Financial Advisor Services are becoming increasingly important for anyone who wants to build wealth confidently and avoid unnecessary financial risks. In this guide, you will learn how professional advisors help you plan smarter, invest wisely, and protect your money in a changing economy. Many people struggle with budgeting, saving, and choosing the right investments, but expert guidance makes these decisions clearer and more effective. Advisors use proven strategies to align your financial choices with your long-term goals.

In 2025, Financial Advisor Services combine human expertise with advanced digital tools to create personalized financial plans. They help reduce risks by analyzing market trends, managing portfolios, and preventing emotional decision-making. With the right support, anyone can strengthen their financial future and grow wealth steadily.

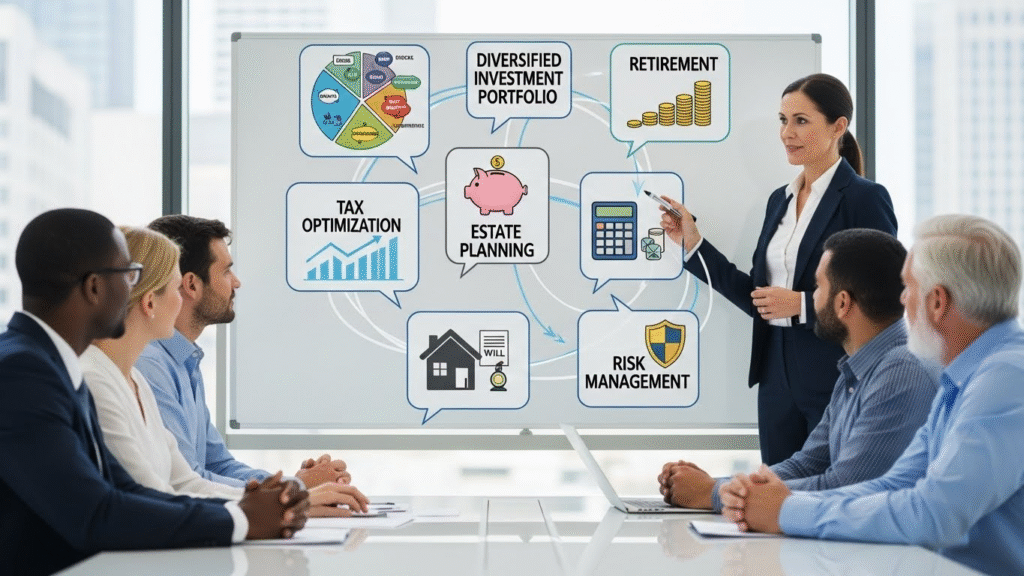

Wealth-Building Strategies Offered by Financial Advisors

Wealth building is a long-term process, and this is where Financial Advisor Services play an important role. These services help people understand their financial goals clearly, whether the goals are short-term, mid-term, or long-term. With Financial Advisor Services, individuals learn how to organize their savings, prioritize their needs, and set realistic targets for their future. Advisors use easy methods to explain how money grows over time and what strategies can support steady progress.

A major benefit of Financial Advisor Services is personalized investment planning. Advisors study your risk level, earning pattern, and life timeline to create a strategy just for you. For example, some people prefer safe investments, while others are comfortable taking more risk. Advisors find the right balance to match your comfort level. They also explain how different investments like stocks, bonds, real estate, and alternative assets—help build a strong and diversified portfolio. Diversification protects you from big losses and helps your wealth grow steadily.

Tax planning is another important part of Financial Advisor Services. Many people lose money because they do not understand tax systems or available deductions. A financial advisor helps you reduce your tax burden legally so you can save more of what you earn. Over time, even small tax savings lead to big financial benefits.

Compounding is also a powerful tool explained by advisors. It means your money earns profit, and that profit earns more profit. Financial advisors show how consistent investing, even in small amounts, leads to large wealth in the future.

Risk Reduction Through Professional Guidance

Managing financial risk is just as important as building wealth, and Financial Advisor Services help individuals navigate this complex area with confidence. Advisors start by identifying different types of risk such as market risk, inflation risk, lifestyle risk, and unexpected emergencies. With Financial Advisor Services, people learn how these risks can impact their long-term financial health and how to prepare for them in advance.

