Real estate investments offer investors multiple ways to grow wealth, generate income, and diversify their portfolios. Understanding the different options is essential for beginners and experienced investors alike. Each type of real estate investment has its own benefits, risks, and income potential, from residential properties to commercial buildings and REITs. By learning about these options, investors can make informed decisions that match their financial goals, risk tolerance, and long-term plans.

In this guide, we will explore various types of real estate investments, including rental properties, commercial spaces, industrial properties, REITs, vacation rentals, and land. You will also discover tips for choosing the right investment and maximizing returns effectively.

Residential Real Estate

Real estate investments often begin with residential properties, which are popular among both beginner and experienced investors. Residential real estate includes single-family homes, multi-family buildings, and other properties where people live. Investing in residential real estate can provide a steady income stream through rental payments, as well as long-term appreciation if property values increase over time. Residential properties are generally easier to understand and manage, making them a preferred choice for investors starting their real estate journey.

Single-family homes are the most common type of residential investment. They are easier to finance, maintain, and sell compared to larger properties. Single-family homes are ideal for investors looking for straightforward rental income and moderate appreciation potential. Managing one unit is less complex than multi-unit buildings, which makes it a good entry point for beginners in real estate investing.

Multi-family properties, such as duplexes, triplexes, or apartment complexes, offer higher rental income potential because they have multiple tenants. Although they require more management and maintenance, multi-family investments can spread risk across several units. If one tenant leaves, others continue paying rent, which reduces income disruption. Multi-family properties also often provide better cash flow compared to single-family homes, making them attractive for long-term investors.

The benefits and risks of residential investing include steady income, potential tax deductions, and property appreciation. However, risks include property damage, vacancy periods, and fluctuating market values. Investors need to consider location, tenant quality, and financing options carefully.

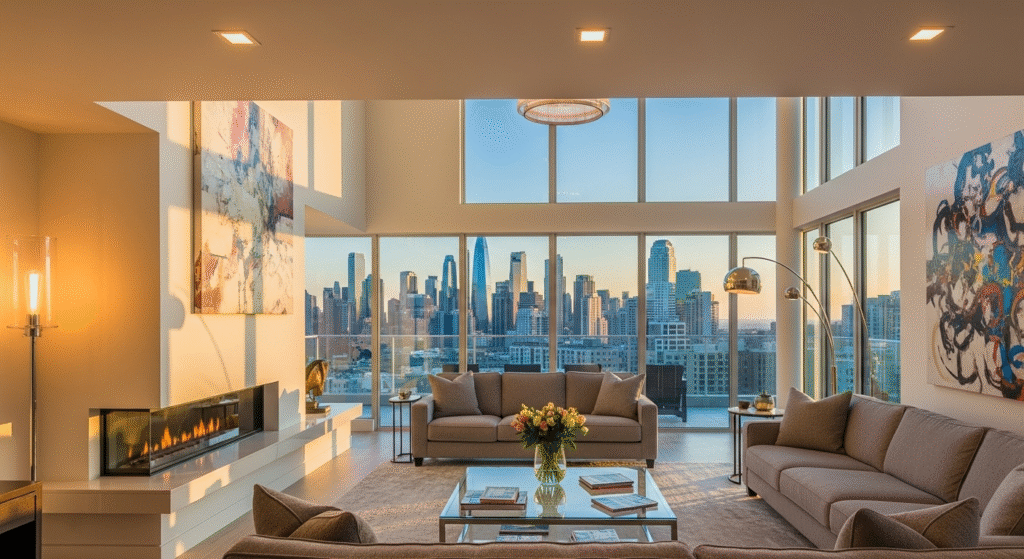

Commercial Real Estate

Real estate investments also include commercial properties, which consist of office buildings, retail spaces, and warehouses. Commercial real estate is typically more complex than residential properties, but it can offer higher income potential and longer-term leases. Investors interested in commercial real estate often seek steady rental income, professional tenants, and opportunities for portfolio diversification.

Office buildings, retail spaces, and warehouses each have unique benefits and considerations. Office buildings can attract long-term tenants with stable rental agreements. Retail spaces benefit from high foot traffic but may be sensitive to economic fluctuations. Warehouses and storage facilities are in demand due to the growth of e-commerce, providing stable rental income with minimal tenant turnover.

Income potential and lease structures in commercial real estate are typically higher than residential investments. Many commercial leases are net leases, where tenants pay some or all property expenses in addition to rent. This structure reduces management costs and can increase net returns for investors. Lease durations are often longer, which provides predictable income over several years.

Market considerations and risks include economic cycles, local demand, and vacancy rates. Commercial real estate can be sensitive to market downturns, changes in consumer behavior, or corporate tenant defaults. Proper research, property location, and tenant vetting are essential for reducing risks.

