Introduction

Lightspeed VC, officially known as Lightspeed Venture Partners (LSVP), is one of the world’s most powerful venture capital firms, with a global footprint across the U.S., Europe, India, Israel, and China. Established in Silicon Valley, the firm has built a strong reputation for spotting innovative startups early and supporting them through every growth stage. In 2025, Lightspeed VC solidified its position as a market leader by playing a major role in some of the biggest startup funding rounds of the year.

Among its 2025 achievements, Lightspeed led a $3.5 billion investment round in Anthropic, one of the most promising AI startups globally. This historic deal not only strengthened its leadership in the artificial intelligence sector but also demonstrated its ability to identify high-growth companies before they become global phenomena. According to SecondTalent reports, Lightspeed VC ranked among the top global venture capital investors of 2025, frequently leading large-scale investments in AI, fintech, and SaaS ventures.

This success was not accidental. Lightspeed VC has consistently combined global scale, deep market research, and a founder-first investment philosophy. Its disciplined strategy and focus on high-potential sectors have allowed it to outperform many peers in the competitive venture capital landscape. In this guide, we’ll explore how the firm’s legacy, strategy, and vision propelled it to become one of the most respected and active investors of 2025. Lightspeed VC’s journey reveals how insight, timing, and innovation can turn a firm into a leader in global startup funding.

Legacy and Background of Lightspeed

The story of Lightspeed VC began in 2000 in Menlo Park, California, when it was founded by a group of seasoned investors aiming to back early-stage technology companies. According to Wikipedia, the firm’s initial focus was on enterprise software and consumer technology startups, sectors that later exploded in global importance. Over time, Lightspeed VC earned a reputation for identifying companies with long-term potential and supporting them from seed funding to IPOs.

According to Waveup, Lightspeed VC made early investments in several iconic brands that reshaped the digital landscape, which established its credibility and trust among founders. These early wins paved the way for significant fund growth, allowing the firm to expand beyond the U.S. into other tech ecosystems such as India, Israel, and China.

As of late 2025, Tracxn reports that Lightspeed VC has invested in more than 900 companies worldwide — an impressive number that highlights its reach and influence. Its assets under management (AUM) have grown into the billions, enabling it to lead massive funding rounds for industry-defining startups. This strong legacy and global diversification positioned Lightspeed VC perfectly to dominate 2025’s biggest startup investments.

Investment Strategy and Vision

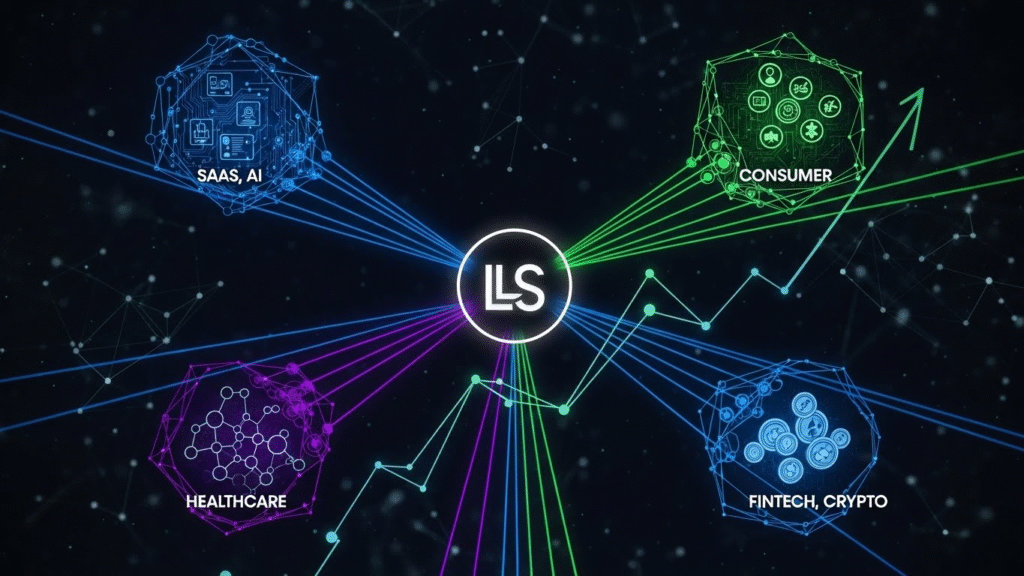

Lightspeed VC follows a disciplined yet dynamic investment strategy that blends early-stage support with growth-stage leadership. The firm invests from Seed through Series F, ensuring that successful portfolio companies receive continuous backing as they scale. According to Lightspeed Venture Partners’ official statements, the firm believes in creating “depth over breadth” investing meaningfully in fewer, high-impact startups rather than spreading capital too thinly.

