Budgeting tips are essential for salaried employees who want to manage their monthly income wisely and avoid financial stress. A fixed salary may feel secure, but rising living costs and unexpected expenses can make money management difficult. With the right planning, it becomes easier to control spending, save regularly, and meet both short-term and long-term goals.

Budgeting tips help you understand where your money goes and how to use it more effectively. In this guide, you will learn simple and practical ways to plan expenses, prioritize savings, and stay prepared for emergencies. These strategies are easy to follow and designed to fit everyday life, helping salaried individuals build financial stability with confidence.

Creating a Realistic Monthly Budget Plan

Creating a realistic monthly budget plan is the foundation of strong financial control for salaried employees. One of the most important budgeting tips is to clearly list your monthly income after tax and deductions. This gives you a true picture of how much money you can spend. Once income is clear, divide expenses into categories such as rent, utilities, groceries, transport, savings, and personal spending. Setting spending limits for each category helps prevent careless use of money and keeps expenses under control.

Another essential budgeting tip is balancing needs and wants. Needs include rent, food, bills, and transport, while wants include dining out, shopping, and entertainment. A realistic budget does not remove enjoyment from life but keeps wants within limits. By controlling non-essential spending, you can reduce financial stress and avoid end-of-month shortages.

Adjusting the budget according to income level is also crucial. Salaried employees often have a fixed income, so expenses must match earnings. If income is limited, budgeting tips suggest focusing more on essential expenses and savings while cutting unnecessary costs. If income increases due to bonuses or raises, the budget should be updated to improve savings and investments rather than increasing lifestyle expenses immediately.

Flexibility is another important factor. Unexpected costs like medical bills or repairs can appear anytime. Including a small buffer amount in your budget allows better adjustment. Regular review of your budget ensures it stays realistic and practical. Overall, following structured budgeting tips helps create a monthly plan that is simple, achievable, and suitable for long-term financial stability.

Prioritizing Savings Before Spending

Prioritizing savings before spending is one of the most powerful budgeting tips for salaried employees. This approach is often called “paying yourself first.” It means setting aside a fixed amount for savings as soon as your salary is received, before spending on other things. This habit ensures savings are not forgotten or delayed due to unnecessary expenses.

An emergency fund is a key part of this strategy. One of the most important budgeting tips is to build an emergency fund that covers at least three to six months of expenses. This fund protects salaried employees from job loss, medical emergencies, or unexpected bills. By saving a small amount regularly, even limited income earners can slowly build financial security.

Consistency is more important than the amount saved. Effective budgeting tips encourage setting a realistic savings target that can be maintained every month. Automatic transfers to savings accounts can help make this process easy and stress-free. When savings are automated, there is less temptation to spend the money elsewhere.

Another useful approach is dividing savings into goals, such as short-term savings, emergency funds, and long-term investments. This keeps motivation strong and makes saving more meaningful. Reviewing savings progress monthly helps identify areas for improvement.

Managing Variable and Lifestyle Expenses

Managing variable and lifestyle expenses is one of the most challenging areas of personal finance. These expenses include food, entertainment, shopping, and social activities. One of the most effective budgeting tips is to set clear limits for these categories. Without limits, small daily expenses can silently damage the monthly budget.

Tracking daily expenses is another important step. Writing down every expense or using a budgeting app helps identify spending patterns. Many budgeting tips recommend reviewing spending weekly to understand where money is being wasted. Awareness alone can significantly reduce unnecessary spending.

Food and entertainment costs can be controlled through simple changes. Cooking at home, planning meals, and limiting dining out are practical budgeting tips that save money without reducing quality of life. Similarly, setting a monthly entertainment budget helps maintain balance while still allowing enjoyment.

Shopping habits also need control. Impulse buying is a major reason budgets fail. One of the smartest Budgeting Tips is to wait before making non-essential purchases. This cooling-off period reduces regret and keeps spending aligned with priorities.

