ETF Investing is one of the easiest and smartest ways for beginners to grow their wealth over time. ETFs, or Exchange-Traded Funds, allow investors to buy a collection of stocks, bonds, or other assets in a single investment. This approach reduces risk compared to buying individual stocks while providing the opportunity for steady growth. ETF investing is flexible, affordable, and accessible to everyone, even with a small budget.

In this guide, you’ll find in-depth explanations on how ETFs work, different types of ETFs, strategies to start investing, portfolio management tips, and practical advice for growing your wealth. By following this guide, beginners can build a diversified portfolio that aligns with financial goals and long-term wealth-building strategies.

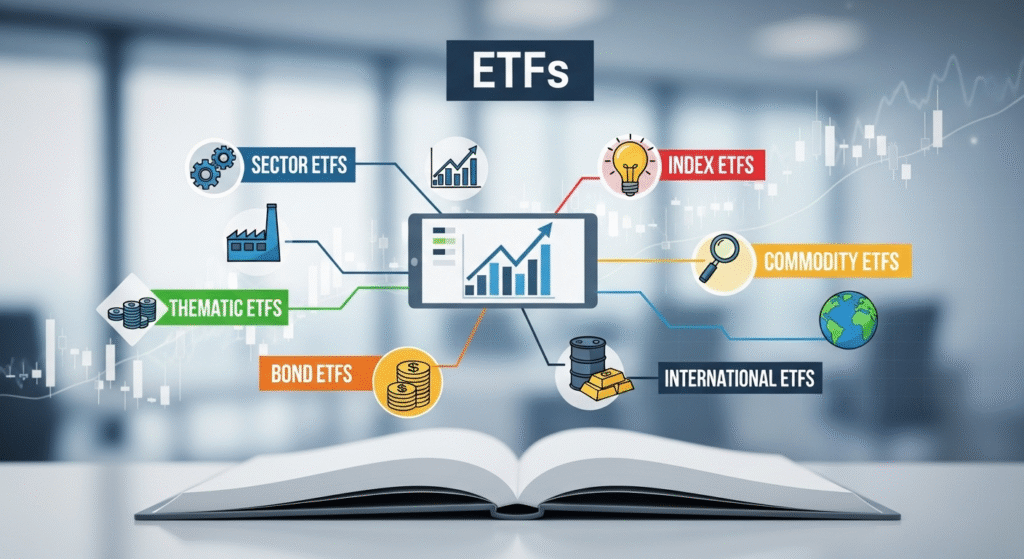

Types of ETFs

ETF Investing offers a wide range of options to suit different financial goals and risk levels. The most common are index ETFs, which track well-known stock market indexes such as the S&P 500. These ETFs give you exposure to a large number of companies, helping to spread risk. Sector ETFs focus on specific industries like technology, healthcare, or energy, making them great for investors who want to target growing markets. Thematic ETFs follow investment trends such as renewable energy or artificial intelligence, ideal for those who want to invest in innovation and long-term global changes.

There are also bond ETFs, which invest in government or corporate bonds and provide more stability with lower risk. Commodity ETFs allow investors to gain exposure to assets like gold, oil, or silver without owning the physical commodity. International ETFs open the door to global markets, helping diversify portfolios beyond domestic investments.

When deciding which ETFs to invest in, consider your risk tolerance and financial goals. Conservative investors may prefer bond or dividend ETFs for stability, while those seeking higher returns might choose sector or thematic ETFs. A well-balanced mix can protect your portfolio from market fluctuations. By understanding the types of ETFs available, beginners can make smarter decisions and create a diversified strategy that supports their long-term financial growth. In ETF Investing, variety and balance are key to minimizing risk and maximizing opportunity.

How ETFs Work?

Understanding how ETFs function is essential before you begin ETF Investing. An ETF is a fund made up of multiple assets such as stocks, bonds, or commodities. Each share represents a portion of the fund’s overall value, known as the Net Asset Value (NAV). The NAV changes throughout the day as the prices of the underlying assets rise and fall. Unlike mutual funds, ETFs are traded on stock exchanges just like regular stocks, allowing investors to buy or sell shares anytime during market hours.

ETF Investing gives you flexibility and liquidity, meaning you can easily adjust your portfolio as market conditions change. Many ETFs also pay dividends, which can be reinvested automatically to increase your holdings over time through compounding growth. Investors can use different brokerage platforms to buy ETFs, and most charge very low fees compared to traditional funds.

The combination of transparency, accessibility, and cost-effectiveness makes ETF Investing ideal for beginners. Each ETF clearly lists its holdings, making it easy to understand where your money is going. You can view real-time data, monitor performance, and trade efficiently. Whether your goal is long-term wealth building or short-term diversification, understanding how ETFs work gives you the foundation to invest wisely and confidently.

Setting Investment Goals

Setting clear and realistic goals is one of the most important steps in successful ETF Investing. Start by defining your short-term and long-term financial objectives. Short-term goals might include saving for a vacation, buying a car, or building an emergency fund, while long-term goals could involve retirement, education funds, or financial independence. Once you’ve identified your goals, you can choose ETFs that align with each timeline and risk level.

For example, if your goal is stability and steady income, bond ETFs or dividend ETFs may be suitable. If your goal is long-term growth, index or thematic ETFs can offer better returns over time. Always assess your risk tolerance — how much fluctuation you’re comfortable with in your investments — to ensure you select ETFs that fit your comfort level.

