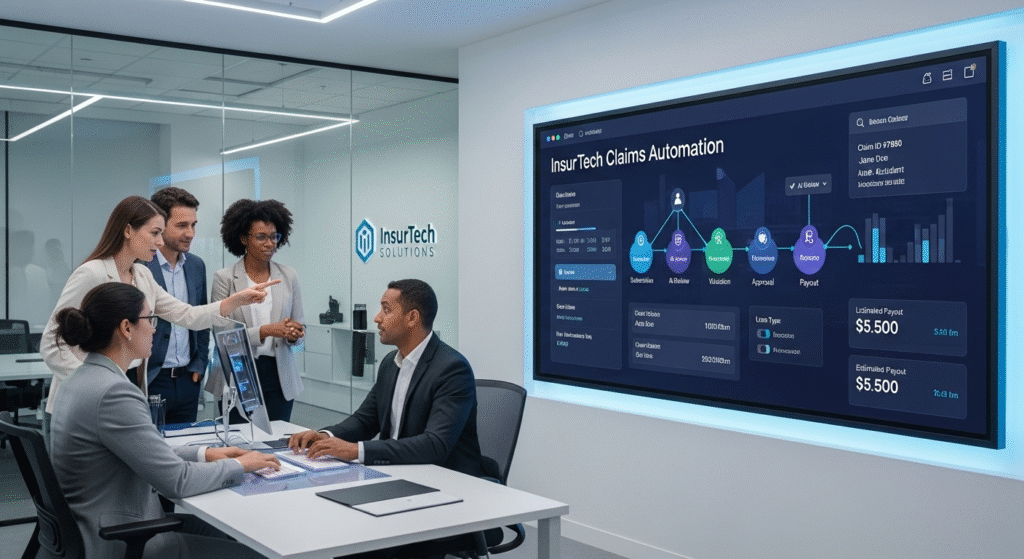

InsurTech is revolutionizing the way insurance companies operate in 2025, bringing innovation, speed, and transparency to every process. One of the most transformative advancements is claims automation, which leverages artificial intelligence, machine learning, and data analytics to simplify claim handling. This technology allows insurers to process claims faster, minimize human error, and improve customer satisfaction.

In this guide, we’ll explore how InsurTech claims automation is changing traditional insurance workflows by reducing paperwork, enhancing fraud detection, and ensuring fair settlements. By combining automation with smart analytics, insurers can make data-driven decisions, lower operational costs, and deliver seamless experiences. It’s reshaping the insurance landscape toward efficiency, accuracy, and trust.

What Is InsurTech Claims Automation?

InsurTech claims automation refers to the use of advanced digital technologies to simplify and speed up the insurance claims process. In traditional insurance systems, claims were handled manually, involving large amounts of paperwork, human verification, and long waiting times. Today, thanks to InsurTech, these outdated methods are being replaced with smart automation tools that make claims management faster, more accurate, and transparent.

At its core, claims automation technology uses artificial intelligence (AI), machine learning, and data analytics to analyze claim requests, verify policy details, detect fraud, and process settlements efficiently. Instead of human agents reviewing every document, AI-powered systems can instantly assess the validity of claims by comparing customer data with policy records. Machine learning helps the system improve over time by learning from past claims, while data analytics ensures better decision-making through predictive insights.

The main difference between traditional and automated claims processing lies in efficiency and accuracy. Manual systems depend on human input, which can lead to delays, errors, and inconsistencies. InsurTech claims automation, on the other hand, handles repetitive tasks automatically such as verifying policy information or detecting unusual claim patterns allowing insurance staff to focus on more complex cases. This results in faster settlements and higher customer satisfaction.

Digital transformation is completely reshaping insurance workflows. Insurers are now adopting cloud-based platforms and AI-powered systems that work together to automate claims from start to finish. Customers can submit claims online or through mobile apps, track progress in real time, and receive faster payouts. With automation, insurance companies reduce administrative workloads, save time, and provide more reliable service.

