Budgeting tips are more important than ever in 2025 as rising costs and financial uncertainty continue to affect daily life. From higher living expenses to unpredictable economic changes, managing money wisely has become a necessity, not just a choice.

Good money management does more than help you save—it also reduces stress. When you know where your money is going, you feel more in control and less anxious about the future. That’s why budgeting is directly linked to peace of mind.

Understand Your Income and Expenses

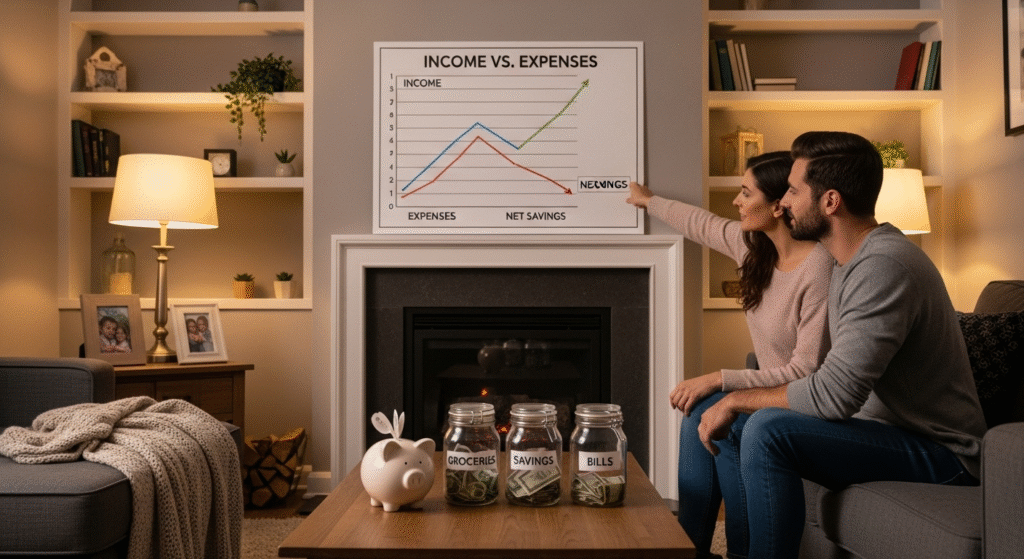

One of the most important budgeting tips for 2025 is learning how to fully understand your income and expenses. Without this clarity, it’s easy to feel overwhelmed or stressed about where your money is going. Start by tracking every source of income, whether it’s your salary, freelance work, side hustles, or passive income streams. This helps you know exactly how much money you’re working with each month.

Once you know your income, the next step is categorizing your expenses. Divide them into two main categories: needs and wants. Needs are essentials like rent, groceries, utilities, and transportation. Wants include things like eating out, shopping, or entertainment. By separating these, you’ll quickly see where most of your money is being spent and where you might cut back.

The benefit of this process goes beyond numbers. When you understand your cash flow, financial anxiety often decreases because you know exactly where your money is going. This awareness gives you control, which builds confidence in your financial decisions. With these budgeting tips, you’ll feel empowered to make changes that save money and reduce unnecessary stress.

Set Realistic Financial Goals

Another crucial budgeting tip is setting realistic financial goals. In 2025, costs may continue to rise, but having clear goals helps you stay focused instead of feeling lost. Financial goals can be divided into short-term and long-term. Short-term goals include things like paying bills on time, reducing credit card debt, or saving for a small emergency fund. Long-term goals might be bigger dreams like buying a house, planning a vacation, or saving for retirement.

Setting these goals provides motivation. Every time you check off a milestone, you’ll feel proud and encouraged to keep going. Even small achievements, like saving an extra $100 a month, build momentum. This keeps you consistent and makes the process less stressful.

Goals also act as a roadmap for your money. Instead of randomly spending, you know exactly what you’re working toward. This clarity reduces stress because your money is aligned with your values and priorities. You’re not just reacting to expenses—you’re planning ahead with confidence.

The best budgeting tips always remind us that goals should be realistic, not overwhelming. Setting the bar too high can lead to disappointment, but achievable goals help you stay motivated long-term. For example, instead of aiming to save $10,000 in one year, break it into smaller steps like $800 each month.

