Membership Cards have become powerful financial tools that go beyond simple loyalty rewards. In this guide, you’ll learn how these cards can help you manage your money more effectively while enjoying exclusive benefits. They offer users discounts, cashback options, and access to special deals that make everyday spending more rewarding. Many financial institutions and retailers now provide digital membership cards that are easy to manage through apps, helping users track their spending and maximize savings effortlessly.

By using membership cards wisely, individuals can make smarter purchasing decisions and improve their financial habits. These cards not only encourage budgeting but also promote responsible spending through reward-based systems. Whether it’s for shopping, travel, or dining, membership cards help users save more while enjoying valuable financial benefits.

What Are Financial Membership Cards?

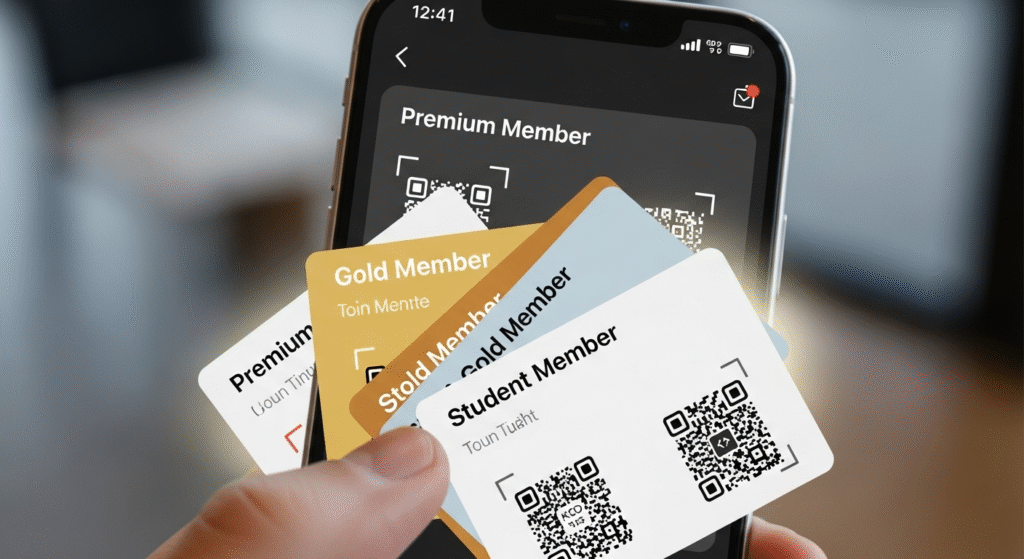

Membership Cards are specialized financial tools designed to offer rewards, discounts, and benefits to loyal customers. These cards are often linked with banks, retail stores, or digital platforms to encourage smart spending and saving habits. They act as both identification and reward systems, giving users access to exclusive deals and personalized financial perks. Over time, Membership Cards have evolved from simple plastic cards to advanced digital solutions integrated with financial apps.

There are several types of Membership Cards available today. Bank membership cards provide cashback, reward points, or lower transaction fees. Store membership cards give frequent shoppers discounts and loyalty bonuses, while digital membership cards offer online accessibility through mobile wallets or apps. Each type caters to different financial needs, making it easier for consumers to choose the one that fits their lifestyle.

Membership Cards work by recording spending patterns and rewarding users based on their purchases. They often connect with personal finance tools that help track expenses, display spending summaries, and suggest ways to save more. Users can monitor all card activities directly through mobile apps, ensuring complete control over their finances.

The main difference between traditional membership cards and digital membership cards lies in accessibility and convenience. Traditional cards are physical and may require manual tracking of rewards. Digital versions, however, are automated, eco-friendly, and synced with online accounts for instant reward redemption. This shift toward digitalization has made Membership Cards more efficient, transparent, and user-friendly, empowering individuals to manage their money better while enjoying added value.

Key Financial Benefits of Membership Cards

Membership Cards provide multiple financial advantages that help users save money, earn rewards, and access exclusive benefits. One of the most popular features is cashback rewards, where a percentage of spending is returned to the user’s account. This benefit encourages cardholders to make purchases wisely and enjoy ongoing savings on regular transactions. Many financial institutions also partner with retailers to offer special discounts, turning Membership Cards into valuable financial companions.