Insurance planning is another major part of Financial Advisor Services. Advisors guide you on choosing the right insurance for health, life, property, disability, and income protection. Insurance helps protect your family from sudden financial loss, and financial advisors ensure you never pay for unnecessary or expensive plans. They compare options, explain benefits, and help you make the right choice.

Emergency fund planning is another skill people often overlook, but Financial Advisor Services make it simple. Advisors recommend saving at least three to six months of expenses to handle emergencies like medical issues or job loss. They also teach liquidity management, ensuring you always have quick access to cash when needed without disturbing long-term investments.

Continuous portfolio monitoring is one of the strongest benefits of Financial Advisor Services. Markets change, economies shift, and new risks appear. Advisors keep track of these changes and adjust your investments at the right time. This helps reduce losses and improves long-term returns.

Retirement Planning Support

Planning for retirement is essential, and Financial Advisor Services make this process easier and more effective. Advisors help individuals create a detailed roadmap for their retirement years, ensuring all future needs are clearly understood. With Financial Advisor Services, people learn how much they need to save, what lifestyle they can expect, and how long their savings will last based on their spending habits.

Another important role of Financial Advisor Services is calculating future expenses. Costs such as healthcare, housing, travel, and daily living increase with age. Advisors analyze these expenses and create a plan that supports financial stability for decades. They also help estimate inflation, which affects the value of money over time.

Choosing the right retirement accounts is another key task handled by Financial Advisor Services. Advisors help select the best options, such as 401(k), IRA, pension plans, and other long-term savings accounts. They explain contribution limits, employer matches, tax benefits, and growth potential. This helps people save more efficiently and build stronger retirement funds.

Safe withdrawal strategies are also taught through Financial Advisor Services. Many retirees fear outliving their savings. Advisors calculate how much money can be withdrawn each year while keeping the retirement fund strong. They adjust the plan regularly to match market conditions and life changes.

Ensuring steady income during retirement is one of the biggest strengths of Financial Advisor Services. Advisors help build multiple income streams such as investments, savings, pensions, rental income, and dividends. This reduces dependence on a single source and creates financial security.

Technology and Modern Tools Used by Financial Advisors

Financial Advisor Services are becoming more advanced as technology continues to evolve and reshape the financial world. Today, financial advisors use modern digital tools that make planning easier, faster, and more accurate for clients. These tools allow both advisors and individuals to understand their financial situation clearly and make better long-term decisions. With innovative platforms, Financial Advisor Services provide real-time support, smarter insights, and data-driven strategies that were not possible years ago. This digital shift makes financial planning more accessible, even for beginners.

One of the most useful tools in Financial Advisor Services is the rise of AI-driven financial planning platforms. These systems analyze income, expenses, goals, and investment behavior to create more accurate and personalized financial plans. With AI, advisors can detect patterns, find hidden risks, and suggest improvements that help clients build wealth more effectively. The combination of artificial intelligence and human expertise results in higher-quality guidance and better financial outcomes.

Another major part of modern Financial Advisor Services is the use of robo-advisors. A robo-advisor offers automated investing based on algorithms, which makes investing simpler and reduces costs. When combined with human advisors, clients receive both automation and personalized support. This hybrid model gives clients clarity, convenience, and confidence while growing their wealth.

Real-time performance tracking is another strong advantage of modern Financial Advisor Services. Clients can view live updates of their portfolios, monitor investment growth, and understand market movements instantly. Automated rebalancing tools adjust portfolios when needed, keeping investments aligned with financial goals without manual effort.

Digital dashboards also play an important role in simplifying complex financial information. With clean visuals, charts, and summaries, clients gain a clear understanding of their savings, investments, debts, and future projections. This makes the financial journey easier and less stressful.

Choosing the Right Financial Advisor

Choosing the right professional is one of the most important steps when using Financial Advisor Services. The right advisor can guide you toward long-term wealth, stability, and financial confidence. However, selecting a suitable advisor requires understanding their approach, fee structure, and qualifications. With many options available today, taking time to evaluate each choice ensures you receive valuable Financial Advisor Services that match your goals and comfort level.

There are three main types of advisors offering Financial Advisor Services: fee-only, commission-based, and hybrid advisors. Fee-only advisors charge a fixed fee or percentage of assets and often provide unbiased guidance. Commission-based advisors earn money from selling financial products, which may influence recommendations. Hybrid advisors use both models. Understanding these differences helps you choose someone who aligns with your financial needs and expectations.

