Certificates of Deposit Rates are a key factor for anyone looking to grow savings safely and steadily. By offering fixed interest over a set period, CDs provide a secure way to earn predictable returns without the risk of market fluctuations. Understanding current rates helps investors and savers choose the best CD options to maximize their earnings while keeping their funds safe.

In this guide, we will explore different types of CDs, how rates vary by term and institution, and tips for selecting the right certificate of deposit. You will learn how certificates of deposit rates can help grow your savings effectively over time.

Factors Affecting Certificates of Deposit Rates

Certificates of Deposit Rates can vary widely depending on several factors. Understanding these factors helps investors and savers choose the best CD to maximize returns while keeping money safe. Knowing what affects rates allows for informed decisions and better savings growth.

Term length (short-term vs long-term) is a major factor. Short-term CDs usually offer lower rates because the bank holds your money for a shorter period. Long-term CDs tend to provide higher rates as banks can use your funds for a longer duration. The choice between short-term and long-term CDs depends on your financial goals, liquidity needs, and interest rate expectations. Some investors prefer short-term CDs to maintain flexibility, while others choose long-term CDs to lock in higher rates for stable growth.

Economic conditions and interest rate trends also influence certificates of deposit rates. Central bank policies, inflation, and overall economic growth impact interest rates offered by banks. When market rates rise, CD rates often increase, providing higher returns. Conversely, in a low-interest environment, rates may be lower. Paying attention to economic forecasts and interest rate trends can help investors choose the right time to open a CD.

Bank policies and promotional rates can significantly affect returns. Banks may offer special promotional CDs with higher rates to attract new customers or deposits. Some banks provide bonuses for large deposits or new accounts. Comparing rates across institutions ensures you find the most competitive option. Understanding terms, penalties, and fine print is essential to maximize benefits from promotional offers.

Types of Certificates of Deposit

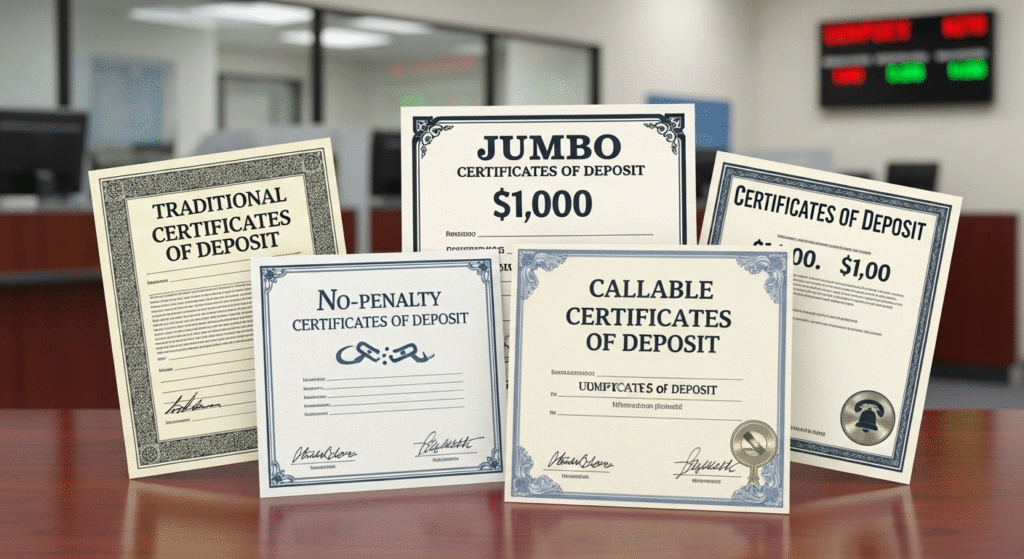

Certificates of Deposit Rates can differ based on the type of CD selected. Each type offers unique features, interest rates, and flexibility, allowing investors to choose based on their financial goals and liquidity needs. Understanding CD types ensures you get the most value from your savings.