Another major benefit of Membership Cards is their points-based system. Every purchase adds reward points that can be redeemed for products, services, or bill payments. This structure motivates consistent and responsible spending. Over time, users can accumulate significant value simply by using their cards for everyday needs. The combination of points and cashback makes Membership Cards appealing for both short-term and long-term savings goals.

Membership Cards also grant access to premium financial services, such as travel insurance, airport lounge entry, and priority banking. These perks transform regular financial tools into personalized lifestyle assets. Many cards come with added financial protection, including fraud alerts and spending limits, to help users maintain security and control over their funds.

How Membership Cards Encourage Smart Spending?

Membership Cards are powerful tools that promote responsible financial behavior and help users spend money more intelligently. They do this by offering transparency, budgeting tools, and incentives that encourage thoughtful purchasing decisions. Each transaction made using Membership Cards is recorded, allowing users to track where their money goes. This clear visibility helps identify unnecessary expenses and create better financial plans for the future.

Most Membership Cards are connected to mobile apps or online dashboards where users can view spending summaries. These insights enable individuals to adjust their budgets in real time. For instance, when cardholders notice that dining expenses exceed their monthly limit, they can reduce such spending to stay within budget. By connecting rewards to responsible use, Membership Cards make budgeting both rewarding and enjoyable.

In addition to tracking, Membership Cards often provide personalized spending advice and alerts. Some cards analyze user habits to suggest when and where to shop for maximum savings. Others allow users to set financial goals, such as earning a certain amount of cashback or collecting specific reward points. This creates a positive cycle where saving and spending decisions reinforce each other.

Lastly, Membership Cards help build financial discipline by offering structured rewards. Many cards encourage purpose-based spending such as fuel, groceries, or travel so users avoid unnecessary purchases. With every transaction contributing to a reward or discount, users become more conscious of how they manage their money. Over time, Membership Cards transform impulsive spending into a strategic, goal-oriented financial habit that leads to better savings and a more secure future.

Using Digital Membership Cards for Better Money Management

Membership Cards have evolved from simple plastic cards to smart digital tools that make managing money easier than ever. Digital Membership Cards connect directly with mobile banking apps and digital wallets, allowing users to monitor spending, earn rewards, and redeem benefits instantly. This integration ensures that every transaction is recorded and analyzed, giving users a full view of their financial habits in one place. By syncing cards with financial platforms, users can manage multiple accounts without confusion or missed opportunities.

One of the best features of Membership Cards is automated savings. Some cards round up purchases to the nearest unit and deposit the difference into a savings account. Others provide spending insights that show where your money goes and how to adjust your habits. These tools help users stay on track with budgets, avoid unnecessary expenses, and make data-driven financial decisions. Over time, small adjustments lead to significant savings, proving that Membership Cards support long-term financial stability.

Digital Membership Cards also offer advanced security and convenience. Unlike traditional cards, they use encryption and authentication technologies that protect users from fraud. You can easily freeze or unfreeze your card, set spending limits, or receive alerts for unusual transactions all through your mobile device. This flexibility ensures safety while maintaining accessibility.

Real-World Examples and Success Stories

Membership Cards have become an essential part of personal and business finance across the world. Many people and organizations use them to improve financial efficiency and build customer loyalty. For instance, large retail chains offer digital Membership Cards that reward customers with points or cashback on every purchase. Over time, these savings add up, motivating repeat business while helping customers save money.

One real-world example comes from a small café that introduced Membership Cards for loyal customers. By offering a free drink after every ten purchases, the café saw a 30% increase in returning visitors. At the same time, customers enjoyed tangible financial benefits, demonstrating how effective Membership Cards can be for both sides.

Financial institutions have also adopted Membership Cards to encourage better money management. Banks often integrate their cards with mobile apps that track spending patterns and recommend saving goals. Compared to traditional spending without tracking, card-based spending provides greater awareness and control. Users can see exactly where they spend most and adjust habits accordingly.

Businesses, too, gain valuable insights from Membership Cards. Data collected from user activity helps them personalize offers and improve customer engagement. This win-win approach fosters loyalty, efficiency, and satisfaction.

Common Mistakes to Avoid

While Membership Cards offer many financial advantages, using them carelessly can reduce their value. One common mistake is overspending for rewards. Many users make unnecessary purchases just to earn points or cashback, which leads to higher expenses instead of savings. The key is to use Membership Cards for planned, essential spending so that rewards truly add value without increasing costs.

