Finance journal prompts are a simple yet powerful way to build better money habits every day. By writing down your thoughts, spending patterns, and financial goals, you gain a clearer picture of where your money goes and how to manage it wisely. Journaling turns financial awareness into a daily routine that helps you stay focused and motivated on your money journey.

Using finance journal prompts encourages mindfulness and accountability. Each prompt helps you reflect on your decisions, identify emotional triggers, and celebrate small wins. Over time, this habit shapes a more confident mindset toward saving, budgeting, and investing, turning your financial goals into achievable daily actions.

Daily Money Reflection Prompts

Daily money reflection prompts help you become more aware of your spending habits and decisions. Each day, write down what you spent money on and why. This helps you notice patterns—like when you tend to overspend or what purchases bring true satisfaction. It’s not about judging yourself, but understanding how your emotions influence your spending.

For example, if you often buy coffee when stressed, write about what triggered that choice. By recognizing emotional spending, you can replace it with healthier habits. Use your finance journal prompts to record small financial wins—like skipping an impulse purchase or saving extra money. Celebrate progress and note lessons learned each day. Over time, these small reflections build strong money discipline, helping you align your spending with your financial goals.

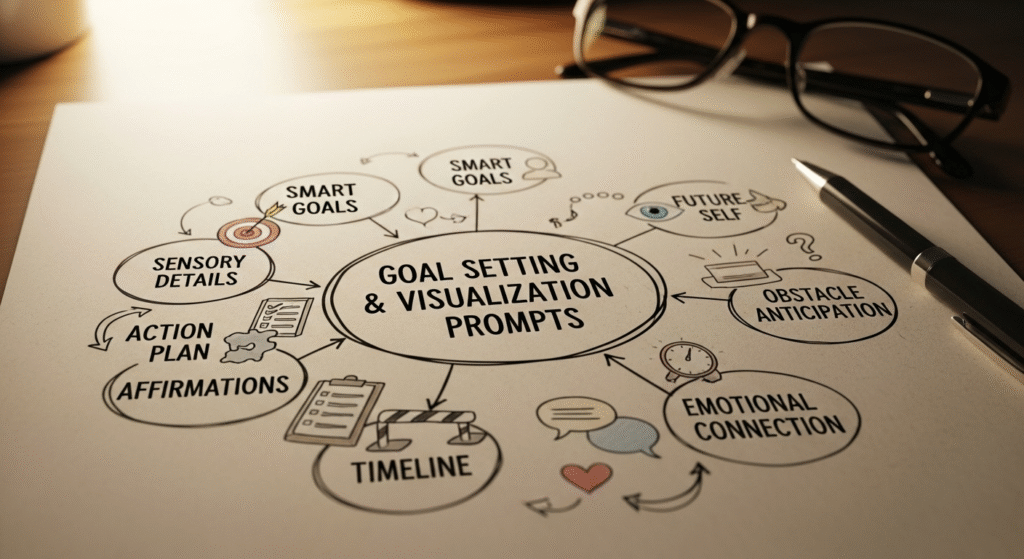

Goal Setting and Visualization Prompts

Goal-setting and visualization are at the heart of every successful money journey. Use finance journal prompts to define both short-term and long-term financial goals. For instance, a short-term goal might be saving $200 this month, while a long-term goal could be becoming debt-free or buying a home. Writing these goals down gives them power and clarity.

Visualization prompts help you picture your dream financial life, what it feels like to live without debt or stress. You can write about the freedom and confidence that comes with financial stability. Reflect on your progress weekly or monthly, tracking how far you’ve come. These prompts motivate you to stay consistent, adjust where needed, and move forward with a clear financial vision.

Mindset and Abundance Prompts

Your mindset shapes your financial reality. Finance journal prompts focused on abundance help shift your thoughts from scarcity (“I never have enough”) to gratitude and growth (“I’m learning to manage money wisely”). Write about things you’re grateful for—like having a steady income, opportunities to earn, or lessons from past mistakes. Gratitude opens the door to financial positivity.

Affirmations also play a key role. Use your journal to write positive statements such as, “I am capable of managing money responsibly” or “I attract financial opportunities with confidence.” These prompts help you replace fear with belief and build a healthy relationship with money. Over time, this mindset attracts abundance and strengthens your financial confidence.

