Introduction to John Maynard Keynes

John Maynard Keynes was a British economist born in 1883 who played a major role in shaping modern economic thinking. He lived during a time of great economic instability, including World War I and the Great Depression. These events strongly influenced his ideas about how economies work. Keynes challenged the traditional belief that markets always fix themselves without help. He believed that economic downturns could last for a long time if governments did nothing. His famous book The General Theory of Employment, Interest, and Money changed how economists and policymakers viewed economic problems. Today, John Maynard Keynes is remembered as the founder of modern macroeconomics and a key figure in the development of fiscal policy.

Brief Background and Historical Context

John Maynard Keynes grew up in England in a well-educated family, which helped shape his interest in economics. He studied at Cambridge University and later taught there. Keynes lived through major global events such as World War I, the Great Depression, and World War II. During the Great Depression, millions of people lost jobs and businesses failed, while traditional economic theories failed to explain the crisis. This pushed Keynes to develop new ideas about government involvement in the economy. He argued that relying only on free markets was not enough during severe downturns. His ideas gained global attention as governments searched for solutions to widespread unemployment and economic decline.

Why Keynes Is Important in Modern Economics?

John Maynard Keynes is important in modern economics because his ideas changed how governments respond to economic problems. Before Keynes, many economists believed markets would naturally return to balance. Keynes showed that unemployment and low growth could continue for years without government action. He promoted the use of government spending and tax policies to manage economic cycles. These ideas helped shape policies used after economic crises. Today, many countries still rely on Keynesian principles during recessions. His influence can be seen in stimulus packages, public investment programs, and budget planning. Because of this lasting impact, Keynes remains a central figure in economic education and policymaking worldwide.

Keynesian Theory of Government Intervention

The Keynesian Theory of Government Intervention explains why governments should take action when the economy is not performing well. John Maynard Keynes believed that free markets do not always solve economic problems on their own, especially during recessions. In difficult times, people often reduce spending because they feel uncertain about jobs and income. Businesses respond by cutting production and delaying investment. This lowers employment and income, which further reduces spending. Keynes argued that this cycle can continue for a long time, causing deep economic damage if governments do nothing.

Markets may fail to self-correct because human behavior is influenced by fear and low confidence. Even if prices or wages fall, people may still avoid spending. Businesses may not invest if they expect low demand. Wages and prices also adjust slowly due to contracts and regulations. As a result, unemployment can remain high for years. Keynes believed that relying only on market forces during such times leads to unnecessary hardship. He argued that government action is needed to restore demand and confidence in the economy.

This is why Keynes supported active government involvement. Governments have the ability to spend money, collect taxes, and influence economic activity. When private spending is weak, governments can step in to support the economy. Public spending on infrastructure, education, healthcare, and social programs creates jobs and increases income. This encourages people to spend more, which helps businesses grow. Governments can also reduce taxes to increase disposable income. According to Keynes, these actions help break the cycle of low demand and speed up economic recovery.

Fiscal Policy Explained

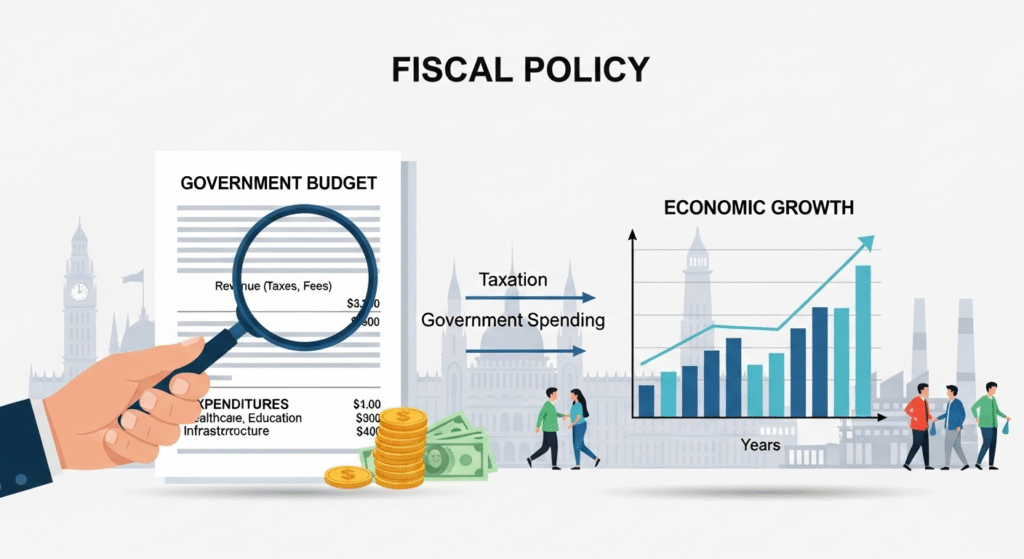

Fiscal policy, which is how governments use spending and taxation to manage the economy. The definition of fiscal policy includes all decisions related to government budgets, public spending, and taxes. Fiscal policy aims to control unemployment, inflation, and economic growth. During recessions, expansionary fiscal policy is used to boost demand. During strong economic growth, contractionary fiscal policy can help control inflation.

