Budgeting planning is more important than ever in 2025. With inflation, rising living costs, and financial uncertainty affecting households worldwide, many people feel the pressure on their wallets. Without a clear strategy, it’s easy to overspend, fall behind on bills, or struggle to save for the future. That’s why having a smart plan isn’t just helpful—it’s essential.

This guide will share actionable strategies to make budgeting easier and more effective. From setting financial goals to using modern tools, you’ll learn how to save more, reduce stress, and build lasting stability. Small changes in planning today can lead to big financial security tomorrow.

Why Smart Budgeting is Important?

Smart budgeting planning is the foundation of financial freedom in 2025. Rising costs of food, housing, and everyday essentials have made it harder for people to manage money without a plan. Budgeting gives you control by helping you track income, cut unnecessary spending, and allocate funds where they matter most. Instead of living paycheck to paycheck, budgeting planning allows you to set aside money for savings, emergencies, and long-term goals.

Another major benefit is reduced financial stress. Many people worry about bills or debt because they don’t have a clear picture of their finances. Smart budgeting planning solves this problem by showing exactly where your money goes and where you can adjust. This clarity turns anxiety into confidence.

Most importantly, budgeting planning helps you make smarter decisions for the future. Whether it’s buying a home, funding education, or preparing for retirement, a well-structured budget gives you the roadmap to reach those milestones. With financial uncertainty in today’s world, planning is not just helpful—it’s a must-have strategy.

Establish Clear Financial Goals

Budgeting planning works best when paired with clear financial goals. Goals provide direction and make it easier to prioritize spending. Without them, money often gets wasted on impulse purchases instead of meaningful savings. In 2025, people face more financial challenges, making it critical to define short-term and long-term targets.

Short-term goals might include paying off monthly bills, clearing small debts, or saving for a vacation. Long-term goals could be buying a home, building retirement savings, or starting a business. When you separate goals into these categories, budgeting planning becomes more structured and achievable.

The biggest advantage of setting goals is how they shape spending habits. Instead of asking, “Can I afford this right now?” you start asking, “Does this align with my financial plan?” This mindset keeps you focused on what truly matters.

Use the Best Budgeting Tools

Technology has transformed budgeting planning into a much simpler and more effective process. Gone are the days of manual notebooks and guesswork. Today, apps, spreadsheets, and automation can track every transaction, send reminders, and provide insights instantly.

Budgeting apps like Mint or YNAB make it easy to connect bank accounts, categorize expenses, and visualize where money is going. Spreadsheets are still powerful for people who prefer customization and manual control. Automation is another game changer in 2025—automatic savings transfers, bill reminders, and subscription tracking reduce human error and encourage consistency.

The main benefit of using budgeting planning tools is accuracy and time savings. Instead of feeling overwhelmed, you can quickly see your financial health with one glance. Many tools also provide tips to cut costs or highlight hidden expenses you may overlook.

Top Budgeting Tools Comparison

When it comes to budgeting planning, having the right tool can make all the difference. Choosing the best tool depends on your financial style, whether you like automation, customization, or simplicity. Below is a quick comparison to help:

| Tool | Best For | Key Features | Cost |

|---|---|---|---|

| Mint | Beginners and casual users | Tracks expenses, bills, credit score monitoring, goal setting | Free (ads supported) |

| YNAB | Serious budgeters, debt payoff | Zero-based budgeting, goal tracking, debt payoff tools, real-time syncing | $14.99/month or $99/year |

| EveryDollar | Goal-based budgeting | Custom categories, debt tracker, Ramsey baby steps | Free basic, $12.99/month Premium |

| PocketGuard | Overspending control | Shows spendable money after bills & savings, subscription tracking | Free basic, $7.99/month Plus |

| Goodbudget | Couples & shared budgets | Envelope system, sync across devices, debt payoff tracking | Free basic, $8/month Plus |

| Personal Capital | Investors & savers | Budgeting + investment tracking, retirement planning, net worth calculator | Free, paid advisory services |

Understanding Income and Expenses

A key part of budgeting planning is fully understanding your income and expenses. Many people only think about their salary as income, but in reality, income can come from many sources. This may include wages, side hustles, rental income, dividends, or freelance projects. When you track all sources, you have a complete picture of how much money flows into your life every month.