Key Technologies Powering Claims Automation in 2025

The rapid progress of InsurTech claims automation in 2025 is being driven by advanced technologies that transform how insurers handle claims. These technologies make insurance operations faster, more transparent, and customer-focused. Artificial intelligence (AI), machine learning, robotic process automation (RPA), blockchain, cloud computing, and API integrations are the main pillars behind this transformation.

Artificial Intelligence (AI) plays a central role in improving claim evaluation and decision-making. AI systems analyze customer data, policy details, and claim histories to verify information and detect irregularities. Predictive analytics powered by AI also helps insurers forecast potential claim outcomes and identify fraud before it occurs. This results in greater efficiency and fairness during the claim approval process.

Machine learning strengthens InsurTech claims automation by enabling systems to learn from past data. Over time, these models improve their ability to assess claims accurately and flag suspicious patterns. For instance, machine learning algorithms can identify fraudulent claims by comparing them with past trends, saving insurers time and money.

Robotic Process Automation (RPA) focuses on handling repetitive administrative tasks such as data entry, policy verification, and document management. By automating these processes, insurers can process more claims with fewer errors and faster turnaround times.

Blockchain technology ensures transparency and security throughout the claims journey. It allows all parties insurers, policyholders, and regulators to view claim data securely without the risk of tampering. This increases trust between insurers and customers.

Cloud computing and API integrations make it easier to connect multiple systems and share information in real time. Cloud platforms provide scalability, allowing insurers to handle large data volumes efficiently. APIs enable seamless communication between different digital tools, ensuring a smooth claims process.

Benefits of InsurTech Claims Automation

InsurTech claims automation offers multiple benefits that are transforming the insurance industry in 2025. By replacing manual processes with digital tools, insurers can improve efficiency, reduce costs, and enhance customer trust. Automation speeds up claims handling, minimizes errors, and provides real-time insights, creating a smoother experience for both insurers and policyholders.

One of the biggest benefits of InsurTech claims automation is faster processing and improved turnaround time. Automated systems can verify policies, check claim validity, and process payments within hours instead of days or weeks. This ensures customers receive quick settlements, which boosts satisfaction and loyalty.

Another key advantage is enhanced accuracy and reduced human error. Automation uses AI and data analytics to make precise decisions based on real-time data. Unlike manual methods that rely on human judgment, automated systems follow standardized procedures, ensuring fairness and consistency in claim approvals.

Lower operational costs are another major gain. InsurTech claims automation eliminates repetitive administrative work, reducing the need for manual labor. This allows insurance companies to allocate resources more effectively, focusing on innovation and customer service instead.

Transparency and trust are also strengthened through automation. Customers can track their claim progress in real time via digital dashboards, giving them confidence in the process. Fraud detection systems powered by AI help identify suspicious claims, protecting both the insurer and honest policyholders.

Additionally, automation supports better fraud prevention and risk management. Machine learning models analyze massive data sets to detect unusual behavior early, helping insurers minimize losses.

Real-World Use Cases and Examples

The adoption of InsurTech claims automation has become a major trend across the global insurance landscape. Leading insurance companies are now integrating digital tools to enhance accuracy and speed. For example, large insurers like AXA, Allianz, and Progressive use automation to manage claims more efficiently. Their systems analyze data in real time, validate policy details, and approve settlements almost instantly. This shift allows insurers to reduce manual effort and improve customer experience by offering faster and fairer claim outcomes.

Case studies show how InsurTech claims automation dramatically reduces settlement times. A typical manual claim might take several weeks to process, but automation can complete the same task in hours. For instance, Lemonade, an InsurTech pioneer, uses AI-based claim bots to approve claims within minutes. This has set a new standard in customer service and efficiency. Similarly, other companies use predictive analytics to detect fraud automatically, reducing false claims and saving millions in operational costs.

Emerging startups are also reshaping the future of claims management. Firms like Tractable and Snapsheet are using computer vision and AI to assess vehicle damage from photos, automating the evaluation process. Their technology allows insurance companies to provide instant repair estimates and settle claims faster. These innovations highlight how InsurTech claims automation benefits both insurers and customers by improving accuracy, trust, and turnaround times.