Another mistake is ignoring card terms, fees, or expiry dates. Some Membership Cards have hidden maintenance fees or point expiration policies that can reduce benefits. Always read the terms carefully to understand how rewards work and when they expire. Keeping track of usage ensures you don’t lose valuable perks due to simple oversight.

A third common error is failing to track accumulated points or cashback. Many users forget to redeem their rewards, allowing points to expire. Setting reminders or using digital apps linked to Membership Cards can help monitor and redeem points efficiently.

Lastly, avoid applying for too many Membership Cards at once. Managing multiple cards can be confusing and might lead to debt if not handled properly. Focus on the few cards that align best with your lifestyle and financial goals.

Conclusion

In conclusion, Membership Cards are valuable financial tools that help individuals save more and spend wisely. They offer cashback, discounts, and exclusive rewards while promoting better money management habits. When used thoughtfully, these cards transform everyday spending into opportunities for financial growth. By tracking expenses, setting budgets, and redeeming rewards, users can gain greater control over their finances. Digital Membership Cards make this process even easier through mobile integration, security, and convenience. However, success depends on responsible usage and awareness of card terms. With smart planning, Membership Cards can truly enhance financial stability and make saving an effortless part of daily life.

FAQs

What are the main benefits of using financial reward cards?

Financial reward cards allow users to enjoy discounts, cashback offers, and exclusive deals while making regular purchases. They help people save money on essentials such as groceries, travel, and entertainment. These cards also promote responsible spending by providing clear insights into transaction history. Many are linked with apps that show monthly spending patterns, helping users make better financial decisions. By using these tools wisely, individuals can turn daily expenses into long-term savings while enjoying convenient access to rewards and special privileges.

How can digital reward cards improve money management?

Digital reward cards are excellent tools for better financial control. They connect directly with mobile wallets and banking apps, giving users real-time access to spending data. This integration makes it easier to track budgets, avoid unnecessary purchases, and identify saving opportunities. Some even include automatic savings features that round up transactions and save the extra change. The ability to receive instant notifications also helps users stay secure and informed. By using these cards effectively, individuals can maintain financial discipline, reduce wasteful spending, and achieve their savings goals more efficiently.

Are loyalty or reward cards worth using for everyday purchases?

Yes, loyalty or reward cards are very useful for everyday spending. They allow customers to earn benefits on things they already buy, such as groceries, fuel, and entertainment. Over time, the accumulated points, discounts, and cashback can lead to meaningful savings. These programs are especially valuable when users remain consistent and make purchases from partnered brands. However, it’s important to use them strategically and not overspend just to earn points. When used thoughtfully, such cards can enhance financial health and make shopping more rewarding and affordable.

What common mistakes should people avoid when using reward-based cards?

A frequent mistake is overspending just to earn points or cashback, which defeats the purpose of saving. Others forget to redeem accumulated rewards or ignore expiration dates. Some users overlook annual fees or transaction charges that reduce card benefits. To avoid these issues, it’s best to stay organized, track points regularly, and understand all card terms. Using digital tools to monitor rewards and budgets can help maintain control. Responsible use ensures these cards remain helpful financial assets rather than causing unnecessary expenses.

How do these financial cards differ from regular debit or credit cards?

Unlike standard debit or credit cards, financial reward cards are designed to offer additional perks, such as cashback, points, or exclusive discounts. Regular cards primarily serve as payment methods, while these add a layer of value through loyalty programs. They often come with spending insights, personalized offers, and financial management tools that help users make smarter choices. Some may also include access to premium services, such as travel insurance or special events. In essence, they combine spending convenience with long-term financial rewards and greater control over daily expenses.

Can using reward-based cards help build better financial habits?

Yes, reward-based cards can play an important role in developing stronger financial habits. They encourage users to track expenses, plan budgets, and spend more consciously. By reviewing spending summaries, people can identify unnecessary costs and make better choices. Earning cashback or rewards also motivates consistent, responsible use rather than impulsive buying. Many cards include budgeting tools and spending alerts that keep users aware of their financial activity. Over time, this awareness leads to improved money management, steady savings growth, and a more disciplined approach to handling personal finances.