Once income is clear, the next step is to understand expenses. Expenses generally fall into three categories: fixed, variable, and discretionary. Fixed expenses are the same each month, such as rent, mortgage, or insurance. Variable expenses change monthly, like groceries, utilities, or fuel. Discretionary expenses are wants, such as dining out, shopping, or entertainment. By separating your expenses this way, budgeting planning becomes more organized and easier to manage.

When you see how money moves in and out, it becomes clear where adjustments can be made. For example, you can’t always reduce fixed expenses quickly, but you can manage variable and discretionary costs. This clarity is powerful—it shows you where savings opportunities exist and how to avoid unnecessary financial stress.

Prioritize Saving and Investing

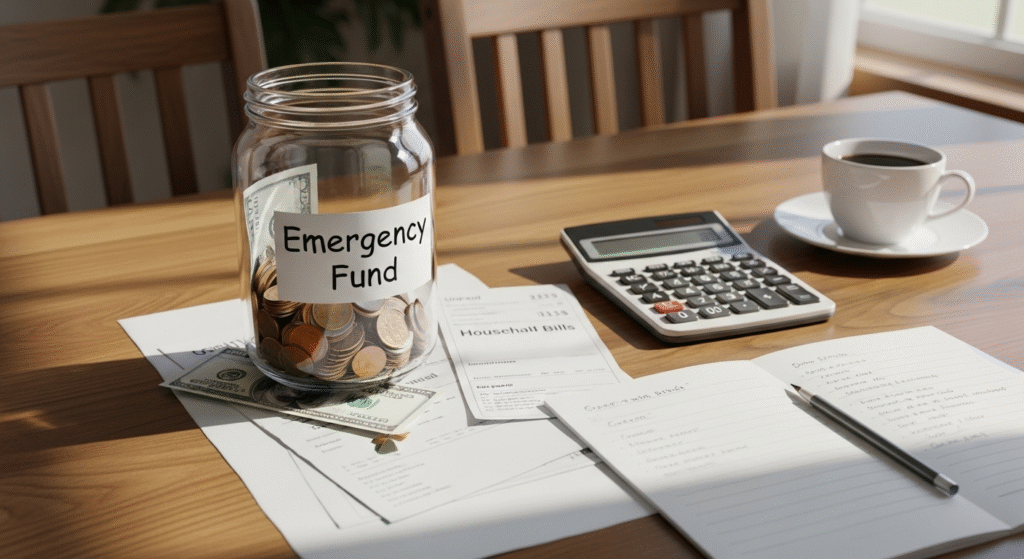

Another critical part of budgeting planning is learning to prioritize saving and investing. Many people wait until the end of the month to see what’s left over, but often nothing remains. The best method is the “pay yourself first” strategy, where you set aside money for savings and investments before spending on anything else.

The first saving priority should be an emergency fund. Life is unpredictable, and expenses like medical bills, car repairs, or job changes can arrive without warning. Budgeting planning helps you prepare by keeping at least three to six months of expenses saved. This emergency fund reduces stress and prevents reliance on credit cards or loans during tough times.

Once an emergency fund is secure, start simple investments. Even small amounts invested consistently can grow over time. Options like retirement accounts, index funds, or beginner-friendly apps make investing easier in 2025. The earlier you start, the more your money benefits from compounding growth.

Manage Debt Strategically

Debt management is one of the most important areas of budgeting planning. Carrying too much debt can drain your finances, especially if interest rates are high. Instead of ignoring it, the key is to manage debt with a clear repayment strategy. Two popular methods are the snowball method and the avalanche method.

With the snowball method, you focus on paying off the smallest debt first while making minimum payments on others. Each time you eliminate a balance, you gain motivation to keep going. The avalanche method, on the other hand, focuses on paying off the debt with the highest interest rate first. This saves more money over time by reducing interest costs.

