REITs vs Physical Property Returns is an important comparison for smart investors deciding how to grow their real estate income. Both options offer unique benefits, risks, and return potential. REITs provide easier access, liquidity, and passive income through dividends, while physical property offers rental income, control, and long-term appreciation. Understanding how returns differ helps investors choose the option that matches their goals, budget, and risk tolerance. This comparison explains income stability, growth potential, costs, and management effort so investors can make informed decisions and build stronger, more balanced real estate portfolios.

Return Comparison Between REITs and Physical Property

REITs vs Physical Property Returns is a key comparison for investors who want to understand how income, growth, and market behavior differ between these two real estate options. Both approaches can generate solid returns, but they work in different ways. Comparing income stability, long-term growth, and volatility helps investors decide which option better suits their financial goals.

Income Stability and Consistency: When comparing REITs vs Physical Property Returns, income stability is an important factor. REITs usually provide regular dividend income because they distribute most of their earnings to investors. This creates predictable cash flow, especially for income-focused investors. Dividends may change, but payments are often consistent. Physical property generates income through rent, which can also be stable if tenants stay long term. However, rental income may stop during vacancies or late payments. In terms of steady income, REITs vs Physical Property Returns often favor REITs for consistency and physical property for higher but less predictable cash flow.

Growth Potential and Long-Term Returns: Long-term growth is another major point in REITs vs Physical Property Returns. REITs can grow through rising property values, rent increases, and portfolio expansion. Investors benefit from both dividends and share price appreciation. Physical property offers growth mainly through property appreciation and rent increases over time. Owners can also increase value through renovations and improvements. Historically, both options have delivered strong long-term returns, but physical property may provide higher gains if managed well. In REITs vs Physical Property Returns, growth depends on market conditions and management quality.

Volatility and Market Sensitivity: Volatility plays a big role in REITs vs Physical Property Returns. REIT prices can change daily because they trade on stock markets. This makes them more sensitive to market sentiment and economic news. Physical property values change slowly and are less affected by short-term market swings. However, they are still influenced by local market conditions. Overall, REITs vs Physical Property Returns shows that REITs are more liquid but volatile, while physical property is stable but less flexible.

Costs and Expenses That Affect Returns

Costs strongly influence REITs vs Physical Property Returns, as expenses directly reduce net income. Understanding fees, taxes, and management costs helps investors calculate real profitability. Both options have different cost structures that impact overall returns.

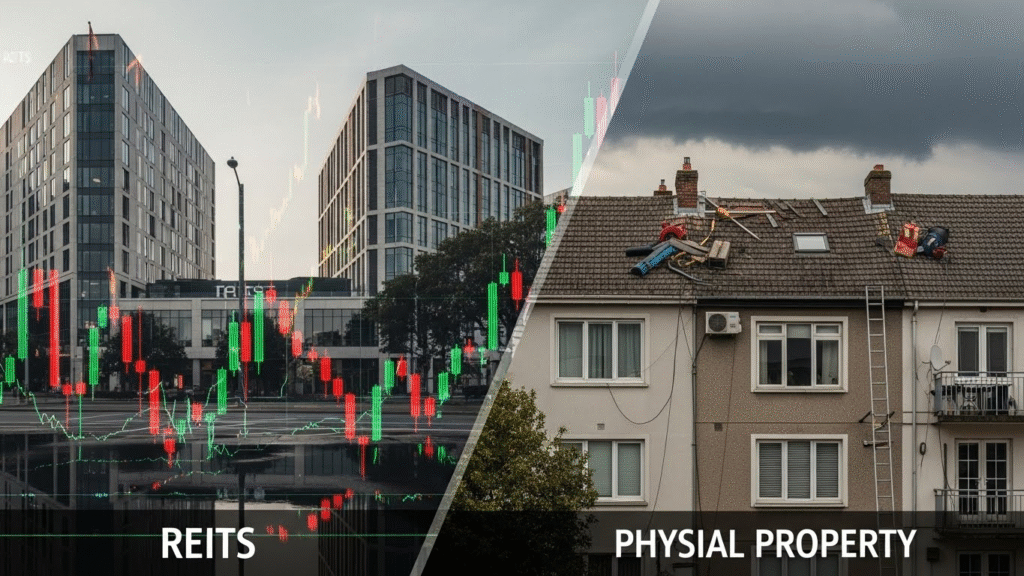

Fees and Expenses in REIT Investments: In REITs vs Physical Property Returns, REIT investors face management fees and operating expenses that are deducted before dividends are paid. These fees cover property management, administration, and financing costs. Investors do not pay directly, but fees reduce overall returns. Some REITs have higher expense ratios, which can limit income growth. However, REIT investors avoid repair costs and daily management expenses. This makes REITs vs Physical Property Returns attractive for passive investors despite ongoing fees.

