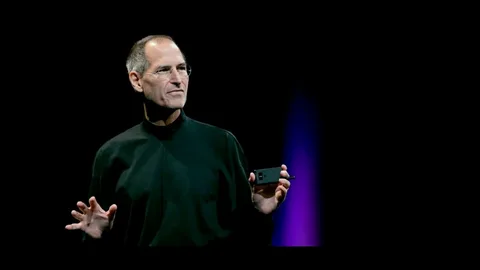

Steve Jobs and Apple represent one of the most powerful success stories in business history. Steve Jobs, the co-founder of Apple, was a visionary leader who believed in combining technology with simple, elegant design. Under his guidance, Apple grew from a small startup into a trillion-dollar company with a loyal global customer base.

Jobs focused on innovation, creativity, and long-term value instead of short-term profits. His philosophy matters for investors and business leaders because it shows how strong leadership, product excellence, and clear vision can build lasting competitive advantages and deliver sustainable growth and long-term shareholder value.

Product Design as a Financial Strategy

Steve Jobs and Apple showed the world that product design is not just about looks but a powerful financial strategy. Steve Jobs believed that simplicity, usability, and premium quality could directly increase a company’s profits. Apple products were designed to be easy to use, visually clean, and emotionally appealing. This focus reduced customer frustration and increased satisfaction, leading to stronger demand and long-term loyalty. For Apple, great design was not an extra cost; it was an investment that produced higher returns.

A key part of this strategy was the deep integration of hardware, software, and services. Steve Jobs and Apple controlled every part of the user experience, from the physical device to the operating system and digital services. This integration allowed Apple to deliver smooth performance and consistent quality that competitors struggled to match. From a financial point of view, this control lowered dependency on third parties and increased efficiency, which supported higher profit margins.

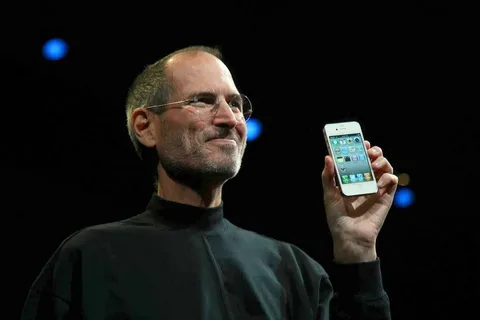

Design-led innovation also gave Apple strong pricing power. While many tech companies competed on low prices, Apple charged premium prices. Customers were willing to pay more because they believed Apple products offered superior value. This pricing power resulted in high gross margins, which attracted long-term investors. Steve Jobs and Apple proved that customers pay for better experiences, not just features.

Superior products also translated into strong revenue growth. Each successful launch, such as the iPod, iPhone, and iPad, created new income streams and expanded Apple’s customer base. Existing customers often upgrade to newer models, generating repeat revenue. Over time, this design-focused strategy helped Apple grow revenues consistently and build one of the strongest financial positions in corporate history.

Branding and Customer Loyalty as Economic Moats

Steve Jobs and Apple understood that branding could become a powerful economic moat. Apple was not marketed as just a technology company; it was positioned as a lifestyle and status brand. From advertising to product packaging, every detail communicated creativity, simplicity, and premium value. This branding strategy made Apple products desirable and different from competitors, protecting the company from price wars.

A strong emotional connection with consumers was central to Apple’s success. Steve Jobs believed people did not just buy products; they bought stories and experiences. Apple customers often felt proud to own Apple devices, which created deep emotional loyalty. This emotional bond reduced customer switching and increased lifetime value, a key metric for long-term investors.

Brand trust played a major role in repeat purchases and ecosystem lock-in. When customers trusted Apple’s quality and innovation, they were more likely to buy multiple Apple products. iPhones, MacBooks, Apple Watches, and services worked best together, making it costly and inconvenient to leave the ecosystem. Steve Jobs and Apple turned this ecosystem into a strong financial advantage by increasing recurring revenue and customer retention.

Visionary Leadership and Long-Term Thinking

Steve Jobs and Apple are closely linked to visionary leadership and long-term thinking. Steve Jobs believed innovation should come before short-term profits. He was willing to invest heavily in research, design, and talent even when returns were uncertain. This mindset helped Apple create breakthrough products that defined entire markets and delivered long-term financial rewards.

One of Jobs’ most important leadership traits was his willingness to disrupt Apple’s own products. Instead of protecting existing revenue streams, he encouraged innovation that replaced older products. The iPhone replaced the iPod, even though the iPod was highly profitable. Steve Jobs and Apple showed that self-disruption is essential for long-term survival and growth in competitive industries.

Strategic product launches were another key element of Jobs’ leadership. Each major launch was carefully timed and supported by clear messaging. These launches often reshaped entire industries, including music, mobile phones, and personal computing. From an investment perspective, these innovations created new revenue categories and expanded Apple’s market reach.

Apple’s Business Model and Revenue Expansion

Steve Jobs and Apple reshaped the traditional technology business model by moving from a single-product company to a complete ecosystem-based revenue structure. In Apple’s early years, the company relied mainly on personal computers. Steve Jobs realized that long-term growth required diversification and deeper customer engagement. His strategy focused on creating products that worked seamlessly together, encouraging users to stay within the Apple ecosystem. This shift reduced revenue risk and increased customer lifetime value, which is highly attractive to investors.

The introduction of the iPod marked the first major step in this transformation. It was followed by the iPhone, iPad, and the App Store, each opening new revenue channels. Steve Jobs and Apple did not simply sell devices; they created platforms. The App Store allowed third-party developers to contribute innovation while Apple earned a share of every transaction. This platform strategy strengthened Apple’s business model and expanded its global reach.

