Estate Planning Tips play a vital role in protecting your assets and ensuring your loved ones are financially secure. Planning ahead helps you organize your property, savings, and investments so they are distributed according to your wishes. It also minimizes legal complications and reduces stress for your family during difficult times.

In this guide, you’ll discover practical steps to make estate planning easier and more effective. From creating a will to setting up trusts and managing taxes, these strategies help you prepare for the future with confidence. With thoughtful planning, you can achieve peace of mind and ensure a stress-free financial future for your loved ones.

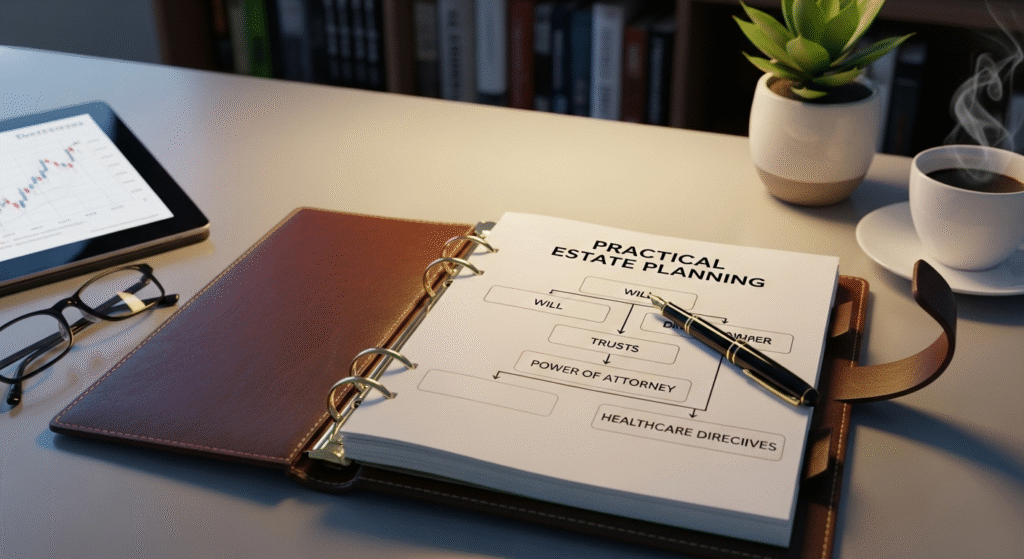

Essential Estate Planning Tips

Planning for the future can feel overwhelming, but with the right Estate Planning Tips, you can make the process easier and ensure your loved ones are financially protected. Estate planning is not only for the wealthy, it’s for anyone who owns property, savings, or valuables and wants to control what happens to them after death or incapacity. These practical steps will help you create a clear plan, reduce taxes, and give your family peace of mind.

Create a Clear and Updated Will: One of the most important Estate Planning Tips is to have a will. A will is a legal document that outlines how your assets, money, and personal belongings will be distributed after your death. Without a will, state laws decide who inherits your property, which might not align with your wishes. Having a well-written will ensures your loved ones receive what you intend and prevents unnecessary family disputes.

A will provides control, clarity, and comfort. It allows you to name beneficiaries, appoint guardians for minor children, and specify who will manage your estate. It also helps avoid lengthy legal processes, known as probate, which can delay the distribution of assets. With a proper will, your family won’t have to deal with confusion or conflict during an already difficult time.

To create a valid will, start by listing all your assets, including real estate, investments, bank accounts, and valuable items. Then, choose your beneficiaries carefully. You’ll also need to appoint an executor, someone responsible for carrying out your wishes. Once the will is written, sign it in front of witnesses, as required by your state laws.

It’s equally important to update your will regularly, especially after major life changes like marriage, divorce, birth of a child, or purchasing property. Reviewing your will every few years ensures it always reflects your current situation and intentions.

Set Up a Trust to Protect Your Assets: Another key part of Estate Planning Tips is setting up a trust. A trust is a legal arrangement that allows you to transfer your assets to a trustee, who manages them on behalf of your beneficiaries. Trusts are powerful tools for protecting wealth, avoiding probate, and reducing taxes.

Types of Trusts and How They Work

There are different types of trusts depending on your goals.

- Revocable Trust: This type allows you to change or cancel the trust during your lifetime. It offers flexibility and helps your estate avoid probate.

- Irrevocable Trust: Once created, it cannot be easily changed. However, it provides strong protection from creditors and helps reduce estate taxes.

- Living Trust: This type of trust takes effect while you’re alive, ensuring that your assets are managed smoothly if you become incapacitated.

- Testamentary Trust: Created through your will, this trust activates after your death to manage inheritance for minors or dependents.

Setting up a trust helps your family receive assets faster and with less legal hassle. Since trusts usually bypass probate court, your loved ones can access their inheritance more quickly. In addition, some trusts offer tax advantages by transferring ownership of assets before death, reducing the taxable value of your estate. A well-structured trust ensures your wealth is distributed smoothly, privately, and in line with your wishes.

Assign Power of Attorney: Among the most valuable Estate Planning Tips is assigning Power of Attorney (POA). This legal document lets someone you trust make decisions on your behalf if you are unable to do so due to illness or incapacity. There are two main types: financial and healthcare POA.

Choosing the right person for Power of Attorney is crucial. This individual should be responsible, trustworthy, and capable of handling important matters. A financial Power of Attorney manages your financial tasks like paying bills, managing investments, or handling property if you’re unable to do so. A healthcare Power of Attorney, sometimes called a medical proxy, allows your representative to make medical and end-of-life decisions based on your preferences.