Geographically, Lightspeed VC maintains a strong presence in key markets such as the U.S., India, Israel, and China, allowing it to access a diverse range of founders and industries. Waveup highlights that this global reach helps the firm stay ahead of trends, from AI and fintech to consumer tech and enterprise SaaS. By understanding local ecosystems while leveraging global insights, Lightspeed VC identifies innovation hot spots before competitors.

According to The Financial Times, Lightspeed VC has also begun exploring non-traditional areas such as secondary markets, late-stage deals, and mega-rounds. This shift shows its adaptability in a changing venture landscape, where capital concentration and global competition are increasing. By combining early-stage conviction with large-scale participation, Lightspeed VC ensures its portfolio companies remain competitive across all growth phases.

Major 2025 Investment Highlights

In 2025, Lightspeed VC reinforced its leadership by leading or co-leading several of the year’s largest and most influential startup funding rounds. One of the most notable was the $3.5 billion round for Anthropic, an artificial intelligence company developing advanced language models and AI safety systems. According to Axios, this investment positioned Lightspeed VC as a top name in the AI funding ecosystem.

Another major highlight was its participation in Mistral AI’s €1.7 billion Series C funding round, as reported by Morgan Lewis. These large-scale deals demonstrated Lightspeed VC’s confidence in next-generation technology and its willingness to fund innovation at a global scale. The firm’s involvement in such transformative rounds not only provided significant capital to these startups but also validated their business potential in the eyes of the entire tech community.

Beyond AI, Lightspeed VC continued to make strategic bets in fintech, climate technology, and SaaS ventures, strengthening its multi-sector portfolio. Each deal reflected its approach of combining financial discipline with visionary thinking. These investments not only generated returns but also cemented its reputation as a trusted partner for ambitious founders worldwide.

Global Expansion and Collaboration

The global reach of Lightspeed VC is one of the main reasons for its dominance in 2025. Unlike many venture firms that limit themselves to regional markets, Lightspeed VC has established a powerful global presence with offices in the U.S., Europe, India, Israel, and China. This international footprint allows the firm to identify high-potential startups across diverse ecosystems and offer strategic support that transcends borders.

Through partnerships with international funds and regional accelerators, Lightspeed VC has built a strong network that connects entrepreneurs, investors, and innovators. Its collaborations in markets like India, Southeast Asia, and Europe have produced some of the most successful startups of the decade. In India alone, Lightspeed VC has been instrumental in the rise of unicorns across fintech, e-commerce, and SaaS sectors. This expansion strategy has positioned the firm as a key bridge between emerging markets and global capital.

Cross-border investments have been another core part of Lightspeed VC’s success story. By facilitating global funding and knowledge sharing, the firm enables startups to grow beyond their local markets. Its team of experts across continents ensures that portfolio companies receive consistent mentorship, guidance, and resources. This approach doesn’t just diversify risk, it strengthens innovation pipelines across industries.

Moreover, Lightspeed VC emphasizes close collaboration with founders, mentoring them throughout their business journey. The firm’s global teams often work directly with startup leadership to help refine business models, improve operations, and scale internationally. This personal, hands-on approach differentiates Lightspeed VC from competitors that primarily focus on capital injection.

The Role of Leadership and Culture

Behind the success of Lightspeed VC lies a leadership team that believes in vision, trust, and innovation. The firm’s managing partners and senior directors bring years of experience from both venture capital and operational leadership, ensuring that every investment is grounded in both strategy and empathy. The leadership vision at Lightspeed VC is simple yet powerful to empower founders, nurture innovation, and build companies that last for decades.

Lightspeed VC fosters a culture built on trust, transparency, and long-term partnership. Rather than treating founders as clients, it sees them as collaborators. This founder-first value system has helped the firm attract some of the most ambitious entrepreneurs around the world. The firm’s partners are deeply involved in mentoring, offering continuous guidance even after funding rounds are completed.

Culturally, Lightspeed VC encourages teamwork, humility, and deep market understanding. It invests heavily in developing its internal team, ensuring analysts and associates are not just financiers but advisors who understand technology, product, and market shifts. The result is a supportive ecosystem where every team member contributes to the firm’s mission of global innovation.

