Invoice Tracking is one of the most important tasks for keeping your business organized and financially healthy. It allows you to manage payments, monitor cash flow, and ensure you get paid on time. Without a clear system, invoices can easily be forgotten or misplaced, leading to missed payments and financial stress.

A proper invoice tracking system helps you keep everything in one place, showing which invoices are sent, pending, or overdue. It saves time, reduces errors, and adds professionalism to your business. Whether you’re a freelancer or a small business owner, using invoice tracking tools makes managing payments easier and keeps your finances running smoothly.

Key Features of an Effective Invoice Tracking System

An effective Invoice Tracking system offers features that make managing payments easier and more efficient. These tools help you organize your billing process, save time, and ensure every payment is received on schedule. The right features can transform how you handle invoices and keep your business running smoothly.

Automated Invoice Generation is one of the most important features of any Invoice Tracking system. Instead of creating invoices manually, automation allows you to generate and send invoices instantly after a project is completed or a product is delivered. This not only saves time but also reduces human errors. Automated invoicing ensures clients receive accurate, professional invoices every time.

Payment Reminders help you stay on top of due or overdue payments. Many Invoice Tracking systems include automatic reminder settings that notify clients before the due date or once an invoice becomes overdue. This eliminates the awkwardness of manual follow-ups and keeps cash flow consistent. Clients appreciate gentle reminders that help them make payments on time.

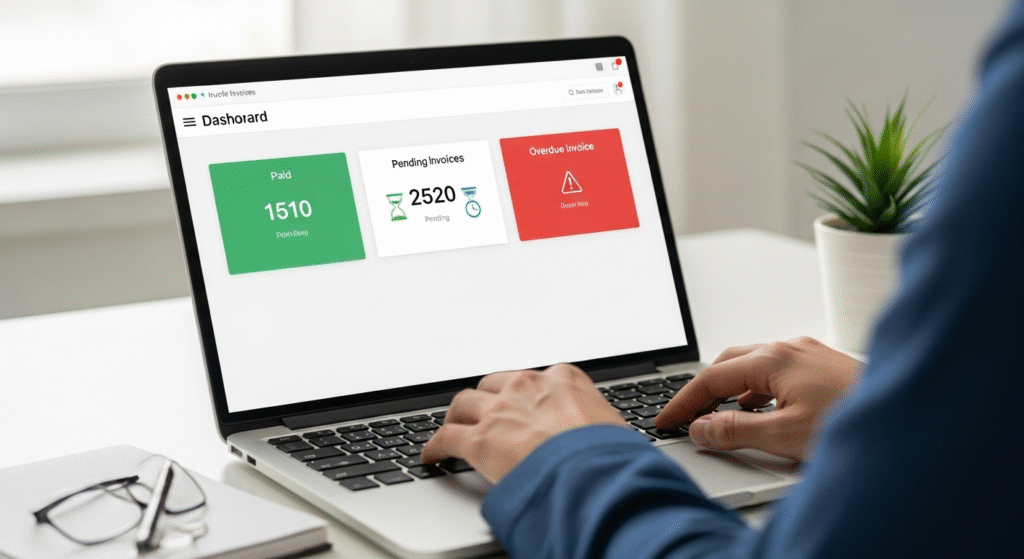

A Dashboard Overview provides a clear picture of your current financial situation. With a single glance, you can see which invoices are paid, pending, or overdue. This visual summary helps you prioritize follow-ups and stay organized. A strong Invoice Tracking dashboard saves you from searching through long lists or spreadsheets.

Client Management is another essential feature. You can store client details, billing addresses, and payment histories within the Invoice Tracking system. Having everything in one place helps you manage recurring clients, understand payment patterns, and build better relationships.

Integration is key for smooth financial management. Integration with Accounting Tools such as QuickBooks, Xero, or Go High Level ensures that your Invoice Tracking system syncs perfectly with your accounting records. This prevents duplicate data entry and keeps financial reports accurate.