Industrial Real Estate

Real estate investments also cover industrial properties, such as warehouses, distribution centers, and manufacturing facilities. Industrial real estate is in high demand due to global supply chain growth and e-commerce expansion. These properties typically have long-term tenants and stable income, making them attractive to investors seeking consistent returns and low management complexity.

Warehouses, distribution centers, and manufacturing facilities each serve different purposes. Warehouses store goods, distribution centers facilitate logistics, and manufacturing facilities support production. Industrial tenants often sign long-term leases, providing predictable cash flow and minimizing vacancy risk. Industrial properties are generally less management-intensive compared to residential or commercial properties.

Long-term leases and tenant stability are a major advantage of industrial real estate. Tenants often commit to multi-year agreements, reducing turnover and income disruption. Industrial properties may also include triple-net leases, where tenants cover taxes, insurance, and maintenance, further reducing investor responsibilities and increasing net returns.

Suitability for different types of investors depends on experience, investment goals, and available capital. Industrial real estate is often favored by seasoned investors or those seeking a hands-off approach. However, beginners can also participate through industrial-focused REITs or partnerships. These options provide exposure to industrial properties without the need for direct management.

Real Estate Investment Trusts (REITs)

Real estate investments include Real Estate Investment Trusts, commonly known as REITs. REITs allow investors to own shares in a portfolio of real estate properties without directly managing them. They are a popular option for investors who want exposure to real estate while enjoying the liquidity and convenience of publicly traded assets. REITs generate income through rent and property appreciation and are required to distribute a majority of earnings as dividends, making them a valuable source of regular income.

What REITs are and how they work is straightforward. REITs pool money from multiple investors to buy, manage, and sell real estate properties. Investors can buy shares in the REIT, similar to purchasing stocks. The income generated from the properties is distributed to shareholders, providing a steady cash flow. REITs can focus on residential, commercial, industrial, or specialized properties, offering diverse investment opportunities.

Publicly traded vs private REITs is an important distinction. Publicly traded REITs are listed on stock exchanges, allowing investors to buy and sell shares easily. Private REITs are not traded publicly and typically require higher minimum investments, but they can offer higher potential returns. Understanding the differences helps investors choose the REIT that fits their financial goals and risk tolerance.

Short-Term and Vacation Rentals

Real estate investments also include short-term and vacation rentals. These properties are rented out for days or weeks instead of long-term leases. Platforms like Airbnb, Vrbo, and Booking.com make it easy for investors to manage these rentals and reach a wide audience of travelers. Short-term rentals can provide higher income than traditional rental properties but require more management and active involvement.

Airbnb and other short-term rental platforms have made this investment accessible to many people. Investors can list properties online, set rental rates, and attract guests from all over the world. These platforms often handle booking and payment systems, reducing the administrative burden. However, investors still need to manage cleaning, maintenance, and guest communications.

Higher income potential vs management effort is a key consideration. Short-term rentals often generate more revenue per month compared to traditional long-term rentals, especially in high-demand tourist areas. However, managing these properties requires time, effort, and sometimes professional property management. Investors must weigh the extra income against the responsibilities involved in maintaining a short-term rental business.

Tax implications and legal considerations are also important. Rental income is taxable, and some local jurisdictions impose regulations on short-term rentals. Investors need to understand local laws, zoning rules, and tax obligations to avoid fines and ensure compliance. Proper planning and accounting help maximize income while remaining legal and tax-efficient.

Land Investments

Real estate investments also include land, which can be raw or developed. Land investments provide opportunities for long-term appreciation, development, or future income generation. Unlike residential or commercial properties, land often requires minimal management, making it attractive to investors seeking simpler investments.

Raw land vs developed land is a critical distinction. Raw land is undeveloped and may require permits, infrastructure, or construction to become profitable. It is often purchased at lower prices and appreciates over time. Developed land has utilities, roads, and sometimes buildings, offering immediate income potential through sales or leasing. Each type has unique advantages and challenges depending on investment goals.

Long-term appreciation and development opportunities make land a compelling types of real estate investments choice. Investors can hold land for years as it increases in value or develop it for residential, commercial, or agricultural purposes. Proper planning and research are essential to identify high-potential areas and maximize returns.

Risks and cost considerations include market fluctuations, property taxes, and potential zoning restrictions. Land may not generate immediate income, and carrying costs can accumulate. Investors should assess location, future development plans, and local regulations before investing. Working with experts or partnering with developers can reduce risks and improve outcomes.

Mixed-Use Properties

Real estate investments include mixed-use properties, which combine residential, commercial, and retail spaces within a single property. Mixed-use developments are becoming increasingly popular in urban areas because they provide multiple income streams from different types of tenants. Investors can benefit from rental income from apartments, office space, and retail shops, making these properties a strong choice for diversifying a real estate portfolio.