Create a Monthly Budget Plan

The heart of most effective budgeting tips is creating a monthly budget plan. Without a plan, money tends to disappear without you realizing where it went. A structured budget ensures your income is allocated wisely so you can cover needs, enjoy wants, and save for the future without stress.

There are different methods you can use. The zero-based budgeting method assigns every single dollar a purpose, ensuring nothing is wasted. The popular 50/30/20 rule divides your income into 50% for needs, 30% for wants, and 20% for savings or debt payoff. Both methods are simple to follow and give you a clear structure.

In 2025, technology makes budgeting easier than ever. There are many apps and tools designed to track expenses, send reminders, and even suggest savings strategies. These digital helpers remove the guesswork and make budgeting feel less overwhelming.

Consistency is the key to success. Creating a budget once isn’t enough—you need to review and adjust it monthly. Life changes, bills fluctuate, and unexpected expenses happen. By staying consistent, you’ll catch problems early and feel less stressed.

The real power of these budgeting tips lies in the peace of mind they provide. A monthly plan helps you avoid overspending, build savings, and pay off debt at a steady pace. It also ensures that you enjoy life while still being financially responsible.

Invest in Versatile Pieces

One of the smartest budgeting tips for anyone in 2025 is to invest in versatile pieces that work across different parts of your life. Instead of buying items that only serve one purpose, choose clothes, gadgets, or tools that can transition between work, casual, and special occasions. For example, a crisp white shirt can be worn in the office with tailored pants, or dressed down with jeans for a weekend outing. This approach saves money while still keeping your style fresh and professional.

Versatile clothing staples include neutral blazers, black trousers, classic shoes, and simple tops that can be mixed and matched to create multiple outfits. By focusing on quality rather than quantity, you build a wardrobe that lasts longer and reduces the need for constant shopping. This same principle applies to other parts of life, like kitchenware, technology, and even home furniture. Investing in multi-purpose items is one of the most practical budgeting tips for reducing wasteful spending.

The beauty of versatility is that it also saves time. You don’t have to stress about what to wear or buy because your essentials already work in multiple situations. Over time, this mindset not only cuts costs but also reduces financial stress by removing the pressure to constantly purchase new things.

Accessorize to Elevate Your Look

Another effective set of budgeting tips focuses on accessories. Accessories are often overlooked, but they’re the easiest and most affordable way to upgrade your look without overspending. A simple outfit can feel completely different when paired with the right watch, scarf, belt, or handbag. Instead of buying new clothes constantly, use accessories to refresh what you already own.

Budget-friendly accessories are widely available in 2025, from online shops to local stores. Items like jewelry, ties, shoes, or hair accessories can be purchased at affordable prices and still give you a polished, professional appearance. By mixing accessories with your wardrobe staples, you can create multiple styles without adding huge expenses. This is one of the most practical budgeting tips because it proves you don’t need to spend a fortune to look stylish.

Accessories also let you express your personality. While clothing basics may remain neutral, a colorful scarf or bold watch can add individuality to your look. This balance between simplicity and creativity helps you stay professional yet unique.

Another advantage is longevity—many accessories last for years if you take care of them. Compared to clothing that wears out quickly, accessories provide better long-term value. This makes them not just stylish add-ons, but smart financial choices.

Care for Your Clothes to Save Long-Term

One of the most overlooked budgeting tips is learning how to properly care for your clothes. Buying quality items is only the first step—making them last is where real savings come in. Simple habits like washing clothes in cold water, avoiding harsh detergents, and air-drying delicate fabrics can extend the life of your wardrobe. When clothes last longer, you spend less replacing them.

Storage also plays a big role. Keeping clothes in breathable garment bags, using padded hangers, and folding knitwear properly prevents damage and keeps items looking new. Even shoes benefit from care—polishing leather, using shoe trees, and rotating pairs all help extend their lifespan. These small actions may seem minor, but they are essential budgeting tips for reducing long-term expenses.

Caring for clothes not only saves money but also reduces stress. Instead of worrying about worn-out outfits before important events, you can rely on a wardrobe that always looks fresh and professional. The peace of mind that comes from maintaining your clothes properly is an underrated benefit of good money management.