The main tools of fiscal policy are government spending and taxation. Government spending directly creates jobs and supports economic activity. Taxation affects how much money people and businesses can spend or invest. By carefully using these tools, Keynes believed governments can stabilize the economy, reduce unemployment, and protect living standards during economic downturns.

Benefits of Keynesian Macroeconomics

One of the most important benefits is reducing unemployment. John Maynard Keynes believed that unemployment is caused by low demand, not just by workers asking for high wages. When people spend less, businesses produce less and hire fewer workers. Keynesian policies address this problem by increasing demand through government spending and tax cuts. When governments invest in public projects such as roads, schools, and hospitals, new jobs are created. People earn income and spend more, which encourages businesses to hire again. This process helps reduce unemployment faster than waiting for markets to recover on their own. By supporting job creation, Keynesian macroeconomics helps improve living standards and social stability.

Another key benefit of Keynesian macroeconomics is stabilizing economic growth. Economies naturally go through cycles of growth and recession. Keynes believed these cycles could be harmful if they became too extreme. During recessions, economic activity slows, while during booms, inflation can rise. Keynesian policies help smooth these ups and downs. When growth is weak, governments can increase spending to support demand. When the economy grows too quickly, governments can reduce spending or raise taxes to control inflation. This balanced approach helps maintain steady growth over time. Stable growth makes it easier for businesses to plan, invest, and create jobs. It also helps governments manage public services more effectively.

Criticism of Keynesian economics

One major concern is inflation. Critics argue that excessive government spending can increase demand too much, leading to rising prices. If governments continue spending even when the economy is strong, inflation may become difficult to control. Inflation reduces purchasing power and increases the cost of living. Some economists believe that Keynesian policies focus too much on short-term growth and ignore long-term price stability. Poor timing of government intervention can make inflation worse instead of better.

Another criticism is related to government debt issues. Keynesian policies often require higher government spending, which can increase budget deficits and public debt. Critics worry that high debt levels place a burden on future generations. Governments may need to raise taxes later to repay debt, which can slow economic growth. There is also concern that governments may misuse spending for political reasons rather than economic need. These issues raise questions about how effectively Keynesian policies are applied in practice.

Keynesian economics in today’s world

Many governments continue to use Keynesian ideas during economic crises. Relevance is especially clear during recessions, financial crises, and global disruptions. Governments use stimulus packages to support businesses, protect jobs, and maintain demand. These policies help prevent deeper recessions and support faster recovery. Keynesian thinking also influences central planning and budget decisions in many countries.

Examples of current policy use include government stimulus programs, public investment projects, and tax relief measures. During economic slowdowns, governments increase spending to support growth. During stronger periods, they focus on reducing deficits and controlling inflation. These actions show that Keynesian economics is still an important tool for managing modern economies, promoting stability, and protecting citizens from severe economic shocks.

Conclusion

John Maynard Keynes’ ideas transformed the way we understand and manage economies. Keynesian macroeconomics focuses on increasing demand during downturns, creating jobs, and stabilizing growth. By using government spending and taxation, governments can reduce unemployment, support businesses, and protect citizens from severe economic problems. While critics point out risks like inflation and higher debt, Keynesian policies remain widely used today because they help manage economic cycles and promote stability. Modern governments continue to apply these ideas through stimulus programs, public investment, and careful fiscal planning. Overall, Keynes’ work provides practical tools to improve living standards and maintain steady economic growth.

FAQs

What is aggregate demand?

Aggregate demand is the total spending on goods and services in an economy. It includes consumption, investment, government spending, and exports minus imports. John Maynard Keynes believed that low aggregate demand causes recessions and unemployment. By increasing aggregate demand through government spending or tax cuts, economic activity can rise. Higher demand encourages businesses to produce more and hire workers, which helps the economy recover faster. Understanding aggregate demand is key to applying Keynesian economics.

How does government spending help the economy?

Government spending helps the economy by creating jobs and increasing income. When the government invests in projects like roads, schools, and hospitals, it hires workers and buys materials. This puts money into the hands of people who then spend more on goods and services. Increased spending boosts demand, encourages businesses to grow, and reduces unemployment. Government spending is especially useful during recessions when private spending is low, helping the economy recover more quickly and maintaining stability.

Why do some economists criticize Keynesian economics?

Some economists criticize Keynesian economics because it can cause inflation if governments spend too much. High spending may lead to higher prices and reduce purchasing power. Another concern is government debt. Large deficits created by increased spending must eventually be repaid, which can burden future generations. Critics also argue that poor timing or misuse of spending can worsen economic problems instead of solving them. Despite these concerns, Keynesian ideas remain influential in modern economic policy.

How does John Maynard Keynes explain recessions?

John Maynard Keynes explained recessions as periods when total demand in the economy falls. When people spend less, businesses produce less, leading to layoffs and lower income. This reduces spending further, creating a negative cycle. Keynes argued that markets do not always fix themselves quickly. To stop recessions, he recommended government intervention through spending, tax cuts, and public projects. These policies increase demand, support jobs, and help the economy recover faster than relying on market forces alone.