Services revenue became another powerful growth driver. Apple introduced services such as iCloud, Apple Music, and the App Store, generating recurring income streams. These services increased revenue stability and improved margins because digital services require lower costs compared to hardware manufacturing. For investors, recurring revenue improves financial predictability and valuation strength.

Financial resilience through diversification is one of the most important outcomes of this model. Steve Jobs and Apple reduced dependence on any single product or market. Even when hardware sales slow, services and ecosystem upgrades continue to generate income. This diversified structure helped Apple remain strong during economic downturns. It also positioned the company as a long-term compounder, showing how innovation, ecosystem strategy, and smart revenue expansion can create sustainable financial growth.

Competitive Advantage and Market Dominance

Steve Jobs and Apple built one of the strongest competitive advantages in business history by controlling design, supply chain, and the retail experience. Apple designs its own hardware and software, allowing full control over product quality and user experience. This vertical integration reduces reliance on external partners and ensures consistent performance, which strengthens Apple’s brand and operational efficiency.

High switching costs for consumers are another key advantage. Once customers enter the Apple ecosystem, switching becomes difficult due to compatibility, data integration, and emotional attachment. Products like the iPhone, MacBook, and Apple Watch work best together. Steve Jobs and Apple intentionally designed this ecosystem lock-in to increase customer retention and repeat purchases, which improves long-term revenue visibility.

Apple also benefits from strong bargaining power and global scale. Its massive production volumes give it leverage over suppliers, lowering costs while maintaining premium quality. Global scale allows Apple to launch products worldwide with strong demand from day one. This advantage supports consistent cash flows and protects profit margins even during competitive pressures.

Apple as a Long-Term Investment Case

Steve Jobs and Apple represent one of the strongest long-term investment stories in modern markets. During Jobs’ leadership, Apple’s stock performance reflected growing confidence in innovation, management quality, and strategic direction. Even after his passing, the foundation he built continued to deliver strong returns, proving the durability of his vision.

Innovation played a major role in sustaining investor confidence. Each product launch reinforced Apple’s reputation as a market leader. Steve Jobs and Apple consistently introduced category-defining products, which helped justify premium valuations. Innovation reduced competitive threats and ensured Apple stayed relevant in rapidly changing technology markets.

There are important lessons for long-term investors from Apple’s journey. First, companies with strong ecosystems tend to outperform over time. Second, brand loyalty and recurring revenue support valuation stability. Third, innovation-driven companies often compound wealth when managed properly. Steve Jobs and Apple show that patience and belief in fundamentals can outperform short-term trading strategies.

Management quality is a critical factor in valuation. Investors often underestimate the financial impact of leadership. Steve Jobs’ focus on excellence, discipline, and long-term thinking shaped Apple’s corporate culture. That culture continues to guide decision-making today. For investors, Apple demonstrates how strong leadership combined with innovation and brand power can create sustainable shareholder value over decades.

Key Investment Lessons from Steve Jobs

Steve Jobs and Apple provide timeless investment lessons that go beyond technology. One key lesson is that innovation creates durable value. Breakthrough products do more than generate sales; they redefine markets and build long-term competitive advantages. Investors benefit when companies focus on innovation rather than short-term earnings manipulation.

Another lesson is that brand equity can outperform price competition. Apple never competed by being the cheapest. Instead, it focused on quality, design, and user experience. Steve Jobs and Apple proved that strong brands can command premium pricing and higher margins, leading to superior long-term returns.

Visionary leadership matters greatly in capital allocation. Steve Jobs invested heavily in design, research, and talent, even when results were uncertain. These investments produced exponential returns over time. For investors, leadership decisions often determine whether capital is wasted or compounded.

Conclusion

Steve Jobs and Apple created one of the most remarkable business and investment stories in modern history. Through innovative product design, strong branding, and visionary leadership, Apple transformed from a small startup into a trillion-dollar company. Jobs’ focus on long-term thinking, ecosystem development, and customer loyalty built durable competitive advantages that continue to generate revenue and profits. For investors and business leaders, his philosophy shows that innovation, brand equity, and strategic leadership drive sustainable growth. Steve Jobs and Apple prove that combining creativity with financial discipline can create lasting shareholder value and global market dominance.

FAQs

Why is Apple considered a strong investment?

Apple is considered a strong investment because it combines brand loyalty, high-quality products, and a growing services ecosystem. The company consistently generates strong cash flow, which supports innovation and shareholder returns. Its recurring revenue from services like iCloud and Apple Music makes earnings more predictable. Apple also maintains global scale and supply chain control, reducing risks. Investors value its long-term growth strategy, financial discipline, and ability to create products that customers love, which helps sustain profitability over time.

How did Steve Jobs influence Apple’s stock growth?

Steve Jobs influenced Apple’s stock growth by focusing on innovation, premium products, and creating a unique ecosystem. Under his leadership, Apple launched game-changing products like the iPhone and iPad that attracted global customers. His long-term vision increased investor confidence and drove market demand. Jobs’ approach created high margins, repeat customers, and brand loyalty, which helped the company grow consistently. Investors benefited from strong financial results and long-term stock appreciation, making Apple a standout example of how leadership can impact a company’s market value.

What makes Apple’s ecosystem profitable?

Apple’s ecosystem is profitable because its products and services work together, encouraging customers to stay inside the Apple environment. Devices like iPhones, Macs, and Apple Watches connect seamlessly with services like the App Store and iCloud. This integration increases customer loyalty and repeat purchases. High switching costs make it difficult for users to leave. Services generate recurring income with low operating costs. Steve Jobs and Apple designed this ecosystem to create stable revenue streams, improve margins, and enhance the company’s long-term financial strength.