Burton Malkiel’s efficient market theory made him one of the most influential thinkers in modern finance. Burton Malkiel is a renowned economist, author, and professor best known for explaining how financial markets work in a simple and practical way. His work helped investors understand that stock prices already reflect available information. By introducing Efficient Market Theory (EMT), he changed how people think about investing and risk. His ideas also played a major role in the growth of index investing, which focuses on matching market performance rather than trying to beat it.

Burton Malkiel’s efficient market theory explains that it is extremely difficult to consistently outperform the market. According to EMT, prices adjust quickly when new information appears, leaving little room for investors to gain an advantage through stock selection or timing. This insight transformed investing by shifting attention from active trading to long-term, low-cost strategies. As a result, index funds became popular because they reflect overall market efficiency while reducing fees and emotional decision-making.

Burton Malkiel’s efficient market theory was shaped by his strong academic background and early research in economics. He studied how markets behave under competition and uncertainty, which influenced his views on price movements. Early in his career, he became skeptical of active stock picking after observing how often professional managers failed to beat the market. These experiences led him to support passive investing and long-term discipline as more reliable paths to building wealth.

Efficient Market Theory Explained Simply

Burton Malkiel’s efficient market theory explains how stock prices behave in a competitive and information-rich market. In simple terms, the theory says that asset prices already reflect all available information. This means when you see a stock price today, it already includes what investors know about the company, the economy, and future expectations. Because information spreads quickly, it becomes very hard for any investor to consistently find undervalued or overvalued stocks.

There are three main types of market efficiency described in Burton Malkiel’s efficient market theory. Weak-form efficiency suggests that past prices and trends are already reflected in current prices, making technical analysis ineffective. Semi-strong efficiency goes further, stating that all public information, such as earnings reports and news, is already priced in. Strong-form efficiency claims that even private or insider information is reflected in prices, though this version is widely debated. These levels help investors understand how much advantage information can truly provide.

Information plays a central role in Burton Malkiel’s efficient market theory. When new data is released, such as economic reports or company announcements, investors react almost immediately. Their buying and selling actions push prices up or down until they reflect the new reality. This rapid adjustment process is what keeps markets efficient. As a result, trying to react faster than others becomes extremely difficult, especially for individual investors.

Core Principles Behind Burton Malkiel’s Efficient Market Theory

Burton Malkiel’s efficient market theory is built on the idea that beating the market consistently is extremely difficult. Thousands of investors analyze the same data every day, competing to find opportunities. This competition quickly removes pricing errors. When one investor spots a potential bargain, others do too, and the price adjusts almost instantly. As a result, long-term market outperformance becomes more about luck than skill.

Information and competition are key forces in Burton Malkiel’s efficient market theory. Financial markets include institutions, professionals, and individual investors, all reacting to news and data. This collective behavior ensures prices move toward fair value. The more liquid and active a market is, the more efficient it becomes. This is why major stock markets tend to follow efficiency principles more closely than smaller or less-developed markets.

The random walk theory is another pillar of Burton Malkiel’s efficient market theory. It suggests that stock price movements are unpredictable and do not follow clear patterns. Price changes depend on new information, which arrives randomly. This means past performance cannot reliably predict future results. Investors who rely on charts or short-term trends often underestimate this randomness.

The Rise of Index Investing

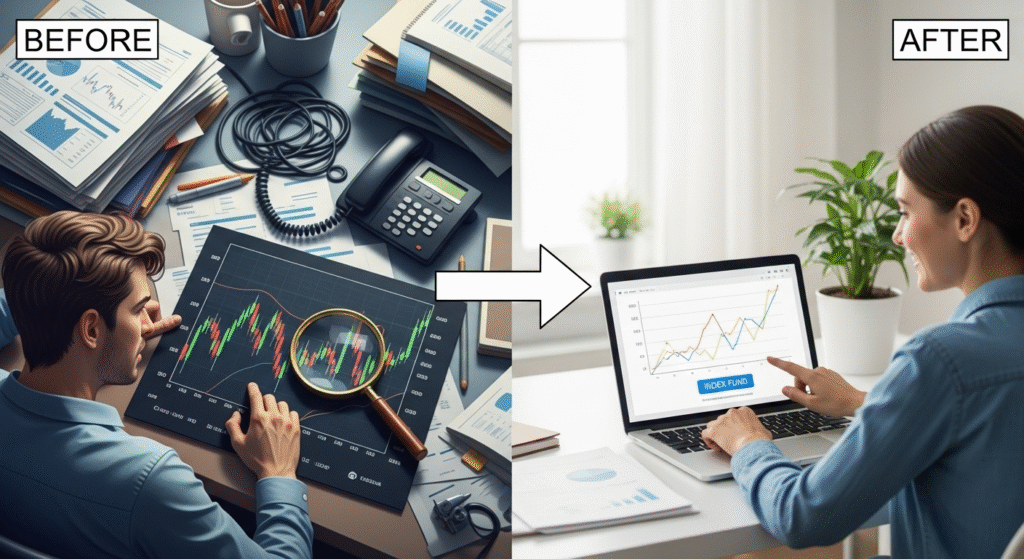

Burton Malkiel’s efficient market theory directly influenced the rise of index investing. Index investing involves buying a fund that tracks a broad market index, such as the S&P 500. Instead of selecting individual stocks, investors own a small piece of the entire market. This approach accepts that markets are efficient and that matching market returns is a realistic and reliable goal.