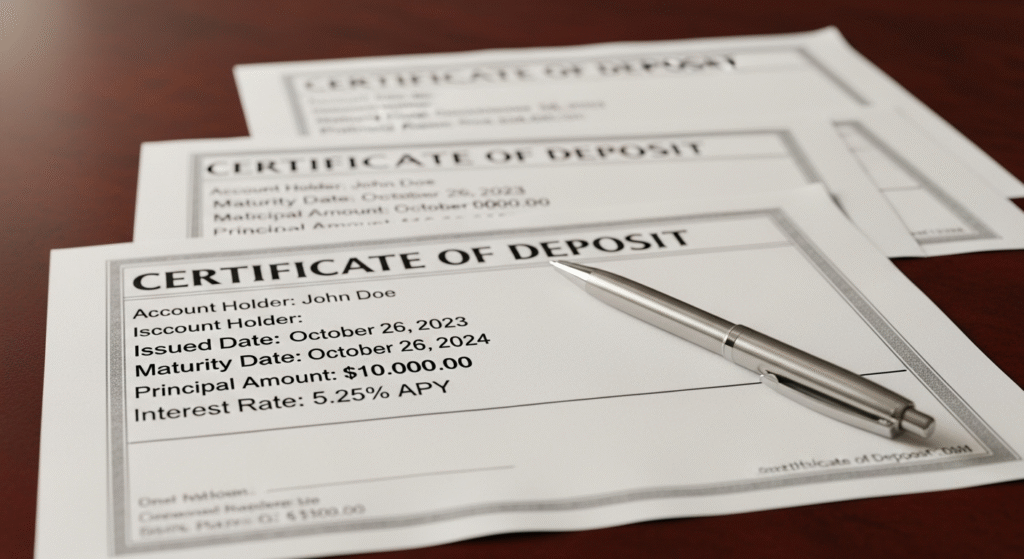

Traditional CDs are the most common type. They provide a fixed interest rate for a set term, ranging from a few months to several years. Traditional CDs are safe, predictable, and usually insured by the FDIC, making them ideal for conservative savers. The rates vary depending on the term length and bank policies.

Jumbo CDs require a larger minimum deposit, often $100,000 or more. Because of the larger investment, banks typically offer higher certificates of deposit rates compared to traditional CDs. Jumbo CDs are suitable for investors with significant savings looking to maximize returns. However, they are less liquid due to the large deposit requirement.

No-penalty and callable CDs provide more flexibility. No-penalty CDs allow early withdrawals without penalties, though rates may be slightly lower. Callable CDs give banks the option to end the CD before maturity if interest rates change. These CDs offer unique strategies for balancing higher returns and flexibility.

Special promotional CDs are offered by banks to attract new deposits. They may feature higher rates, bonus interest, or limited-time offers. Promotional CDs can help savers earn more interest but often have specific conditions or shorter terms. Comparing offers across institutions is essential to maximize benefits.

Maximizing Savings with CD Rates

Certificates of Deposit Rates can significantly affect the growth of your savings, and using the right strategies can help you maximize returns. Understanding how to compare rates, use laddering techniques, and time deposits effectively ensures you earn the most interest while keeping funds safe and accessible.

Comparing rates across banks and credit unions is the first step. Different financial institutions offer different CD rates for similar terms. Online banks often provide higher rates than traditional banks due to lower overhead costs. Credit unions may also offer competitive rates to members. Comparing offers allows you to find the best CD rates for your needs. Paying attention to fees, minimum deposit requirements, and promotional offers helps maximize returns from your CDs.

Laddering strategy for consistent returns involves spreading your investment across multiple CDs with different maturities. For example, you can invest in CDs with 6-month, 12-month, and 24-month terms. As each CD matures, you reinvest the principal at current rates. Laddering reduces the risk of locking in low rates for long periods and provides a steady stream of accessible funds. This strategy allows you to benefit from rising certificates of deposit rates while maintaining liquidity.

Timing deposits for optimal interest is another way to maximize earnings. Interest rates can fluctuate based on economic conditions and bank policies. Opening CDs when rates are high locks in better returns. Monitoring market trends and comparing rates regularly helps you decide the best time to invest.

Risks and Considerations

While certificates of deposit rates offer safe returns, investors should consider potential risks to make informed decisions. Being aware of these factors helps protect savings and ensure financial goals are met.

