Money saving envelope system is one of the easiest and most effective ways to take control of your budget. Even in 2025, this simple method continues to help people understand where their money goes each month. By assigning cash or digital funds into specific categories like groceries, bills, or entertainment, you can manage spending with clarity and intention.

The money saving envelope system teaches you to plan your expenses ahead of time and avoid unnecessary purchases. Whether you use traditional envelopes or digital budgeting apps, it keeps your finances organized and goal-focused. This timeless approach adapts perfectly to modern lifestyles, helping you save more and spend smarter every day.

Envelope System Basics

The envelope system is a classic money management method that helps you take full control of your spending. It works by dividing your income into specific spending categories such as groceries, rent, transportation, or entertainment. You assign a set amount of cash to each envelope, and once the money in that envelope is gone, you stop spending in that category until the next month. This hands-on method creates awareness of where every dollar goes and prevents unnecessary spending.

Separating your money into different categories increases your financial awareness. You can see exactly how much is available for each need, which helps you make better decisions. For example, if your “dining out” envelope is almost empty, you might choose to cook at home instead of ordering takeout. It’s a simple yet powerful way to control impulse spending.

Common envelope categories include groceries, gas, utilities, personal care, dining, and fun money. You can customize these categories based on your lifestyle and priorities. The system also encourages saving for future goals by dedicating envelopes to things like “emergency fund” or “vacation savings.” Over time, this method builds discipline and helps you stay consistent with your financial goals.

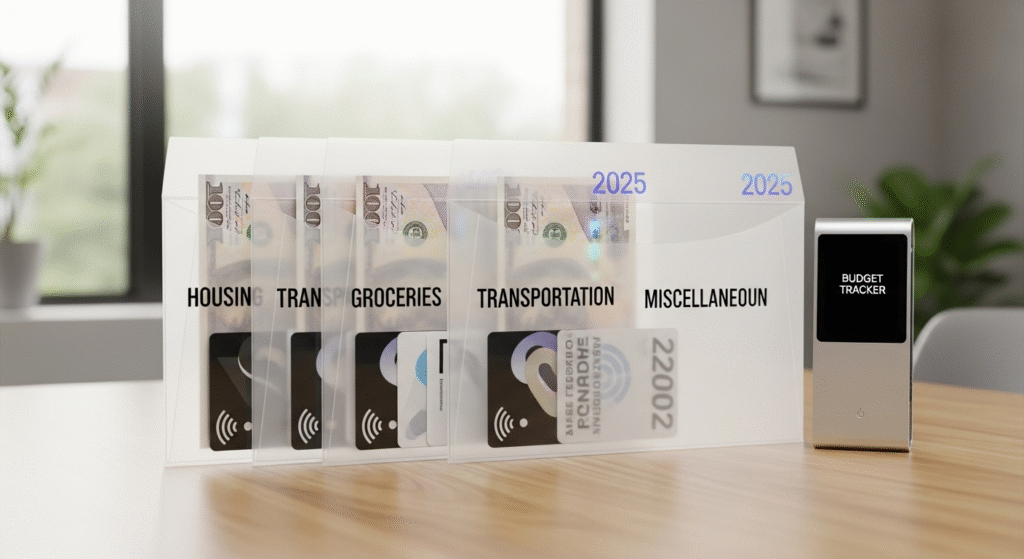

Modern Envelope System for 2025

In 2025, the envelope system has evolved with technology, making it easier than ever to manage your money digitally. Instead of using physical cash envelopes, many people now use digital envelope apps such as Goodbudget, Mvelopes, and YNAB (You Need A Budget). These apps allow you to create virtual envelopes for different categories and track your spending in real time.

The modern money saving envelope system combines automation with budgeting for better results. You can set up automatic transfers to your digital envelopes right after payday. For instance, you can automatically move funds to your “groceries,” “bills,” or “savings” envelopes. This ensures that your money is allocated before you have the chance to overspend.

Technology also makes tracking and adjustments much easier. With budgeting apps, you can get spending reports, reminders, and insights into where your money goes. Many apps connect directly to your bank account, so you can instantly see how much you’ve spent and what’s left in each category. You can also adjust amounts as your financial needs change without dealing with physical cash.

Setting Up Your Envelope Budget Step by Step

Creating your envelope budget is simple once you understand your income and expenses. Start by identifying your total monthly income and dividing your expenses into two groups: fixed and variable. Fixed expenses include rent, insurance, and loan payments, while variable expenses include things like groceries, gas, or dining out.

Next, decide how much to allocate to each envelope based on your spending habits and priorities. Review past statements or receipts to get a clear picture of where your money usually goes. Then, assign realistic amounts to each category, enough to meet your needs but not so much that it encourages overspending.

If you’re using physical envelopes, label each one clearly and place the budgeted cash inside. For a digital system, create virtual categories in your app and set your monthly limits. The key is to make sure all your income is assigned a purpose, this prevents waste and helps you reach your goals faster.

