Robo advisor investing is a modern approach to managing your money using automated digital platforms. These platforms use smart algorithms to create and manage investment portfolios based on your financial goals, risk tolerance, and time horizon. Unlike traditional financial advisors, robo advisors offer low-cost, efficient, and personalized investment solutions, making it easier for beginners and busy investors to grow their wealth.

In this guide, we will explain how robo advisor investing works, the benefits it offers, and tips to choose the right platform for your needs. By understanding these tools, you can make informed decisions and achieve smarter financial growth.

How Robo Advisors Work?

Robo advisor investing works by using smart technology to help manage your investments automatically. These platforms are designed to make investing simple and accessible, even if you do not have experience with the stock market. Robo advisors collect information about your financial situation, goals, and risk tolerance through an online questionnaire. This information helps the system build a personalized investment plan that matches your needs.

One key feature of robo advisor investing is algorithm-based portfolio management. The algorithm studies your financial goals and spreads your money across different types of investments, such as stocks, bonds, and ETFs. The goal is to maximize returns while minimizing risks. Algorithms can also adjust your investments automatically as market conditions change. This means you do not need to spend hours monitoring your portfolio or worrying about market fluctuations.

Robo advisors also focus on risk assessment and goal setting. When you start using a robo advisor, you answer questions about your financial goals, like saving for retirement, buying a house, or building an emergency fund. You also indicate how much risk you are willing to take. Based on this, the robo advisor suggests an investment plan that balances growth and safety. This makes it easier for beginners to invest confidently without making emotional decisions during market ups and downs.

Another important aspect is automatic rebalancing and tax optimization. Over time, some investments may grow faster than others, causing your portfolio to drift from the original plan. Robo advisors automatically adjust your investments to maintain the right balance. Some platforms also use tax-loss harvesting strategies to reduce your tax burden, which can improve your overall returns.

Benefits of Robo Advisor Investing

Robo advisor investing provides several benefits for both new and experienced investors. One of the biggest advantages is low-cost investment management. Traditional financial advisors often charge high fees, sometimes a percentage of your total investments every year. Robo advisors usually charge much less, often below 1% annually. This means more of your money stays invested and grows over time. Lower fees make investing accessible for people who do not have a large portfolio but still want professional guidance.

Another benefit of robo advisor investing is accessibility for beginner investors. Many people avoid investing because they feel it is too complicated. Robo advisors simplify the process. You do not need deep knowledge of the stock market or complicated financial strategies. With a few clicks, you can start investing based on your goals and risk tolerance. This opens the door for more people to grow their wealth over time.