ETF Investing also emphasizes diversification, which means spreading your money across different assets and sectors to reduce overall risk. You can balance high-risk growth ETFs with lower-risk bond or index ETFs to create a stable, profitable portfolio. Setting measurable milestones helps track your progress and keeps you motivated.

How to Start Investing in ETFs

Starting your journey in ETF investing is easier than it sounds, especially for beginners who want to build wealth gradually. The first step is opening a brokerage account. Many online brokers now offer commission-free trading, low minimum deposits, and user-friendly apps. Choose one that provides access to a wide range of ETFs, good research tools, and educational resources. Once your account is set up, you can start exploring ETFs that align with your goals.

When selecting ETFs for your first investment, focus on simplicity and stability. For beginners, index ETFs that track the S&P 500 or total market are great options because they provide instant diversification across many companies. Avoid picking complex or niche funds in the beginning. Look for low expense ratios since fees can reduce your long-term returns.

One of the best strategies in ETF investing is dollar-cost averaging. This means investing a fixed amount regularly—monthly or quarterly—regardless of market conditions. Over time, this approach smooths out price fluctuations and helps you buy more shares when prices are low. You can even automate your investments, so contributions happen consistently.

As you gain experience, consider balancing your ETF portfolio with a mix of asset classes, such as stocks, bonds, and international ETFs. This helps reduce risk while keeping your long-term goals in sight. Remember, the key to successful ETF investing is starting small, staying consistent, and letting compound growth work for you.

Tracking and Managing Your ETF Portfolio

Once you’ve started ETF investing, tracking your portfolio is essential for long-term success. Monitoring ETF performance regularly helps you stay informed about how your investments are growing. Keep an eye on metrics like total return, dividend yield, and expense ratio. However, avoid checking your portfolio daily—quarterly reviews are usually enough for long-term investors.

Rebalancing your portfolio periodically is another important step. Over time, some ETFs may outperform others, shifting your allocation away from your target mix. For example, if stocks grow faster than bonds, your portfolio might become riskier than intended. Rebalancing—selling a portion of the overperforming assets and reinvesting in underperforming ones—helps maintain your desired risk level and diversification.

Technology makes ETF investing management easier than ever. Use financial apps or brokerage dashboards to track performance, asset allocation, and diversification. Some platforms even send automatic alerts when your portfolio drifts from your target mix. Consider using spreadsheets or portfolio trackers that show your ETFs’ growth, dividends, and overall returns.

Don’t forget to review your ETFs periodically to ensure they still align with your goals. If your financial situation changes such as saving for a home or nearing retirement, you may need to adjust your strategy. Successful ETF investing isn’t about constant trading; it’s about consistent review and disciplined management.

Tips for Beginners to Grow Wealth with ETFs

For those new to ETF investing, a few smart habits can make a huge difference in long-term wealth building. The first rule is to avoid chasing high yields. While it’s tempting to invest in ETFs that promise big returns, high yields often come with higher risks. Instead, focus on well-diversified ETFs with a steady track record of performance.

Diversification is one of the best advantages of ETF investing. Spread your investments across various sectors, asset types, and global regions. This helps reduce risk and ensures that your portfolio can weather different market conditions. For example, when tech stocks decline, bond or international ETFs might remain stable, keeping your overall performance balanced.

Another key to success is patience. ETF investing is not a get-rich-quick method, It’s a long-term strategy. Market fluctuations are normal, but staying consistent with your investment plan helps you benefit from compounding over time. Automating your contributions can make this easier by ensuring you invest regularly without emotional decision-making.

Conclusion

ETF investing is one of the easiest and smartest ways for beginners to grow wealth over time. It allows you to diversify across different assets, minimize risks, and enjoy steady long-term growth without needing expert-level knowledge. By choosing the right ETFs, setting clear goals, and staying consistent with your investments, you can build a strong foundation for financial success. With patience and regular contributions, your portfolio can grow through market gains and reinvested dividends. Remember, ETF investing isn’t about timing the market, It’s about time in the market. Stay focused, review your strategy occasionally, and let compounding work its magic toward long-term financial freedom.

FAQs

Is ETF investing good for beginners?

Yes, ETF investing is ideal for beginners because it offers instant diversification and low costs. You can invest in a wide range of stocks or bonds through one ETF, reducing risk while keeping management simple. ETFs are also easy to buy and sell like regular stocks, making them a convenient way to start building wealth without needing deep market knowledge or large initial investments.

How much money do I need to start ETF investing?

You can start ETF investing with a small amount, sometimes as little as $50 or $100, depending on your brokerage. Many platforms now offer fractional shares, allowing you to invest with whatever amount fits your budget. The key is to begin early and stay consistent. Even small, regular investments in ETFs can grow significantly over time through compounding and reinvested dividends.

Are ETFs safer than individual stocks?

Generally, yes. ETFs are considered safer than individual stocks because they spread your investment across many companies or assets. This diversification helps reduce the risk of losses from one poor-performing stock. However, like all investments, ETFs still carry some level of risk depending on the market and asset type. Choosing broad-market or index ETFs is often a safer option for beginners.

How do I choose the best ETFs for my portfolio?

To choose the best ETFs, first define your financial goals and risk tolerance. Look at the ETF’s performance history, fees, underlying assets, and diversification level. Beginners often start with broad-market ETFs that track major indexes like the S&P 500. It’s also wise to compare expense ratios, lower costs mean better long-term returns. Research and consistency are key to successful ETF investing.