Both strategies work, and the choice depends on your personality. If you need quick wins for motivation, snowball may be better. If you want to maximize savings, avalanche could be the smarter choice.

Budgeting planning also helps reduce debt by identifying areas to cut expenses. Extra money saved each month can go toward faster debt payoff. Reducing high-interest debt not only frees up cash flow but also improves long-term financial stability.

Do Not Forget About Taxes

Taxes are often overlooked in budgeting planning, but they play a major role in financial health. Failing to prepare for taxes can lead to unexpected bills and unnecessary stress. By planning ahead, you can avoid surprises and even find opportunities to save money.

The first step is to include taxes in your budget. If you’re self-employed, freelancing, or earning side income, set aside a portion of your earnings for tax payments. Budgeting planning ensures you always have funds ready when deadlines arrive. For employees, understanding your paycheck deductions is just as important so you can adjust withholding if needed.

Beyond paying taxes, there are also ways to save. Taking advantage of tax deductions, credits, and retirement contributions can reduce your taxable income. For example, contributing to retirement accounts or health savings accounts can provide benefits now and in the future.

Prepare for Unexpected Expenses

A key part of budgeting planning is preparing for unexpected expenses. Life can change quickly, and emergencies often come without warning. Medical bills, sudden car repairs, home maintenance issues, or even losing a job can put serious pressure on your finances. Without preparation, these moments can lead to stress and force you to borrow money at high interest.

That is why having an emergency cushion is essential. In budgeting planning, experts recommend setting aside three to six months of living costs. This fund should cover basics like rent, food, utilities, and transportation. By building this safety net, you avoid falling into debt when challenges appear.

Another way budgeting planning helps is by identifying irregular but expected costs. For example, annual insurance payments, school fees, or holiday expenses are not emergencies, but they often surprise people who don’t plan ahead. Setting aside a small amount monthly makes these bills easier to handle when they arrive.

Maximize Your Paycheck

Budgeting planning is not just about cutting costs—it’s also about making the most of the money you earn. Many people focus only on expenses but forget that increasing take-home pay can be just as powerful for saving more.

Start with your salary. In budgeting planning, negotiating pay is a smart move. If you’ve gained new skills, experience, or responsibilities, ask for a raise or explore better opportunities. Even small increases add up over time. Benefits also matter—health insurance, retirement contributions, and professional perks can save you money in the long run.

Next, look at your paycheck deductions. Sometimes, unnecessary deductions lower your take-home pay. Review retirement contributions, insurance add-ons, or flexible spending accounts to ensure they align with your financial goals. Adjusting them can increase what you bring home each month.

Cut Unnecessary Expenses Without Sacrificing Comfort

Budgeting planning is most effective when you cut expenses that don’t add real value to your life. Often, people waste money on things they barely notice, like unused subscriptions, forgotten memberships, or frequent impulse buys. Identifying these leaks helps free up money without reducing your comfort.

Start by reviewing your bank statements. Look for recurring charges from streaming services, gym memberships, or apps you no longer use. Canceling or pausing them can save a surprising amount each month. Budgeting planning is about making conscious choices—if you’re not using something, it shouldn’t drain your budget.

Smart swaps are another helpful strategy. Instead of dining out daily, cooking at home a few times a week saves money and can be healthier. Choosing generic brands, doing simple DIY repairs, or borrowing instead of buying can also lower costs without lowering your quality of life.

Automate Your Finances

Budgeting planning becomes much easier when you use automation. In today’s busy world, it’s common to forget due dates or skip savings goals, which can cost you in late fees and missed opportunities. By setting up automatic payments and transfers, you remove the risk of human error and make money management effortless.

Start with your bills. Automating utility payments, rent, and subscriptions ensures you never face late charges. Most banks and service providers let you set recurring payments, so you can stop worrying about due dates. This also helps protect your credit score, since on-time payments are a big factor in keeping it strong.