Challenges and Risks of Claims Automation

While InsurTech claims automation offers many advantages, it also presents challenges that insurers must address carefully. One of the biggest concerns is data privacy and cybersecurity. Since insurance companies handle large volumes of sensitive customer information, automated systems must ensure strict data protection. Any breach can result in loss of trust and financial penalties. Therefore, implementing strong encryption and compliance measures is crucial for safe automation.

Another challenge lies in integrating InsurTech claims automation with legacy systems. Many traditional insurers still rely on outdated software that isn’t compatible with modern digital platforms. Transitioning to automated systems requires time, investment, and technical expertise. Without proper planning, integration issues may disrupt existing operations. Insurers must adopt flexible APIs and cloud-based platforms to ensure smooth connectivity between old and new systems.

Employee reskilling is another important aspect. Automation changes job roles, requiring employees to adapt to new technologies. Training staff to manage and oversee automated systems is essential for success. InsurTech claims automation should not replace human expertise but instead complement it by handling repetitive tasks. This allows employees to focus on decision-making and customer care.

The Future of InsurTech Claims Automation

The future of InsurTech claims automation looks incredibly promising as technology continues to advance. Artificial intelligence and generative analytics are expected to drive the next phase of automation by enabling even smarter decision-making. In 2025 and beyond, insurers will rely on predictive models to evaluate claims before they are even submitted, identifying potential fraud and estimating settlement amounts in seconds. These tools will make the entire claims journey faster, more accurate, and more transparent.

Between 2025 and 2030, InsurTech claims automation will push the insurance industry toward fully digital, customer-centric ecosystems. Policyholders will be able to file claims through mobile apps, interact with AI chatbots for instant updates, and receive payouts almost instantly. Automated systems will continuously learn from data, improving accuracy and reducing human involvement in routine processes. This digital shift will lead to greater satisfaction, lower costs, and a more efficient insurance model.

Partnerships between InsurTech firms and traditional insurers will play a vital role in this transformation. Innovation hubs and collaboration platforms are emerging worldwide to develop AI, blockchain, and cloud solutions tailored for insurance operations. These partnerships will help accelerate digital adoption, enabling insurers to remain competitive in a rapidly changing market.

Conclusion

InsurTech claims automation is transforming the insurance industry by making claim processing faster, more accurate, and customer-friendly. It replaces outdated manual systems with smart, data-driven tools that save time and build trust. As insurers embrace automation, they benefit from lower costs, improved transparency, and stronger fraud prevention. In 2025, adopting InsurTech claims automation is no longer optional, it’s a necessity for growth and competitiveness. By combining technology with human insight, insurance companies can deliver seamless services that meet modern customer expectations. The future of insurance is digital, efficient, and innovative powered by the ongoing evolution of InsurTech.

FAQs

What is the main purpose of InsurTech claims automation?

The main purpose of InsurTech claims automation is to simplify and speed up the insurance claims process. It uses technologies like AI, machine learning, and data analytics to verify claims, detect fraud, and process payments quickly. This automation reduces manual work, minimizes human error, and enhances customer satisfaction by delivering faster, more accurate, and transparent claim outcomes.

How does InsurTech claims automation improve customer experience?

InsurTech claims automation enhances customer experience by offering quicker claim settlements and real-time updates. Customers can easily submit claims online or through mobile apps, reducing paperwork and waiting times. Automated systems also ensure fair and consistent claim decisions, while chatbots and AI assistants provide instant support. Overall, automation makes the entire process smoother, faster, and more reliable for policyholders.

What technologies power InsurTech claims automation in 2025?

The core technologies behind InsurTech claims automation include artificial intelligence (AI), machine learning, robotic process automation (RPA), blockchain, and cloud computing. AI and machine learning help analyze data and detect fraud, while RPA handles repetitive tasks efficiently. Blockchain ensures data security and transparency, and cloud platforms improve scalability and system integration, creating a fully automated, digital claims ecosystem.