For international businesses, Multi-currency and Tax Support is extremely valuable. Your Invoice Tracking software should handle different currencies and automatically calculate taxes according to each region’s rules. This feature saves time and ensures compliance.

Finally, Secure Payment Options are vital for client trust and convenience. A reliable Invoice Tracking system should support multiple payment methods like credit cards, PayPal, or bank transfers. Security features such as encryption protect sensitive payment data, keeping both you and your clients safe.

Benefits of Using an Invoice Tracking System

Using an Invoice Tracking system comes with many benefits that help you stay organized, professional, and financially stable. Whether you’re a freelancer or running a small business, this tool ensures that every payment is accounted for and managed efficiently.

The biggest advantage is that it keeps your finances organized and accessible. Instead of using messy spreadsheets or paper records, an Invoice Tracking system centralizes all your invoices in one place. You can quickly see which clients have paid, which invoices are pending, and which are overdue. This clarity helps prevent confusion and saves time.

It also helps you follow up professionally with clients. Automated reminders make it easy to maintain polite and timely communication. Rather than sending personal emails, your Invoice Tracking tool does it automatically, keeping interactions smooth and professional. This feature ensures you get paid without feeling uncomfortable about reminding clients.

Another key benefit is that it reduces payment delays and missed invoices. The automation in Invoice Tracking ensures that invoices are sent immediately after completion of a job. Clients receive reminders before the due date, which significantly reduces late payments. You no longer have to worry about tracking down forgotten invoices.

Invoice Tracking systems also provide data insights for financial planning. You can view reports that show how much money you’ve earned, your outstanding payments, and your most reliable clients. These insights help you make smarter business decisions, manage cash flow, and forecast future income more accurately.

Professionalism is another major gain. A business that uses Invoice Tracking software appears more reliable and efficient. Clients appreciate receiving detailed, branded invoices and timely updates. This level of organization improves your brand image and encourages repeat business.

How to Set Up an Invoice Tracking System

Setting up an Invoice Tracking system is simple, and once it’s done, you’ll see how much easier it becomes to manage payments. Whether you choose QuickBooks, FreshBooks, Go High Level, Wave, or Zoho, the process follows similar steps to help you stay organized and efficient.

The first step is to choose the right software. Consider what features you need — automation, reminders, integrations, or reporting. For example, Go High Level and QuickBooks are great for growing businesses that need full control over Invoice Tracking and client communication. Choose a platform that fits your goals and budget.

Next, customize your invoice templates with branding. A professional look builds trust with clients. Add your logo, business name, contact details, and preferred payment terms. Most Invoice Tracking systems allow you to save these templates so every invoice looks polished and consistent.

Then, import client data and payment terms into the system. Include names, addresses, contact numbers, and email addresses. Setting clear payment terms, like due dates and accepted payment methods, ensures smoother transactions. The Invoice Tracking tool will use this data for automatic invoice generation and reminders.

After setup, automate reminders and recurring invoices. If you have clients with regular monthly payments, automate their invoices so you never forget to bill them. Set reminders for upcoming due dates or overdue payments. This feature keeps cash flow steady and prevents delays.

Lastly, regularly review reports for better cash flow management. Most Invoice Tracking tools include built-in analytics that show income trends, outstanding balances, and average payment times. Reviewing these reports helps you make informed business decisions, plan budgets, and identify loyal or late-paying clients.

Additionally, always test your system after setup. Send a few test invoices to ensure emails are delivered correctly and payment links work smoothly. Keeping your Invoice Tracking software up to date ensures data accuracy and maximum security.

Common Mistakes to Avoid

When using an Invoice Tracking system, it’s easy to overlook small details that can lead to big problems later. To keep your invoicing process smooth and effective, it’s important to understand the most common mistakes and how to avoid them.

One major mistake is forgetting to follow up on unpaid invoices. Even with an automated system, you must regularly check for overdue payments. Some clients may miss reminders, so sending a friendly follow-up helps maintain communication and ensures you receive your payment without delay.