Lifestyle inflation is another common issue for salaried employees. When income increases, expenses often increase too. Applying consistent budgeting tips helps maintain discipline and prevents overspending. By managing variable expenses wisely, salaried employees can stay within budget, increase savings, and maintain long-term financial stability.

Handling Debt and Loan Repayments Wisely

Handling debt carefully is essential for salaried employees who want financial stability. One of the most important budgeting tips is to list all debts clearly, including credit cards, personal loans, and installment plans. Knowing the total outstanding amount, interest rate, and due dates helps create a repayment strategy that fits the monthly income. This clarity prevents missed payments and unnecessary penalties.

Managing credit cards wisely is another key area. High interest rates can quickly increase debt if balances are not paid on time. Budgeting tips suggest paying more than the minimum amount each month to reduce interest burden faster. Using credit cards only for planned expenses and emergencies also helps keep debt under control. Avoiding multiple cards can make tracking and repayment easier.

Avoiding unnecessary borrowing is equally important. One of the smartest budgeting tips is to distinguish between essential and non-essential loans. Borrowing for emergencies or education may be reasonable, but taking loans for lifestyle upgrades often creates long-term stress. Before borrowing, salaried employees should check if their savings can cover the expense instead.

Reducing interest burden should be a priority. Budgeting tips recommend focusing on high-interest debts first, such as credit cards, while paying minimum amounts on lower-interest loans. Refinancing or consolidating loans can also help lower interest costs. Setting aside a fixed repayment amount in the monthly budget ensures consistency.

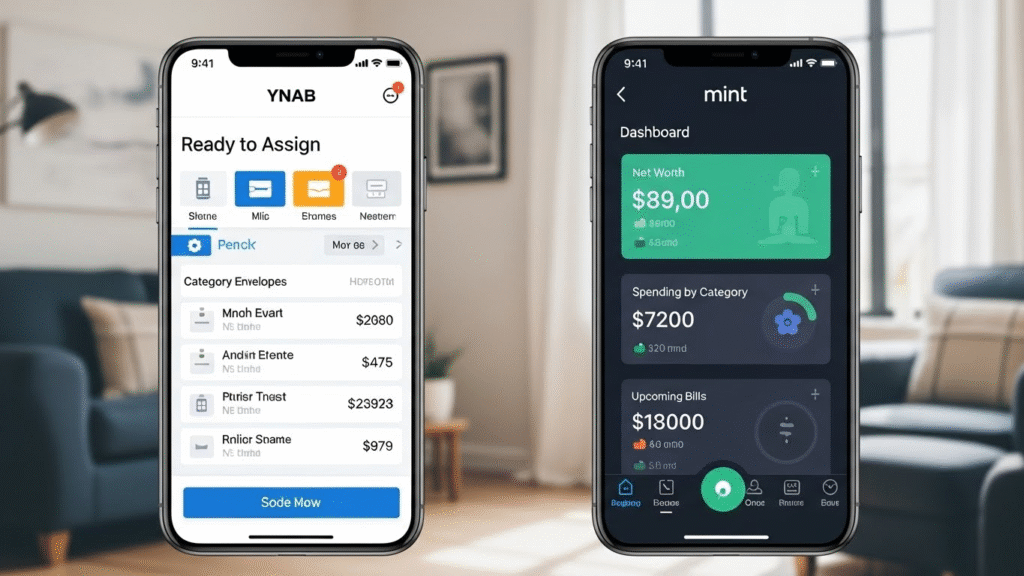

Using Budgeting Tools and Apps

Using budgeting tools and apps makes money management easier and more accurate for salaried employees. One of the most practical budgeting tips is to track income and expenses digitally instead of relying on memory. Budgeting apps automatically record transactions, categorize spending, and provide clear reports, helping users understand where their money goes each month.