Types of Robo Advisors

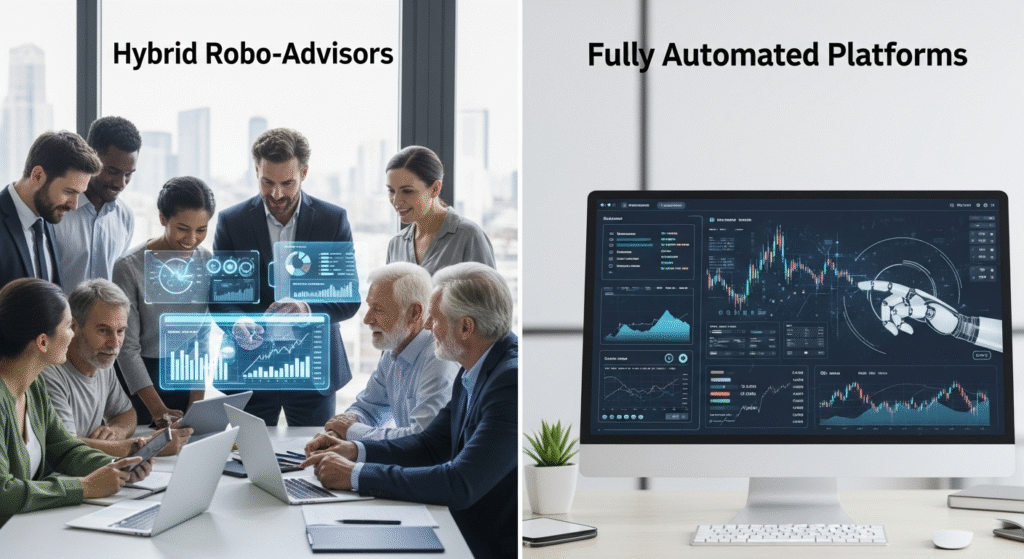

Robo advisor investing has grown rapidly in recent years, offering different types of platforms to meet the needs of various investors. Understanding these types can help you choose the right platform that fits your financial goals, risk tolerance, and level of involvement. In general, robo advisors can be divided into three main categories: fully automated platforms, hybrid robo advisors, and specialty robo advisors.

Fully automated platforms are the most common type of robo advisor investing. These platforms use algorithms to manage your investments entirely without human intervention. When you start, you answer questions about your financial goals, risk tolerance, and investment horizon. The platform then creates a personalized portfolio and handles everything automatically, including rebalancing, tax-loss harvesting, and monitoring market conditions. Fully automated robo-advisors are ideal for beginner investors or those who want a hands-off approach. They offer low fees and convenience because you do not need to meet with a financial advisor or actively manage your portfolio. Some popular examples of fully automated platforms include Betterment, Wealthfront, and SoFi Invest.

Hybrid robo advisors combine robo advisor investing with limited human support. These platforms use algorithms to manage your portfolio automatically, just like fully automated platforms. However, they also allow access to professional financial advisors for guidance. This is helpful for investors who want the efficiency of automation but also value expert advice for complex financial situations. Hybrid robo advisors often provide personalized planning for retirement, education funding, or tax strategies while keeping fees lower than traditional financial advisors. Examples of hybrid platforms include Vanguard Personal Advisor Services and Schwab Intelligent Portfolios Premium.

Specialty robo advisors are designed for specific financial goals or types of investments. These platforms focus on areas such as retirement planning, socially responsible investing (ESG), or high-risk growth portfolios. For instance, some robo advisors only invest in sustainable companies or funds that prioritize environmental, social, and governance factors. Others focus on helping investors build retirement portfolios with features like target-date funds or guaranteed income strategies. Specialty platforms allow you to align your investments with personal values or specific long-term goals while still benefiting from robo advisor investing automation.

Factors to Consider Before Choosing a Robo Advisor

Robo advisor investing has become a popular way to manage money, but not all platforms are the same. When choosing a robo advisor, there are several important factors to consider to ensure your investments are safe and effective.

Fees and commissions are a key factor. Some robo advisors charge a small percentage of your total assets, while others may have flat monthly fees. Low fees are important because high costs can reduce your overall returns over time. Robo Advisor Investing is generally cheaper than traditional advisors, but it is still wise to compare costs before committing.

Investment options and portfolio customization are also important. Different robo advisors offer various types of assets such as stocks, bonds, ETFs, or socially responsible investments. Some platforms allow you to customize your portfolio based on personal goals or risk tolerance, while others use preset options. Choosing a platform that matches your needs ensures better control over your investments.

Security and privacy features are crucial. Since robo advisors work online, it is important to check if the platform uses encryption, two-factor authentication, and secure servers. Protecting your personal and financial information is essential in robo advisor investing.

Customer support and platform usability matter as well. Some investors may need help with technical issues or questions about their portfolio. A user-friendly interface and responsive customer service make investing easier and more efficient.

Robo Advisor Investing vs Traditional Financial Advisors

Robo advisor investing and traditional financial advisors both help manage money, but they differ in cost, personalization, and investor suitability. Understanding these differences helps you decide which option is best for your financial goals.