Index funds gained popularity because they align perfectly with Burton Malkiel’s efficient market theory. If markets already price information efficiently, then trying to outperform them becomes costly and uncertain. Index funds eliminate the need for constant trading and analysis. They offer simplicity, transparency, and consistency, making them attractive to both beginners and experienced investors.

The relationship between EMT and passive investing is central to Burton Malkiel’s efficient market theory. Passive investing avoids frequent buying and selling, reducing emotional decisions. It also minimizes transaction costs and taxes. By holding the market long-term, investors benefit from overall economic growth rather than short-term speculation.

A Random Walk Down Wall Street: Impact and Legacy

Burton Malkiel’s efficient market theory reached millions of people through his famous book A Random Walk Down Wall Street. First published in 1973, the book explained complex financial ideas in clear and simple language. Malkiel used real-world examples to show why predicting stock prices is extremely difficult. The book challenged traditional beliefs about stock picking and market timing, making it accessible to everyday investors rather than just academics or professionals.

One of the key messages in A Random Walk Down Wall Street is that most investors cannot consistently beat the market. According to Burton Malkiel’s efficient market theory, stock prices already reflect available information, so trying to outsmart the market usually leads to disappointment. Malkiel encouraged investors to focus on diversification, long-term discipline, and low costs. These ideas helped readers understand that investing does not need to be complicated to be effective.

The book played a major role in popularizing index investing. Burton Malkiel’s efficient market theory supports the idea that matching the market is often better than trying to beat it. Through his writing, Malkiel showed how index funds allow investors to benefit from overall market growth without high fees or frequent trading. This message helped index funds move from a niche concept to a mainstream investment strategy.

The influence of A Random Walk Down Wall Street extended beyond individual investors. Burton Malkiel’s efficient market theory became a foundation in financial education around the world. Universities, financial advisors, and institutions began teaching these principles as part of standard investment knowledge. The book remains widely read today, proving its lasting impact. Its legacy lies in empowering investors with realistic expectations and promoting smarter, long-term investing behavior.

How Index Investing Changed Personal Finance?

Burton Malkiel’s efficient market theory played a major role in transforming personal finance through index investing. One of the biggest impacts has been on retirement planning. Instead of relying on expensive actively managed funds, investors began using low-cost index funds for long-term savings. This shift helped individuals build wealth more efficiently while reducing unnecessary risk and fees.

The growth of ETFs and low-cost funds is closely tied to Burton Malkiel’s efficient market theory. Exchange-traded funds made index investing even more accessible by offering flexibility, transparency, and diversification. Investors could now buy and sell diversified portfolios easily. As competition increased, fees dropped significantly, allowing investors to keep more of their returns over time.

Index investing also led to the democratization of investing. Burton Malkiel’s efficient market theory supports the idea that anyone can succeed without special knowledge or timing skills. With index funds, small investors gained access to the same market opportunities as large institutions. This leveled the playing field and reduced reliance on financial advisors and complex strategies.

Conclusion

Burton Malkiel’s efficient market theory changed how millions of people understand investing. By explaining that markets quickly reflect available information, he encouraged investors to focus on discipline rather than prediction. His ideas helped shift attention away from risky stock picking toward low-cost, long-term strategies. Through index investing, everyday investors gained a simple and reliable way to grow wealth. Even with criticism and market imperfections, his core message remains strong. Burton Malkiel’s efficient market theory continues to guide investors toward diversification, patience, and cost efficiency. For anyone seeking steady financial growth, his work offers timeless lessons that remain highly relevant in today’s markets.

FAQs

Is Efficient Market Theory suitable for beginner investors?

Yes, Efficient Market Theory is very suitable for beginners because it promotes simple and disciplined investing. It teaches new investors that predicting short-term market movements is difficult and often unproductive. Instead of complex strategies, beginners can focus on diversification, low costs, and long-term investing. This approach reduces stress, avoids emotional decisions, and helps beginners build wealth steadily without needing deep financial knowledge or constant market monitoring.

Can Efficient Market Theory apply to emerging or small markets?

Efficient Market Theory applies more strongly to large, developed markets with high trading activity. Emerging or small markets may be less efficient because information spreads more slowly and fewer investors participate. This can create short-term opportunities. However, these markets also carry higher risk and uncertainty. Even in less efficient markets, consistently identifying opportunities remains challenging, which is why diversification and long-term strategies are still important.

How does Efficient Market Theory affect financial advisors?

Efficient Market Theory has changed the role of financial advisors by shifting focus away from stock picking. Many advisors now emphasize asset allocation, diversification, tax planning, and long-term goals. Instead of trying to beat the market, advisors help clients manage risk, control costs, and stay disciplined during market ups and downs. This approach aligns better with investor behavior and long-term financial success.