varying income levels. Low to mid-income individuals can plan their budget to ensure EMIs do not strain their monthly expenses. High-income earners can evaluate higher loan amounts and compare offers to optimize interest payments.

Top Loan EMI Calculators for Home Loans

Home loans are typically long-term loans with larger amounts and varying interest rates. A loan EMI calculator for home loans is essential for planning monthly payments, comparing lenders, and budgeting effectively over years. By using such a calculator, borrowers can adjust tenure, interest rate, or loan amount to find the most manageable EMI.

Popular Home Loan EMI Calculators

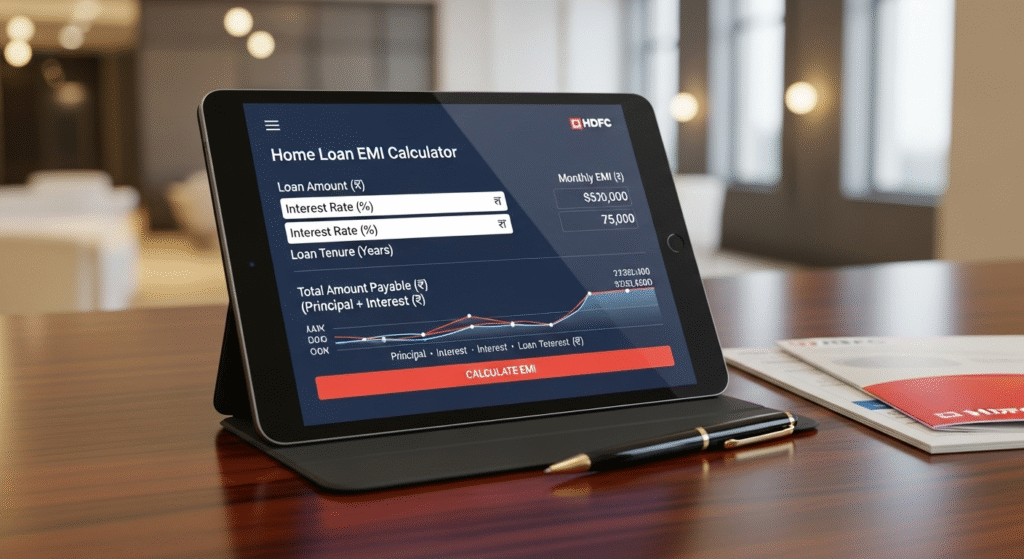

- HDFC Home Loan EMI Calculator

HDFC Bank offers a reliable loan EMI calculator for home loans. It helps borrowers estimate monthly payments based on loan amount, interest rate, and tenure.

Features:

- EMI calculation with different interest rate options

- Graphical representation of principal vs interest

- Prepayment and part-payment options

Pros:

- Accurate and updated with current interest rates

- Helps plan long-term payments

- Supports detailed budgeting

Cons:

- Mostly limited to HDFC home loans

- Advanced features may require bank login

Suitability: Ideal for first-time home buyers and salaried individuals looking for accurate EMI planning.

- ICICI Home Loan EMI Calculator

ICICI Bank provides an intuitive loan EMI calculator for home loans. It allows users to quickly calculate monthly EMIs and explore different repayment options.

Features:

- EMI estimation for varying loan amounts and tenures

- Visual representation of payment schedule

- Prepayment impact calculator

Pros:

- Free and easy to use

- Helps understand total interest and principal

- Useful for financial planning

Cons:

- Best suited for ICICI loans, may not cover other lenders fully

- Limited personalized advice

Suitability: Suitable for salaried professionals and self-employed individuals planning long-term home loans.

How They Help in Planning and Budgeting?

Home loans require careful planning due to their long tenure and high principal amounts. Using a loan EMI calculator helps borrowers:

- Estimate monthly EMIs before applying

- Adjust loan amount or tenure to match budget

- Compare lenders and interest rates efficiently

- Understand total interest payable over the loan period

Advantages and Limitations

Advantages:

- Saves time by providing instant EMI estimates

- Helps with financial planning and avoids over-borrowing

- Allows comparison between multiple lenders and interest rates

Limitations:

- May not consider hidden charges, processing fees, or insurance costs

- Does not replace professional financial advice for complex cases

- Estimates may vary slightly from actual EMI depending on lender calculations

Top Loan EMI Calculators for Car Loans

Car loans are short- to medium-term loans that help buyers purchase vehicles without paying the full amount upfront. A loan EMI calculator for car loans is essential for estimating monthly payments and planning finances effectively. These calculators allow buyers to input the loan amount, interest rate, tenure, and down payment to get a clear idea of their EMIs.