Cost comparison is the most obvious difference. Traditional financial advisors often charge higher fees, usually a percentage of your total assets, plus additional fees for complex planning. Robo Advisor Investing platforms generally have much lower fees, often under 1% annually, making them more affordable for beginners or those with smaller portfolios.

Level of personalization is another factor. Traditional advisors can provide tailored financial plans and advice for complex situations, including tax strategies and estate planning. Robo advisor investing relies on algorithms to customize portfolios based on your goals and risk tolerance, but it may not offer the depth of human advice. Hybrid robo advisors combine both approaches.

Suitability for different investor types is also important. Robo advisor investing works well for beginners, tech-savvy investors, and those seeking a hands-off approach. Traditional advisors may be better for high-net-worth individuals, people with complex financial situations, or those who prefer personal interaction.

Future Trends in Robo Advisor Investing

Robo advisor investing continues to evolve, driven by technological advancements and changing investor preferences. Understanding future trends can help you stay ahead and make better investment decisions.

AI advancements and smarter algorithms are shaping the future of robo advisors. Artificial intelligence can now analyze large amounts of financial data, predict market trends, and make faster, more accurate investment decisions. These improvements make Robo advisor investing more efficient, helping investors maximize returns while managing risks.

Integration with banking and fintech services is another trend. Many robo advisors are now linked to checking accounts, savings accounts, and other financial tools. This allows users to view all their finances in one place, making investing easier and more convenient. Such integration improves the overall user experience in robo advisor investing.

Growing popularity among millennials and Gen Z is also driving innovation. Younger investors prefer digital, automated solutions that are accessible via apps and mobile devices. As these generations continue to adopt robo advisor investing, platforms are developing more user-friendly interfaces, lower fees, and socially responsible investment options to attract new users.

Conclusion

Robo advisor investing is a convenient and affordable way to grow your wealth. These platforms use smart algorithms to manage investments automatically, saving time and reducing errors. With different types of robo advisors, from fully automated to hybrid and specialty platforms, there is a solution for every investor. Choosing the right platform depends on factors like fees, investment options, security, and personal goals. As technology improves and more people adopt digital investing, robo advisors will continue to offer smarter, safer, and more accessible investment solutions. Start exploring robo advisors to make investing simple and effective.

FAQs

How much money do I need to start with a robo advisor?

Most robo advisors allow you to start with a small amount, sometimes as little as $100. Some platforms have higher minimums, but generally, you can begin investing even with limited funds. Robo Advisor Investing is designed to make investing accessible to beginners. Starting small helps you learn about investing, grow your portfolio over time, and take advantage of automatic rebalancing and other features. Consistent contributions matter more than the starting amount.

Can I withdraw money anytime from a robo advisor account?

Yes, most robo advisor accounts allow you to withdraw money whenever you need it. However, some investments may take a few days to sell, depending on market conditions. Robo Advisor Investing is flexible, giving you access to your funds while still growing your portfolio. Keep in mind that withdrawing frequently may affect long-term growth. Planning withdrawals carefully can help you maximize returns and achieve your financial goals without penalties or delays.

Are robo advisors safe for my money?

Robo advisors use advanced security measures like encryption and two-factor authentication to protect your accounts. Most are regulated by financial authorities, which ensures safety and compliance. Robo Advisor Investing reduces the risk of human error, but market risks still exist. Diversified portfolios and automated rebalancing help manage these risks. Always choose a reputable platform, monitor your investments, and follow best practices for online security to keep your money safe while benefiting from automation.

Do I need financial knowledge to use a robo advisor?

No, you do not need extensive financial knowledge. Robo Advisor Investing is designed for beginners and busy investors. Platforms guide you through simple questions about your goals and risk tolerance, then automatically create and manage a portfolio. While basic understanding of investing helps, the platform handles most tasks, including rebalancing and tax optimization. This makes it easy for anyone to start investing, save time, and grow wealth without deep knowledge of financial markets.