Maintenance, Taxes, and Management Costs in Physical Property: Physical property owners face direct costs that affect REITs vs Physical Property Returns. These include maintenance, repairs, property taxes, insurance, and management fees if a property manager is hired. Unexpected repairs can reduce income significantly. Vacancy periods also increase costs without income. However, owners may deduct some expenses for tax purposes. In REITs vs Physical Property Returns, physical property offers control but comes with higher responsibility and cost uncertainty.

Impact of Costs on Net Returns: Net returns are the true measure in REITs vs Physical Property Returns. REITs offer predictable expenses and stable dividends, making net returns easier to estimate. Physical property returns vary based on management skill and unexpected costs. While physical property may produce higher gross income, net returns can shrink due to expenses. Understanding total costs helps investors choose wisely in REITs vs Physical Property Returns.

Risk Factors in REITs and Physical Property

Risk analysis is essential when comparing REITs vs Physical Property Returns. Each option faces different types of risks related to markets, tenants, and interest rates. Managing these risks helps protect long-term returns.

Market Risks and Economic Cycles: Economic conditions affect REITs vs Physical Property Returns differently. REITs are closely linked to stock markets, so they react quickly to recessions or market downturns. Share prices may fall even if properties perform well. Physical property values move slowly but can decline during economic slowdowns. Rental demand may also drop. In REITs vs Physical Property Returns, market risk is more visible in REITs and more gradual in physical property.

Vacancy and Tenant Risks: Vacancy risk is a major factor in REITs vs Physical Property Returns. REITs reduce this risk by owning many properties across different locations. One vacancy has little impact. Physical property owners rely on fewer tenants, so vacancy can seriously reduce income. Tenant damage and late payments add further risk. Diversification gives REITs an advantage in REITs vs Physical Property Returns.

Interest Rate Sensitivity: Interest rates strongly influence REITs vs Physical Property Returns. Rising rates can reduce REIT prices because borrowing costs increase and dividends become less attractive. Physical property owners also face higher mortgage costs. However, property owners with fixed-rate loans are less affected. In REITs vs Physical Property Returns, both are sensitive to rates, but REITs react faster.

Tax Treatment and Its Impact on Returns

Tax rules play a major role when comparing REITs vs Physical Property Returns because taxes directly affect how much profit investors keep. Even if gross income looks attractive, tax treatment can significantly change overall results. Understanding how dividends and rental income are taxed helps investors make smarter real estate decisions.

Taxation of REIT Dividends: In REITs vs Physical Property Returns, REIT income mainly comes from dividends. These dividends are usually taxed as regular income rather than capital gains. This means investors may pay higher tax rates depending on their income level. Some regions offer partial tax relief on REIT dividends, but this varies by country. The advantage is simplicity: taxes are straightforward, and investors do not deal with property-related filings. However, higher dividend taxes can reduce net income. When analyzing REITs vs Physical Property Returns, investors must consider after-tax dividend income, not just the payout amount.

Tax Benefits and Deductions in Property Ownership: Physical property ownership offers more tax flexibility in REITs vs Physical Property Returns. Property owners can often deduct expenses such as maintenance, repairs, insurance, management fees, and mortgage interest. Depreciation allows owners to reduce taxable income even when the property is profitable. These deductions can significantly improve after-tax returns. In some cases, capital gains taxes may be lower if the property is held long term. This gives physical property an advantage in REITs vs Physical Property Returns for investors who actively manage taxes.

How Taxes Change Overall Profitability? Taxes can shift the final outcome in REITs vs Physical Property Returns. REITs provide easy income but may lose value after taxes. Physical property requires more effort but can deliver stronger after-tax profits through deductions and long-term tax strategies. Investors who ignore tax impact may overestimate returns. A clear tax plan helps maximize real income in REITs vs Physical Property Returns and supports long-term wealth building.

Liquidity and Investment Flexibility

Liquidity and flexibility are critical factors in REITs vs Physical Property Returns, especially for investors who want easy access to their money. The ability to buy, sell, or rebalance investments can strongly influence portfolio performance and risk management.