Another common issue is not keeping backups or proper records. Relying on one system without regular backups can be risky. If something goes wrong or data is lost, you could face serious financial confusion. Always store backups, either on a cloud service or an external drive, to protect your invoicing history.

Sending unclear or incomplete invoices is another problem many businesses face. Missing details like due dates, payment methods, or item descriptions can confuse clients and delay payments. Always double-check your invoices before sending them. A clear and detailed invoice shows professionalism and prevents misunderstandings.

Some users also ignore overdue reminders, thinking automation will handle everything. However, it’s essential to personally review overdue accounts. Sometimes, reminders may not reach the client, or they might require a manual check-in. Staying proactive shows responsibility and helps maintain good client relationships.

Lastly, relying on manual methods that slow down your workflow is a major setback. Managing invoices using spreadsheets or paper files increases the chance of errors and wastes time. Upgrading to a digital Invoice Tracking system saves hours of work and helps you stay organized.

Best Invoice Tracking Tools (2025 Edition)

Choosing the right Invoice Tracking tool makes a big difference in how efficiently you manage your business finances. In 2025, several powerful and user-friendly platforms stand out for their features, reliability, and ease of use.

QuickBooks Online is one of the most trusted names in accounting and Invoice Tracking. It offers automation, payment reminders, and deep reporting features. Its integration with banks and tax tools makes it ideal for small to mid-sized businesses.

FreshBooks is perfect for freelancers and small business owners. It combines simple Invoice Tracking with time tracking, client management, and online payment options. Its intuitive interface makes sending invoices and following up on payments easy.

Wave is a free option that’s great for startups. It offers solid Invoice Tracking, accounting, and receipt scanning features. Despite being free, it provides professional-quality invoices and payment reminders.

Zoho Invoice is known for its strong automation features. It supports multiple currencies, automatic reminders, and recurring invoices. It’s an excellent choice for global users and businesses that handle many clients.

Paymo offers project management alongside Invoice Tracking, making it ideal for service-based businesses. You can track time, manage tasks, and create invoices in one platform. This integration saves time and boosts productivity.

GHL CRM Invoicing (Go High Level) is perfect for agencies and digital marketers. It combines CRM, automation, and Invoice Tracking in one system. You can send invoices directly from the CRM, set reminders, and monitor payments within your workflow making it a powerful all-in-one solution.

Conclusion

An Invoice Tracking system is one of the best tools to keep your business organized and financially secure. It helps you send invoices on time, track payments, and follow up with clients easily. By automating your billing process, you save time, reduce errors, and maintain a steady cash flow. Whether you’re a freelancer, small business owner, or agency, using Invoice Tracking ensures every payment is clear and well-documented. It also improves your professionalism and client relationships. Staying consistent with your invoicing routine builds trust and keeps your business running smoothly. Start using an Invoice Tracking system today to get paid faster and stress-free.

FAQs

What is an Invoice Tracking system?

An Invoice Tracking system is a digital tool that helps you create, send, and manage invoices efficiently. It keeps all your billing records in one place and shows which invoices are paid, pending, or overdue. This system saves time, prevents missed payments, and ensures accuracy. Whether you’re a freelancer or a small business owner, Invoice Tracking helps you stay organized, manage cash flow, and get paid faster with less manual effort.

Why is Invoice Tracking important for small businesses?

Invoice Tracking is essential for small businesses because it helps maintain financial order and steady cash flow. It ensures every payment is properly recorded and reminds clients about due or overdue bills. By reducing missed or late payments, businesses can focus more on growth and less on chasing payments. It also builds professionalism and improves relationships with clients, showing that your business is reliable and well-organized in handling finances.

Can Invoice Tracking help reduce late payments?

Yes, Invoice Tracking greatly helps reduce late payments. Automated reminders notify clients before and after due dates, ensuring they don’t forget to pay. It also keeps all invoices visible in one dashboard, so you can follow up quickly when needed. When clients receive clear, timely invoices, they’re more likely to pay on schedule. Consistent tracking and reminders make the payment process smoother and improve your business’s cash flow and reliability.