A durable Power of Attorney remains valid even if you become mentally or physically incapacitated. This ensures your finances and healthcare decisions are continuously managed without court involvement. Having both durable and healthcare POA documents in place avoids confusion, gives your loved ones guidance, and ensures your personal choices are honored during critical moments.

Plan for Taxes and Debts: Estate planning is not just about dividing assets, it’s also about managing liabilities. A crucial part of Estate Planning Tips is understanding how taxes and debts affect your estate’s value. Planning ahead can save your heirs from unnecessary financial stress.

Estate taxes are fees imposed on the transfer of property after your death. In the United States, federal estate taxes generally apply only to very large estates, but state-level taxes can affect smaller ones too. Without proper planning, taxes can reduce the value of what your beneficiaries receive. Additionally, debts such as mortgages, loans, or credit card balances must be settled before assets are distributed.

Several strategies can help reduce taxes and preserve your wealth. Gifting assets during your lifetime, setting up irrevocable trusts, and making charitable donations can all lower taxable amounts. Another effective approach is converting large estates into smaller portions through family limited partnerships or insurance policies. Consulting a financial advisor or estate attorney can help you find the best tax-saving options tailored to your financial goals.

Keep Documents Organized and Accessible: The final section of our Estate Planning Tips focuses on organization. Even the best plan can fail if documents are lost or difficult to access. Keeping everything in order ensures your loved ones can act quickly and efficiently when needed.

A complete estate planning file should contain your will, trust documents, Power of Attorney forms, life insurance policies, property deeds, financial account information, and beneficiary designations. It’s also helpful to include personal notes explaining your wishes, funeral preferences, and contact details for your attorney or financial advisor.

Storing documents safely is just as important as creating them. You can use a fireproof safe, a safety deposit box, or a secure digital vault for electronic copies. Make sure at least one trusted person knows where these documents are stored and how to access them in an emergency. It’s also wise to keep copies with your attorney or estate planner to ensure nothing gets misplaced.

Digital Estate Planning

In today’s modern world, many people have online accounts, digital assets, and investments stored electronically. That’s why Digital Estate Planning has become an important part of overall financial planning. It ensures your online property, such as bank accounts, cryptocurrency, emails, and social media profiles is properly managed and passed on according to your wishes.

One of the key steps in Digital Estate Planning is organizing and protecting your online assets. These include your digital wallets, online bank accounts, investment platforms, and even photos stored in the cloud. Start by creating a list of all your digital accounts along with usernames and passwords. Use a secure password manager or encrypted document to store this information safely. It’s also helpful to assign a trusted person who can access these accounts if you are unable to do so. Managing your online investments, such as stocks or cryptocurrencies, is equally important to prevent loss or misuse.

Just like physical property, your digital property should also be included in your will or trust. Mention who should manage or inherit your digital accounts and assets. This ensures that your social media accounts, digital photos, or online earnings are handled correctly after your death. Adding clear instructions about digital property helps your executor or trustee avoid confusion and ensures your wishes are respected.

Involving Family in the Process

Estate planning, whether traditional or digital, becomes much smoother when your family understands your plans. Clear communication prevents misunderstandings and ensures everyone is on the same page.

Discussing your Digital Estate Planning decisions with family members helps them understand your goals and preferences. It gives them confidence in how to manage your assets and reduces emotional stress during difficult times. When everyone is aware of your choices, there’s less room for conflict or confusion later on.

Transparency is the best way to avoid family disputes. Be open about how you’ve divided your property, both digital and physical, and explain the reasons behind your decisions. Encouraging shared understanding builds trust and ensures a peaceful transfer of your estate in the future.

Conclusion

Digital Estate Planning is an essential part of modern financial management. It ensures your online assets, passwords, and digital investments are safe, organized, and accessible to trusted individuals when needed. Including digital property in your wills and trusts provides clarity and prevents future legal or emotional challenges for your family. Open communication with loved ones builds trust and helps avoid misunderstandings or disputes. Planning ahead not only protects your digital legacy but also gives peace of mind knowing your wishes will be respected. With careful preparation, you can create a complete and stress-free estate plan for the future.

FAQs

What happens if I don’t follow proper estate planning tips?

If you ignore important Estate Planning Tips, your assets and wishes might not be handled the way you want. Without a clear plan, your family could face delays, confusion, and extra legal costs. Following expert advice helps you protect your property and loved ones. A good estate plan gives peace of mind for the future.

How do estate planning tips help manage digital assets?

Modern Estate Planning Tips guide you on how to include digital accounts, passwords, and online investments in your plan. They ensure that your digital property is properly organized and accessible when needed. This prevents valuable data or funds from being lost after your death. With the right tips, your digital legacy stays secure and well managed.

Who should I talk to before following estate planning tips?

Before applying any Estate Planning Tips, it’s best to consult a financial advisor or estate lawyer. These professionals can explain legal terms and help you make informed choices. They ensure your plan follows local laws and meets your family’s needs. Professional advice turns general tips into a personalized, effective plan.

How often should I review my estate planning tips and documents?

You should review your Estate Planning Tips and documents at least once a year. Life events like marriage, buying property, or having children require updates. Regular reviews help keep your plan accurate and up to date. This simple habit ensures your wishes are always respected.