Digital tools offer many benefits. They save time, reduce calculation errors, and provide real-time updates on spending. Budgeting tips encourage using apps that send alerts when spending exceeds limits. These alerts help control impulsive purchases and maintain discipline throughout the month.

Budgeting apps also improve consistency. Another helpful budgeting tip approach is linking bank accounts to budgeting tools for automatic tracking. This reduces manual work and ensures accuracy. Visual charts and summaries make it easier to analyze spending patterns and adjust budgets when needed.

Choosing simple tools is important for salaried workers. Budgeting tips suggest selecting apps with easy interfaces and basic features like expense tracking, budget limits, and savings goals. Complex tools with too many options can become confusing and lead to poor usage.

Planning for Emergencies and Irregular Expenses

Planning for emergencies and irregular expenses is a vital part of financial security. One of the most important budgeting tips is to prepare for expenses that do not occur every month, such as medical bills, travel costs, or home repairs. Without planning, these expenses can disturb the entire monthly budget.

Medical emergencies are one of the most common unexpected costs. Budgeting tips recommend setting aside a small amount every month to build a separate emergency fund. This fund reduces stress and prevents the need for loans or credit cards during difficult times. Travel expenses and family events should also be planned in advance whenever possible.

Building a financial buffer is essential. One of the most effective budgeting tips is to aim for an emergency fund that covers at least three months of basic expenses. This buffer protects salaried employees from income disruptions, sudden repairs, or urgent needs. Even small contributions can grow into a strong safety net over time.

Irregular expenses should be estimated and included in the budget. Budgeting tips suggest reviewing past expenses to predict future costs. This makes planning more realistic and reduces surprises. Keeping emergency savings separate from daily spending money also helps maintain discipline.

Conclusion

Smart budgeting helps salaried employees manage their income with confidence and control. By planning monthly expenses, saving regularly, managing debt wisely, and preparing for emergencies, financial stress can be reduced. Simple budgeting habits create clarity and discipline, making it easier to meet daily needs while working toward future goals. Using budgeting tools and reviewing plans regularly ensures better decisions over time. With consistent effort, salaried individuals can improve financial stability, handle unexpected expenses, and build a secure future. A well-structured budget is not about restriction, but about smart choices that support long-term financial well-being.

FAQs

Why do salaried employees struggle with budgeting?

Salaried employees often struggle with budgeting because their income feels fixed and predictable, leading to relaxed spending habits. Monthly expenses, lifestyle costs, and unexpected bills can quietly increase. Without tracking expenses, small daily purchases add up. Many people also delay savings, thinking they will start later. Lack of planning and financial awareness are the main reasons budgeting becomes difficult for salaried individuals.

How often should a monthly budget be reviewed?

A monthly budget should be reviewed at least once every month. Reviewing helps identify overspending, unused budget categories, and changing expenses. It also allows adjustments based on salary changes, price increases, or new financial goals. Regular reviews improve discipline and accuracy. Even a short review can help maintain control and keep financial plans realistic and effective.

Is it necessary to use budgeting apps?

Using budgeting apps is not mandatory, but they make budgeting easier and more accurate. Apps help track expenses automatically, categorize spending, and show clear summaries. They reduce manual work and help users stay consistent. For people who prefer simplicity, a notebook or spreadsheet can also work. The key is consistency, not the tool itself.

How can budgeting help with financial stress?

Budgeting reduces financial stress by giving clarity and control over money. Knowing where income is going removes uncertainty and fear. Planning for expenses and emergencies helps avoid panic during unexpected situations. Budgeting also builds confidence by improving decision-making. When finances are organized, individuals feel more secure and better prepared for future needs.

Can budgeting help achieve long-term financial goals?

Yes, budgeting plays a major role in achieving long-term financial goals. It helps allocate money for savings, investments, and future plans like retirement or education. Regular budgeting builds discipline and consistency. Small monthly savings grow over time, making big goals achievable. A clear budget keeps priorities aligned and ensures steady progress toward financial success.