Think of maintenance as an investment. A shirt that lasts five years because you cared for it is far cheaper than replacing the same item every year. This mindset can also be applied to other items you own, from electronics to furniture. The better you care for what you have, the less you’ll need to spend later.

Practice Mindful Spending

One of the most powerful budgeting tips is to practice mindful spending. This means pausing before each purchase and asking yourself, “Do I really need this, or is it just a want?” By making that small shift in thinking, you can stop impulse buying and move toward intentional decisions that serve your long-term goals.

Mindful spending doesn’t mean depriving yourself—it means being aware of where your money goes and choosing wisely. For example, instead of buying coffee every morning, you might prepare it at home and save that money for something more meaningful. These small, conscious choices add up to big savings over time. This is one of the budgeting tips that not only protects your wallet but also encourages healthier financial habits.

Another benefit of mindful spending is the positive effect on mental health. When you are in control of your spending, you feel less regret and guilt after shopping. Your money habits align with your values, reducing stress and boosting confidence. Instead of chasing the thrill of buying something new, you enjoy the satisfaction of building financial stability.

Practicing mindful spending also creates space for gratitude. You learn to appreciate what you already own instead of constantly seeking more. This balanced mindset improves both financial well-being and emotional health.

Review and Adjust Regularly

Even the best budgeting tips will not work if you don’t review and adjust your plan regularly. Life changes—new jobs, family needs, health expenses, or economic shifts in 2025—can quickly affect your budget. That’s why monthly or quarterly check-ins are essential. These reviews help you identify what’s working, what’s not, and where changes are needed.

Start by tracking your actual income and expenses compared to your planned budget. If you notice overspending in one category, adjust your limits or cut back elsewhere. Likewise, if you’ve had a salary increase, decide how much of it should go to savings or debt repayment rather than extra spending. This proactive approach keeps your financial goals on track.

Regular adjustments also reduce stress. Instead of waiting until a financial problem becomes overwhelming, you address small issues early. This gives you a sense of control and prevents money worries from building up. One of the most useful budgeting tips is to treat your budget like a living plan, not a fixed document.

Technology can make this process easier. Budgeting apps in 2025 allow you to get reminders, track spending in real time, and quickly see where you stand. With these tools, reviews take only a few minutes but make a huge difference in your financial success.

Conclusion

Following these budgeting tips in 2025 can make a real difference in both your financial health and mental well-being. By tracking your income, setting realistic goals, practicing mindful spending, and reviewing your budget regularly, you can save money while keeping stress levels low. The key is to start small. Even one change—like cutting unnecessary expenses or reviewing your budget monthly—can put you on the path toward stability. Over time, these small actions build powerful financial habits.

Remember, budgeting isn’t about restriction—it’s about freedom. When you take control of your money, you take control of your peace of mind. Begin today by choosing one tip from this guide and applying it in your life. The sooner you start, the sooner you’ll feel the relief that comes with financial confidence.

FAQs

What are the biggest budgeting challenges people face in 2025?

Many people in 2025 struggle with the rising cost of living, making it harder to stick to a budget. Subscription services and impulse online shopping are also common money leaks. Another challenge is balancing short-term enjoyment with long-term savings goals. Without clear priorities, people often overspend in small areas that add up over time. The good news is that smart budgeting habits can help overcome these challenges.

How can budgeting tips help with debt repayment?

Budgeting tips make debt repayment more structured by helping you allocate money specifically toward debt each month. Whether you use the snowball or avalanche method, a budget ensures steady progress. Tracking spending prevents money from slipping away on unnecessary purchases. Over time, you’ll notice smaller debts disappearing, which creates motivation to keep going. A clear budget turns debt repayment from overwhelming to achievable.

How much should I save from my budget each month?

The amount depends on your income and expenses, but a common rule is to save at least 20% of your earnings. If that’s not possible, even saving 5–10% regularly can add up. The key is consistency—making savings a non-negotiable part of your budget. In 2025, automated savings tools make this process much easier. Building savings slowly but steadily helps create long-term security.