Budgeting and Expense Awareness Prompts

Budgeting prompts keep your finances organized and intentional. Start by writing about how you manage your income, what portion goes to essentials, savings, and leisure. Finance journal prompts can include questions like: “What unnecessary expense can I reduce this month?” or “Did I stick to my budget plan this week?” These reflections make budgeting more practical and personal.

You can also list your top spending categories and evaluate which ones align with your priorities. Tracking essential vs. non-essential expenses helps identify where to cut back without feeling deprived. Journaling about your budget helps you stay consistent, notice improvement areas, and develop a clear financial routine that supports your long-term goals.

Overcoming Financial Challenges Prompts

Everyone faces financial struggles, but journaling helps you learn and grow from them. Use finance journal prompts to write about past money challenges, missed payments, overspending, or unexpected bills, and how you handled them. Reflecting on these experiences builds resilience and prepares you for the future.

Ask yourself: “What can I learn from this setback?” or “What changes can I make to avoid repeating it?” Journaling also helps you manage stress by expressing emotions linked to money anxiety. When you put your thoughts on paper, solutions become clearer. Over time, these prompts help you turn obstacles into opportunities and develop a stronger, calmer approach to managing money.

Building Long Term Money Habits

Consistency is key to lasting financial success. Finance journal prompts focused on long-term habits help you stay accountable and motivated. Write weekly or monthly reflections on your progress, what goals you met, what challenges you faced, and what adjustments you made. Reviewing your journey regularly keeps you focused and inspired.

Use prompts like: “How has my money mindset improved?” or “What new habits am I building this month?” Over time, these reflections turn small changes into lifelong habits. Treat your finance journal as a roadmap to wealth, a record of your growth, discipline, and achievements. With patience and consistency, journaling becomes your guide to long-term financial confidence and independence.

Conclusion

Using finance journal prompts is one of the most effective ways to build strong, lasting money habits. By writing daily, you become more aware of your financial choices, emotions, and progress. Journaling helps you set clear goals, track achievements, and stay motivated even when challenges arise. It transforms your relationship with money from stressful to empowering. When you use finance journal prompts consistently, you create a powerful routine that encourages growth and accountability. Over time, this simple practice leads to better budgeting, smarter spending, and a confident mindset toward wealth. Remember, your financial success starts with daily reflection and the small, consistent steps you take each day.

FAQs

What are finance journal prompts and how do they help?

Finance journal prompts are guided questions that help you reflect on your money habits, goals, and financial mindset. They encourage daily awareness about spending, saving, and decision-making. By answering these prompts regularly, you gain clarity on where your money goes and how to manage it better. Over time, finance journal prompts help you identify emotional spending patterns, stay accountable to your goals, and develop a positive relationship with money that supports long-term financial growth and confidence.

How often should I use finance journal prompts?

Using finance journal prompts daily or weekly depends on your goals and schedule. Daily journaling helps track spending and emotions, while weekly reflection works well for budgeting and long-term planning. The key is consistency—make journaling a simple routine that fits your lifestyle. When you regularly use finance journal prompts, you build self-awareness and improve your money mindset. This steady reflection helps create strong financial habits that make budgeting, saving, and achieving your goals more effective and rewarding over time.

What should I write about in my finance journal?

In your journal, use finance journal prompts to write about spending choices, savings progress, or financial emotions. Reflect on questions like, “What was my best money decision this week?” or “How can I improve my budgeting next month?” These reflections help you stay mindful and organized. Over time, finance journal prompts allow you to see patterns in your financial behavior, helping you make smarter money choices, reduce stress, and build lasting confidence in managing your personal finances effectively.

Can finance journal prompts help me save more money?

Yes! Finance journal prompts make saving easier by helping you understand your money mindset and spending triggers. When you write regularly, you see where you can cut costs and how small changes lead to bigger savings. By setting clear goals and tracking progress, finance journal prompts keep you motivated and consistent. This reflection turns saving into a daily habit instead of a challenge, helping you reach your goals faster while feeling more in control of your financial journey.

Do I need a special notebook for finance journal prompts?

You don’t need anything fancy for finance journal prompts—a simple notebook, spreadsheet, or digital journal works perfectly. What matters most is consistency and honesty in your reflections. Some people prefer dedicated finance journals with pre-made prompts, while others create their own. The key is to write regularly and review your progress. When you use finance journal prompts with focus and intention, you’ll see clear improvement in your money habits, confidence, and ability to make better financial decisions daily.