Next, automate your savings. One of the best budgeting planning strategies is to “pay yourself first.” Arrange auto-transfers from your paycheck or checking account into your savings or investment accounts. Even small amounts saved consistently add up over time. Automation removes temptation since the money is moved before you have a chance to spend it.

Automation can also help with debt repayment. Setting up fixed payments toward credit cards or loans ensures you’re steadily reducing your balances. You can even schedule extra payments when possible to save on interest.

Involve Your Family in Budgeting

Budgeting planning works best when it’s not just a solo effort but a family practice. Money affects everyone in the household, and involving your family ensures that everyone understands and supports the financial goals. Open discussions about money can also reduce conflicts and build stronger financial habits for the future.

Start with family meetings. Share your budget, income, and expenses in simple terms so everyone knows where money goes. When your spouse, partner, or kids understand the reasons behind financial decisions, they’re more likely to cooperate with spending limits. This prevents unnecessary arguments and builds teamwork.

Teaching kids about money early is another powerful step. Simple lessons like saving a portion of their allowance, comparing prices, or waiting before making purchases can build lifelong financial skills. Kids learn more from what they see at home, so modeling smart money behavior matters.

Budgeting planning as a family also helps with accountability. For example, if you’re cutting back on dining out, the whole family can contribute by suggesting fun and affordable alternatives. If saving for a vacation, involve kids by showing them how their small efforts (like skipping a toy) help reach the family goal faster.

Monitor Your Credit Score

Budgeting planning isn’t just about managing daily spending—it’s also about building long-term financial health. A major part of this is monitoring and improving your credit score. Your credit score impacts many areas of life, from getting a loan to renting an apartment or even securing lower insurance rates.

A strong credit score saves you money. For example, if you apply for a mortgage, a higher score usually means lower interest rates, which could save thousands over time. On the other hand, a weak score can cost you more in fees and limit financial opportunities. That’s why keeping track of your credit health is essential in 2025.

Thankfully, monitoring your credit score has never been easier. Many banks, apps, and online tools now offer free credit score checks. Reviewing it regularly helps you spot errors early, such as incorrect balances or unauthorized accounts. Fixing these quickly can prevent damage to your financial reputation.

Conclusion

Smart budgeting planning in 2025 is about more than tracking numbers—it’s about creating peace of mind and financial freedom. By automating payments, involving your family, and monitoring your credit score, you set yourself up for success while reducing stress. Each small habit builds momentum and keeps you moving toward long-term goals. Remember, you don’t need to master everything at once. Start with one simple strategy, like automating savings or reviewing your credit score, and build from there. Budgeting planning is a journey, and progress matters more than perfection. Take the first step today—create your personalized 2025 budget plan and gain control over your money and your future.

FAQs

What is the first step in budgeting planning if I’ve never done it before?

The first step is to get a clear picture of your income and expenses. Write down all sources of money coming in and track where every dollar goes for at least a month. Once you see your spending habits, it becomes easier to make adjustments. Many people are surprised to find small areas of waste, like unused subscriptions or daily coffee runs. Awareness is the foundation of effective budgeting planning.

How much should I save from each paycheck in 2025?

A good rule of thumb is to save at least 20% of your income if possible. However, with rising living costs in 2025, even saving 5–10% consistently is valuable. Start small and increase your savings percentage whenever you get a raise or reduce expenses. The key is consistency, not perfection. Even small savings can grow into a strong financial cushion over time.

Should I use apps or spreadsheets for budgeting planning?

It depends on your preference. Apps are convenient and often connect directly to your bank accounts, making tracking effortless. Spreadsheets give you more control and customization if you enjoy hands-on planning. Some people use both: apps for tracking and spreadsheets for long-term planning. The best tool is the one you’ll use consistently.

What if my income changes often, like with freelancing or gig work?

If your income varies, budgeting planning becomes even more important. Start by calculating your average monthly income over the past six months. Then, budget based on a conservative figure to avoid overspending. Build a larger emergency fund to handle low-income months. This way, fluctuations won’t derail your financial goals.