Another key leadership strength of Lightspeed VC is adaptability. In 2025, the venture landscape evolved rapidly, driven by AI, sustainability, and fintech revolutions. The firm’s leadership responded proactively by expanding its focus areas, developing new funds for frontier technologies, and enhancing its digital infrastructure. This agility ensures that Lightspeed VC remains ahead of the curve in identifying next-generation trends.

Challenges and Competitive Landscape

Even at the top of the venture capital world, Lightspeed VC faces intense competition and evolving challenges. In 2025, major players such as Sequoia Capital, Accel, a16z, and SoftBank continued to dominate the global funding space. However, Lightspeed VC managed to stay ahead through innovation, diversification, and its ability to adapt quickly to changing market conditions.

One of the major challenges Lightspeed VC faced in 2025 was the tightening of global capital markets. Economic uncertainty, fluctuating valuations, and shifting investor sentiment forced many VCs to become more selective. Yet, Lightspeed VC turned these challenges into opportunities by focusing on quality over quantity. The firm concentrated its resources on high-performing sectors such as artificial intelligence, climate tech, and enterprise software, areas with strong long-term growth potential.

Another factor that helped Lightspeed VC navigate competition was its unique deal sourcing strategy. Instead of chasing hype-driven startups, the firm relied on deep research, data analytics, and founder networks to find promising ventures early. This allowed it to invest at the right time and support startups through every growth phase.

Moreover, Lightspeed VC has learned from past market cycles. Its experience during earlier tech downturns helped shape a more balanced risk management approach. The firm diversified its portfolio across sectors and geographies, ensuring stability even during volatile economic periods.

While many competitors focused solely on mega-deals, Lightspeed VC maintained a blend of early-stage and late-stage investments, allowing it to capture innovation from inception to maturity. This adaptability, combined with its global mindset, made Lightspeed VC a dominant force in 2025 despite fierce rivalry.

Conclusion

The story of Lightspeed VC in 2025 is a powerful example of vision, discipline, and innovation. Through its global reach, strategic investments, and strong founder relationships, Lightspeed VC proved that success in venture capital requires more than just funding; it demands insight and long-term commitment. By leading billion-dollar deals, expanding across continents, and supporting entrepreneurs with integrity, Lightspeed VC built a lasting global reputation. Its leadership, adaptability, and diversified strategy have positioned it as a driving force behind the world’s most promising startups. In 2025 and beyond, Lightspeed VC continues to shape the future of innovation, one investment at a time.

FAQs

What makes this venture firm different from others?

This firm stands out because of its founder-first approach, global presence, and long-term investment mindset. It doesn’t just provide capital, it guides entrepreneurs to grow their business successfully. By operating across multiple continents, it discovers innovative startups early and supports them through every stage. Its balance of early-stage and late-stage funding allows it to manage risks while helping companies scale effectively. This approach has built a reputation for trust and reliability in the venture world.

How does the firm decide which startups to fund?

The company looks for startups with strong leadership, clear goals, and scalable business models. It uses market research, data, and expert judgment to identify high-potential opportunities. The firm favors industries like AI, fintech, software, and consumer tech. Beyond financial metrics, it also evaluates founders’ dedication, integrity, and long-term vision. This careful selection ensures that investments have the potential to grow sustainably and create global impact while providing the support founders need to succeed in competitive markets.

Which industries receive the most investment?

The firm invests in several sectors, but top areas include artificial intelligence, enterprise software, fintech, and consumer technology. Recently, it has also expanded into sustainability, health tech, and digital infrastructure. By focusing on high-growth, innovation-driven industries, the company balances risk and opportunity. This diverse portfolio allows it to support startups that have the potential to transform markets while also creating long-term value. Strategic sector selection ensures that investments remain relevant in changing global conditions.

Why was 2025 a significant year for the firm?

In 2025, the company led several of the largest startup funding rounds worldwide. These deals helped it gain recognition as a top venture firm. By identifying emerging companies early and supporting them through major funding rounds, it strengthened its global influence. The firm’s success reflected careful planning, strategic partnerships, and a deep understanding of market trends. This milestone year demonstrated its ability to adapt, scale, and maintain a competitive edge in a highly dynamic investment environment.

What lessons can entrepreneurs learn from its approach?

Entrepreneurs can learn the importance of strategic thinking, adaptability, and building strong partnerships. The firm shows that sustainable growth comes from careful planning and long-term focus. Founders should prioritize innovation, disciplined execution, and expanding their networks. Success is not just about raising capital but also about creating value, scaling responsibly, and making informed decisions. By studying its approach, entrepreneurs can understand how vision, consistency, and strategic guidance can turn early-stage startups into successful, impactful companies.