Best Car Loan EMI Calculators for Buyers

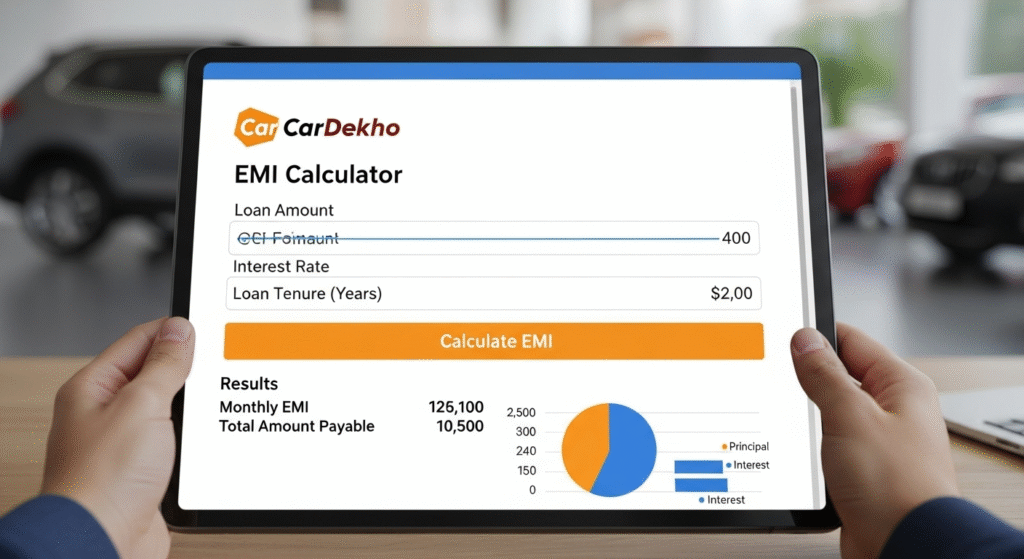

- CarDekho EMI Calculator

CarDekho provides a user-friendly loan EMI calculator for car buyers. Users can enter the vehicle price, down payment, interest rate, and loan tenure to get instant EMI estimates.

Features:

- Down payment and tenure options

- Graphical view of principal vs interest

- Quick comparison of different car loan offers

Pros:

- Simple and free to use

- Helps buyers plan budgets before applying

- Useful for comparing multiple lenders

Cons:

- Limited to vehicles listed on CarDekho

- May not include all additional charges like insurance or registration

- BankBazaar Car Loan EMI Calculator

BankBazaar offers a reliable loan EMI calculator for car loans, allowing users to explore EMIs for multiple banks.

Features:

- Multiple loan options and interest rates

- EMI calculation including down payment

- Prepayment and part-payment scenarios

Pros:

- Accurate and updated interest rates

- Easy comparison between lenders

- Helps plan short-term financial commitments

Cons:

- Limited advanced features for complex financing

- Best suited for standard car loans

Benefits for Car Buyers

A loan EMI calculator helps car buyers decide the right loan amount, compare interest rates, and plan their monthly budget. By entering different down payments or tenure options, buyers can see how EMIs change, ensuring affordability and financial comfort. Using these tools reduces surprises and allows for better decision-making when purchasing a vehicle.

Online vs Mobile App EMI Calculators

Loan EMI calculators are available as online tools and mobile apps, each with advantages and limitations.

Advantages and Disadvantages of Online Calculators

Online calculators are convenient and accessible from any browser without installation. They provide instant EMI estimates and are often free. However, they may have limited features for complex loans and require an internet connection, which could be inconvenient in some situations.

Benefits of Mobile App-Based Calculators

Mobile app loan EMI calculators offer convenience, allowing users to calculate EMIs on the go. They often include features like storing multiple loan scenarios, notifications for EMI schedules, and integration with financial planning apps.

Conclusion

Using a loan EMI calculator makes managing personal, home, and car loans easier and more accurate. These tools help borrowers estimate monthly payments, plan budgets, and compare different loan options before committing. Whether you use online calculators or mobile apps, they simplify complex calculations and provide a clear picture of principal, interest, and tenure. By choosing calculators with accurate results, user-friendly interfaces, and security features, borrowers can make informed financial decisions.

FAQs

How can I calculate my monthly loan payments?

You can calculate monthly payments by knowing the loan amount, interest rate, and loan tenure. Using a calculator or formula, you divide the total interest and principal over the number of months in the loan term. This helps you plan your monthly budget and ensures payments fit your income. Regularly calculating payments can also help you explore different loan options and choose the one that is most affordable and manageable.

Are online calculators reliable for planning loans?

Online calculators are generally reliable for estimating monthly payments. They provide quick results based on your input of principal, interest rate, and tenure. However, they may not include extra charges like processing fees or insurance. For precise planning, it’s important to verify results with your lender. These tools are excellent for budgeting and comparison, giving a clear view of possible monthly obligations before making loan decisions.

How often should I review my loan repayments?

It’s important to review your repayments regularly, especially if interest rates, income, or expenses change. Checking monthly or quarterly helps ensure you stay on track, avoid overdue payments, and adjust your budget if necessary. Reviewing your repayments also allows you to plan prepayments or changes in tenure to save money and manage financial obligations more effectively. Regular monitoring reduces stress and helps maintain financial discipline throughout the loan period.