Early withdrawal penalties are one of the main risks. Most CDs require funds to remain deposited until maturity. Withdrawing money early usually results in losing some or all accrued interest. Understanding penalty terms is crucial before investing. Some CDs, like no-penalty CDs, offer flexibility, but they often have slightly lower rates compared to traditional CDs.

Inflation impact on real returns is another important consideration. If inflation rises faster than your CD rate, your money’s purchasing power may decrease over time. While CDs are safe, the interest earned may not always keep up with inflation. Choosing higher-yield CDs or laddering strategies can help mitigate this risk.

Choosing terms that fit financial goals ensures your funds are available when needed. Short-term CDs provide flexibility but may have lower rates. Long-term CDs offer higher certificates of deposit rates but lock money for extended periods. Assess your liquidity needs and savings objectives before selecting a term.

Tips for Choosing the Right CD

Selecting the best CD requires evaluating rates, terms, and your personal financial goals. Certificates of Deposit Rates vary by institution, term, and type, so careful planning ensures optimal returns and financial flexibility.

Matching CD term with savings goals is the first step. Short-term CDs are ideal for near-future expenses, while long-term CDs suit funds that can remain untouched to earn higher rates. Aligning term length with financial objectives ensures your money is available when needed without sacrificing interest earnings.

Evaluating interest rates vs flexibility is also important. Higher rates often come with longer terms or early withdrawal penalties. If liquidity is essential, no-penalty CDs or shorter-term options may be better, even with slightly lower certificates of deposit rates. Balance between earning potential and access to funds.

Using CDs in a diversified savings strategy can further optimize returns. Combining multiple CDs with different terms, alongside other savings or investment options, spreads risk and maximizes interest. Laddering or staggering investments ensures consistent access to funds while taking advantage of varying rates.

Conclusion

Certificates of Deposit Rates are a safe and effective way to grow your savings steadily. By understanding how rates vary by term, institution, and type of CD, investors can make informed decisions that maximize interest earnings. Using strategies like comparing rates, laddering investments, and timing deposits helps optimize returns while maintaining flexibility. Awareness of risks, including early withdrawal penalties and inflation, ensures funds are protected. By carefully selecting CDs that match financial goals and using diversification strategies, savers can enjoy reliable growth, financial security, and peace of mind.

FAQs

What is a certificate of deposit?

A certificate of deposit is a savings product offered by banks and credit unions. You deposit a fixed amount of money for a set term, such as six months or five years. In return, you earn interest at a guaranteed rate. The money is generally safe and insured by the FDIC. CDs offer predictable growth, making them suitable for conservative savers who want a stable return without market risk.

Can I withdraw money early from a CD?

Early withdrawal from a CD is usually allowed but comes with penalties. You may lose some or all of the interest earned, depending on the terms. Some banks offer no-penalty CDs, which allow withdrawals without fees but often have slightly lower rates. Before investing, it’s important to understand early withdrawal rules. Choosing a term that matches your financial goals helps avoid penalties while still earning competitive interest.

How do I choose the best CD rates?

To find the best CD rates, compare offers from different banks and credit unions. Consider term lengths, interest rates, minimum deposits, and any promotional offers. Online banks often provide higher rates due to lower costs. Align the CD term with your financial goals and liquidity needs. Using laddering strategies can also help maximize returns. Regularly checking market rates ensures you can take advantage of the most competitive CDs available.

Are CD earnings taxable?

Yes, interest earned from a CD is considered taxable income. Banks report the interest to the IRS, and you must include it on your tax return. Earnings are taxed at your ordinary income tax rate. Some tax-advantaged accounts, like IRAs or certain retirement plans, may allow CD interest to grow tax-deferred. Understanding tax implications helps plan your investments and ensures accurate reporting while maximizing after-tax returns.

What is CD laddering?

CD laddering is a strategy where you split your savings across multiple CDs with different maturity dates. As each CD matures, you reinvest the funds into new CDs at current rates. This approach provides consistent access to funds while taking advantage of higher certificates of deposit rates over longer terms. Laddering reduces the risk of locking in low rates for long periods and helps maintain flexibility while maximizing overall returns.