Before hiring an advisor, it is important to ask key questions. You should ask how they create financial plans, what tools they use, how often they communicate, and whether they have experience with your specific financial situation. These questions help you judge the quality and transparency of their Financial Advisor Services. It also ensures you understand exactly what you are paying for and what results to expect.

Credentials also matter when selecting a professional. Reliable advisors often hold certifications such as CFP (Certified Financial Planner), CFA (Chartered Financial Analyst), or CPA (Certified Public Accountant). These credentials show training, ethics, and expertise. When an advisor holds strong qualifications, it increases trust and ensures better financial guidance.

Another key step is comparing fees and understanding how the advisor earns money. Transparent Financial Advisor Services clearly explain costs without hidden charges. Reviewing service packages helps you choose the best match for your goals, whether you want retirement planning, investment management, debt support, or risk control.

Real-World Success Examples

Real-world success stories help show how Financial Advisor Services make a positive impact on people’s lives. These stories highlight how individuals, families, and business owners benefit from expert financial guidance. By using professional support, many people achieve goals faster, manage risks better, and build long-term wealth with greater confidence. These examples reflect how Financial Advisor Services turn financial challenges into opportunities and empower clients to stay on track during economic changes.

One example involves individuals who struggled with inconsistent savings and unclear investment strategies. Through Financial Advisor Services, they created organized plans that included budgeting, systematic investing, and long-term goal setting. Advisors helped them choose the right investment mix, manage taxes, and stay disciplined during market swings. Over the years, their small contributions grew into strong wealth, proving how structured advice can change financial outcomes.

Another real-world case reflects how Financial Advisor Services protect clients during economic downturns. During market declines, many investors panic and make emotional decisions. However, clients who worked with advisors received guidance to stay calm, rebalance portfolios, and shift funds into safer assets. This reduced losses and helped them recover faster when the economy improved. These stories show how professional guidance is vital during uncertain times.

Families also benefit greatly from Financial Advisor Services. Advisors help them plan for children’s education, manage high expenses, balance debt, and prepare for retirement. With organized plans and regular monitoring, families avoid financial stress and move confidently toward their goals. Advisors also help protect assets through insurance planning and emergency fund strategies.

Conclusion

Financial Advisor Services play a powerful role in helping people build wealth, reduce risks, and plan for a stable financial future. With expert guidance, individuals can make smarter investment decisions, understand their financial goals clearly, and avoid costly mistakes. Advisors use modern tools, AI insights, and personalized strategies to create plans that fit every stage of life. They also help protect clients during market changes, ensuring long-term financial security. Whether you are planning for retirement, managing investments, or improving daily finances, Financial Advisor Services provide the support needed to stay confident and prepared. With the right advisor, financial success becomes more achievable.

FAQs

Why do people need guidance when managing money?

Many people seek guidance because financial decisions can be confusing and overwhelming. Professional help makes it easier to set clear goals, understand investment options, and avoid unnecessary risks. Experts also explain complex topics in simple terms, helping individuals make better choices. With structured planning and ongoing support, people can manage their savings, spending, and long-term plans more confidently. This guidance provides direction, reduces mistakes, and helps create a more secure financial future.

How can someone improve their investing skills?

Improving investing skills starts with learning the basics, such as understanding different asset types and how markets work. Reading reliable financial material, taking online courses, and following economic news can help. Beginners can start small, track results, and adjust their strategies over time. Speaking with professionals or joining educational programs also builds confidence. Practicing discipline, avoiding emotional decisions, and staying focused on long-term goals are the most important habits for better investing.

What should beginners know before making financial plans?

Beginners should first understand their income, expenses, and savings habits. Knowing exactly where money goes helps create a realistic plan. They should set clear goals, such as buying a home, paying debts, or preparing for retirement. Learning about budgeting, emergency funds, and simple investment options is also helpful. It’s important to start slowly, avoid high-risk choices, and review progress regularly. With time and consistency, financial planning becomes easier and more effective.

How often should someone review their financial progress?

Reviewing financial progress every few months helps ensure everything is on track. This allows individuals to adjust their plans when income, expenses, or life goals change. Regular reviews also help identify new opportunities for saving or investing. During economic shifts, checking more frequently can reduce unnecessary risks. Staying aware of financial health helps people make better decisions and stay prepared for unexpected situations. Consistent tracking leads to better long-term results.