Tracking your progress is essential for consistency. Review your envelopes weekly or monthly to see where you’re doing well and where adjustments are needed. If one category runs out early, resist the urge to move money from another envelope. Instead, use that as a signal to budget better next month.

Tips to Make the Envelope System Work Long Term

For the envelope system to truly work, discipline and consistency are key. One of the best tips is to respect your spending limits. Once an envelope is empty, don’t pull money from another category. This teaches self-control and helps you develop better money habits.

It’s also important to adjust your envelopes as your financial goals or life situations change. For example, if you’re saving for a vacation, you might add a temporary envelope for that goal. Likewise, if you’ve paid off a debt, you can redirect those funds to savings or investments. Flexibility keeps your system practical and sustainable over time.

Include savings envelopes in your plan as well. Many people forget to budget for savings, but having a dedicated envelope for emergencies, home repairs, or big purchases ensures you’re always prepared. This small step builds long-term financial security.

Lastly, review your envelopes monthly to track progress and celebrate small wins. Seeing your savings grow or sticking to your limits brings motivation to continue. With patience and practice, the envelope system becomes a habit that keeps your finances balanced and stress-free.

Digital vs. Physical Envelopes: Which Is Better?

Choosing between digital and physical envelopes depends on your lifestyle and preferences. The cash-based envelope system gives a tangible sense of money—you can physically see it leave your hand, which often makes people spend less. It’s simple, visual, and doesn’t rely on technology. However, it can be less convenient in a world that’s moving toward digital payments.

On the other hand, digital envelope systems are perfect for those who prefer online banking or mobile apps. They’re secure, accessible from anywhere, and automatically track your transactions. Apps like YNAB or Goodbudget help you plan ahead and stay accountable. However, digital systems can make it easier to overspend if you’re not paying close attention.

A balanced approach can be the best option. For example, use digital envelopes for fixed bills and savings goals but keep physical envelopes for flexible categories like dining or entertainment. This combination allows you to enjoy convenience while maintaining spending awareness. The goal is to choose the system that helps you stay consistent and comfortable in your financial journey.

Building Financial Freedom with the Envelope System

The envelope system isn’t just a budgeting tool, it’s a path to financial freedom. By assigning every dollar a purpose, you take full control of your money instead of wondering where it went. This method helps you spend intentionally, save consistently, and avoid unnecessary debt.

Over time, the money saving envelope system trains your mind to make mindful choices. You become more aware of your financial habits and start setting priorities that align with your goals. The discipline you build through this system creates lasting financial confidence.

In 2025, with so many digital distractions, this simple approach stands out for its clarity and effectiveness. Whether you use cash, apps, or a mix of both, the envelope system keeps your finances organized and goal-driven. By sticking to your plan, reviewing your progress, and making small adjustments, you’ll build not just savings but true financial independence.

Conclusion

The money saving envelope system continues to be one of the most practical and effective budgeting methods, even in 2025. Whether you prefer traditional cash envelopes or modern digital apps, this approach helps you gain full control over your spending habits. By setting clear categories, tracking expenses regularly, and committing to your limits, you can easily stay on top of your finances. With the money saving envelope system, you develop discipline, reduce financial stress, and make smarter money decisions. It’s not just about saving, it’s about creating a sustainable financial lifestyle that supports your goals and gives you lasting freedom and confidence with every dollar you manage.

FAQs

How does the money saving envelope system help me control overspending?

The money saving envelope system helps you set clear limits by assigning a fixed amount of cash or digital funds to specific spending categories. Once an envelope is empty, you stop spending in that category, which prevents impulse purchases. This method builds awareness of your spending patterns and encourages smarter financial habits. Over time, the money saving envelope system makes budgeting easier and helps you stick to your financial goals consistently without feeling deprived.

Can I use the money saving envelope system if I don’t use cash?

Yes, you can easily apply the money saving envelope system digitally using apps like Goodbudget or YNAB. These apps allow you to set virtual envelopes for different categories, track spending automatically, and stay organized without handling physical money. The money saving envelope system works just as well in digital form, giving you flexibility while maintaining financial discipline in today’s cashless world.

How many categories should I have in the money saving envelope system?

When starting the money saving envelope system, it’s best to begin with five to eight main categories such as groceries, dining, gas, entertainment, and savings. Too many envelopes can get confusing, while too few may not reflect your spending accurately. The money saving envelope system works best when categories are simple, clear, and aligned with your lifestyle and financial goals.

Is the money saving envelope system good for saving for big goals?

Absolutely! The money saving envelope system is excellent for saving toward big goals like vacations, car purchases, or emergency funds. By creating a dedicated envelope for each goal, you can visually track your progress and stay motivated. The money saving envelope system makes long-term saving more structured and satisfying since you can literally see your money grow over time.