Ease of Entry and Exit for REIT Investors: One major advantage in REITs vs Physical Property Returns is liquidity. REITs are traded on stock markets, allowing investors to buy or sell shares quickly. This makes entry easy, even with small amounts of capital. Investors can exit their position within minutes during market hours. This flexibility supports active portfolio management and quick response to market changes. In REITs vs Physical Property Returns, REITs clearly offer higher liquidity and convenience.

Long-Term Commitment in Physical Property: Physical property requires a long-term mindset in REITs vs Physical Property Returns. Buying or selling property takes time, paperwork, and transaction costs. Investors cannot exit quickly during market changes. This lack of liquidity can be risky in emergencies. However, long holding periods allow property values to grow steadily. In REITs vs Physical Property Returns, physical property suits investors comfortable with long-term commitments.

Flexibility for Portfolio Rebalancing: Portfolio flexibility differs greatly in REITs vs Physical Property Returns. REIT investors can rebalance easily by adjusting share quantities. Physical property investors cannot partially sell assets. While REITs allow better diversification and quick adjustments, property offers stability. Smart investors balance both in REITs vs Physical Property Returns.

Which Option Suits Different Investor Profiles

Choosing between REITs vs Physical Property Returns depends heavily on investor personality, goals, and resources. There is no single best option. Each suits different profiles based on involvement level, income needs, and risk tolerance.

Passive Investors vs Hands-On Investors: Passive investors usually prefer REITs vs Physical Property Returns that require minimal effort. REITs provide income without management duties. Hands-on investors enjoy managing tenants, repairs, and upgrades. Physical property suits those willing to be involved daily. In REITs vs Physical Property Returns, effort level is a key decision factor.

Short-Term Income Seekers vs Long-Term Growth Investors: Income-focused investors often favor REIT dividends in REITs vs Physical Property Returns. Growth-focused investors may choose physical property for appreciation. REITs offer quick income, while property rewards patience. Understanding time horizon is essential in REITs vs Physical Property Returns.

Risk Tolerance and Capital Availability: Risk tolerance shapes outcomes in REITs vs Physical Property Returns. REITs fluctuate with markets but need less capital. Physical property requires more funds but offers stability. Matching capital and comfort level ensures better results in REITs vs Physical Property Returns.

Conclusion

Choosing between REITs and physical property depends on your investment goals, time commitment, and risk tolerance. REITs offer simplicity, steady income, and easy buying or selling, making them suitable for investors who prefer a hands-off approach. Physical property provides control, tax advantages, and long-term appreciation but requires active management and higher upfront costs. Both options can deliver strong returns when used wisely. Smart investors often combine both to balance income, growth, and risk. Understanding returns, costs, taxes, liquidity, and risks helps you make better decisions and build a more stable and diversified real estate portfolio over time.

FAQs

Is real estate better than stocks for long-term investing?

Real estate and stocks both offer long-term growth, but they serve different purposes. Real estate can provide stable income, inflation protection, and asset-backed security. Stocks may offer higher growth potential and easier diversification. The better option depends on your financial goals, risk tolerance, and investment timeline. Many investors choose a mix of both to balance growth and stability while reducing overall risk.

How much money do I need to start real estate investing?

The amount needed depends on the type of investment. Some options require large capital for down payments and setup costs, while others allow smaller investments through pooled or market-based structures. Starting small is possible, especially for beginners. It’s important to also keep extra funds for emergencies, fees, and unexpected expenses to avoid financial stress.

Can real estate investments provide passive income?

Yes, many real estate investments can generate passive income, but the level of involvement varies. Some require active management, such as handling tenants and maintenance, while others are more hands-off. Passive income options are popular for investors seeking regular cash flow without daily involvement. Choosing the right structure helps match income goals with available time and effort.

How does inflation affect real estate investments?

Real estate often performs well during inflation because property values and rental income tend to rise with higher prices. This can help protect purchasing power over time. However, inflation can also increase costs such as maintenance, taxes, and financing. Investors should consider both benefits and challenges when using real estate as an inflation hedge.

Should beginners invest alone or with partners?

Beginners can benefit from partnering with others to reduce risk, share costs, and gain experience. Partnerships allow access to larger opportunities and shared responsibilities. However, clear agreements and trust are essential to avoid conflicts. Investing alone provides full control but requires more capital and effort. The best choice depends on financial capacity, experience, and comfort with shared decision-making.