Combining residential, commercial, and retail in one property allows investors to generate income from multiple sources. For example, a building could have apartments on upper floors, offices on the middle floors, and retail shops on the ground floor. This diversification can reduce risk because income does not depend on a single tenant type or market segment. If one sector experiences a slowdown, other parts of the property may continue generating revenue, providing stability.

Benefits for cash flow and diversification are a major advantage of mixed-use properties. They offer multiple revenue streams, which can improve overall cash flow. Investors can also benefit from long-term tenant leases in commercial spaces while earning rental income from residential tenants. Diversification within a single property reduces reliance on a single market sector, making mixed-use properties a strategic option in types of real estate investments for both beginner and experienced investors.

Challenges in management and planning should also be considered. Managing mixed-use properties is more complex than single-use buildings. Investors need to handle different tenant types, varying lease agreements, and maintenance requirements. Zoning regulations and planning permissions can also complicate development and management. Effective property management and careful planning are essential to maximize returns and minimize risks.

Tips for Choosing the Right Type of Real Estate Investment

Choosing the best real estate investments requires careful planning and consideration of multiple factors. Different investments have unique benefits, risks, and income potential, so aligning your choices with financial goals is crucial for long-term success. By following specific tips, investors can make informed decisions and maximize returns.

Assessing investment goals and risk tolerance is the first step. Investors should define whether they seek passive income, long-term appreciation, tax benefits, or portfolio diversification. Risk tolerance helps determine which property types to invest in, such as residential, commercial, industrial, or land. Understanding your financial goals and comfort with potential market fluctuations ensures smarter investment choices.

Market research and location analysis are key to successful real estate investing. Location affects property value, rental demand, and long-term appreciation. Investors should research local real estate trends, neighborhood growth, job markets, and infrastructure development. A property in a high-demand area is more likely to attract reliable tenants and increase in value over time, making it a better option within types of real estate investments.

Financing and exit strategy considerations are also important. Understanding available loans, interest rates, and leverage options helps investors manage cash flow and maximize returns. Having a clear exit strategy, whether selling, refinancing, or holding long-term, ensures that the investment aligns with personal goals and market conditions. Proper planning reduces risk and improves overall profitability.

Conclusion

Understanding the real estate investments is essential for building wealth, generating passive income, and diversifying your portfolio. From residential properties and commercial buildings to industrial spaces, REITs, short-term rentals, land, and mixed-use developments, each type offers unique benefits and challenges. Choosing the right investment depends on your financial goals, risk tolerance, and market research. Proper planning, financing strategies, and effective property management help maximize returns and reduce risks. By applying the tips and insights in this guide, both beginners and experienced investors can make informed decisions, create multiple income streams, and build long-term financial stability through real estate.

FAQs

How can beginners start with real estate investments?

Beginners can start real estate investments by learning the basics, setting clear goals, and exploring low-cost options. REITs and crowdfunding platforms allow small initial investments, making it easy to enter the market. Starting with a single rental property is another option. Researching the local market, understanding financing options, and planning for maintenance or management are essential. By taking small, informed steps, beginners can gain experience, build confidence, and gradually expand their real estate investments over time.

Are real estate investments safe during economic downturns?

Real estate investments are generally stable, but they can be affected by economic downturns. Property values may decline, and rental demand can fluctuate during recessions. Diversifying across property types, locations, or investing in REITs can reduce risk. Long-term real estate investments often recover and provide steady income. Proper planning, market research, and selecting high-demand areas help protect your investment. While no investment is completely risk-free, real estate investments offer tangible assets and income potential, making them relatively resilient compared to some other investment options.

Can I earn passive income through real estate investments?

Yes, real estate investments can generate passive income. Rental properties provide monthly cash flow from tenants. REITs pay dividends without requiring direct property management. Short-term vacation rentals or industrial properties can also provide steady income if managed efficiently. Using property managers or automated platforms can reduce daily involvement. By diversifying across different types of real estate investments, you can maintain multiple income streams. Consistent planning, proper maintenance, and smart property selection allow investors to build reliable passive income while growing wealth over the long term.

How do location and market trends affect real estate investments?

Location and market trends are critical for real estate investments. Properties in growing areas with job opportunities, good schools, and amenities attract tenants and increase in value. Market trends, like rising demand for rental housing or commercial space, impact rental income and property appreciation. Researching neighborhoods, local economic development, and population growth helps investors make informed decisions. By analyzing location and trends, investors can choose real estate investments with higher potential returns and reduced risks, ensuring long-term profitability and a stronger, diversified portfolio.