Real estate remains one of the strongest wealth-building assets because it offers steady income, long-term value growth, and protection against inflation. Unlike short-term investments, property allows investors to earn regular cash flow through rent while building equity over time. In this guide, we explore how smart real estate choices can help create financial stability and long-term wealth in 2026.

Market trends shaping real estate in 2026 include rising demand for rental housing, growth in urban and suburban areas, and increasing interest in sustainable and smart properties. Technology, flexible living spaces, and changing lifestyle needs are also influencing buying and investing decisions, creating new opportunities for real estate investors.

Short-Term Rentals and Airbnb Investments

Short-term rentals have become a popular real estate idea because travelers now prefer flexible, home-like stays instead of traditional hotels. Families, remote workers, and digital nomads look for fully furnished homes where they can stay for a few days, weeks, or even months. This growing demand for flexible stays has made platforms like Airbnb and Vrbo powerful tools for property owners. In 2026, tourism recovery, remote work culture, and frequent short trips continue to push demand for short-term rental properties.

The best locations for short-term rental success are areas with consistent visitor traffic. Tourist destinations, beach towns, hill stations, business hubs, and cities with major events perform well. Properties near airports, city centers, hospitals, universities, and popular attractions often achieve higher occupancy rates. Safety, local transport, and nearby amenities like restaurants and shopping also play a big role in guest satisfaction and repeat bookings.

Income potential from short-term rentals is often higher than traditional long-term renting, especially during peak seasons. A well-managed Airbnb can generate strong monthly cash flow if occupancy remains high. However, income can fluctuate due to seasonality, competition, and travel trends. Owners should also budget for cleaning, maintenance, utilities, and platform fees.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, commonly known as REITs, offer a simple way to invest in real estate without owning physical property. Passive real estate investing through REITs allows individuals to buy shares in companies that own income-generating properties such as offices, shopping malls, apartments, hotels, and warehouses. Investors earn returns mainly through dividends, which come from rental income and property profits.

One major benefit of REITs is diversification. Instead of putting all your money into one property, REITs spread investments across many properties and locations. This reduces risk if one property or market performs poorly. Another advantage is liquidity. Unlike physical real estate, REIT shares can be bought or sold easily on stock exchanges, making them more flexible for investors who may need quick access to their money.

REITs are attractive for wealth building because they provide regular income and long-term growth potential. Many REITs are required to distribute a large portion of their profits as dividends, which makes them appealing for income-focused investors. In 2026, REITs focused on logistics, data centers, healthcare facilities, and residential housing are expected to perform well due to changing economic and lifestyle trends.

REITs also require lower capital compared to buying property directly. This makes them suitable for beginners or investors who want exposure to real estate without dealing with tenants, repairs, or management issues.

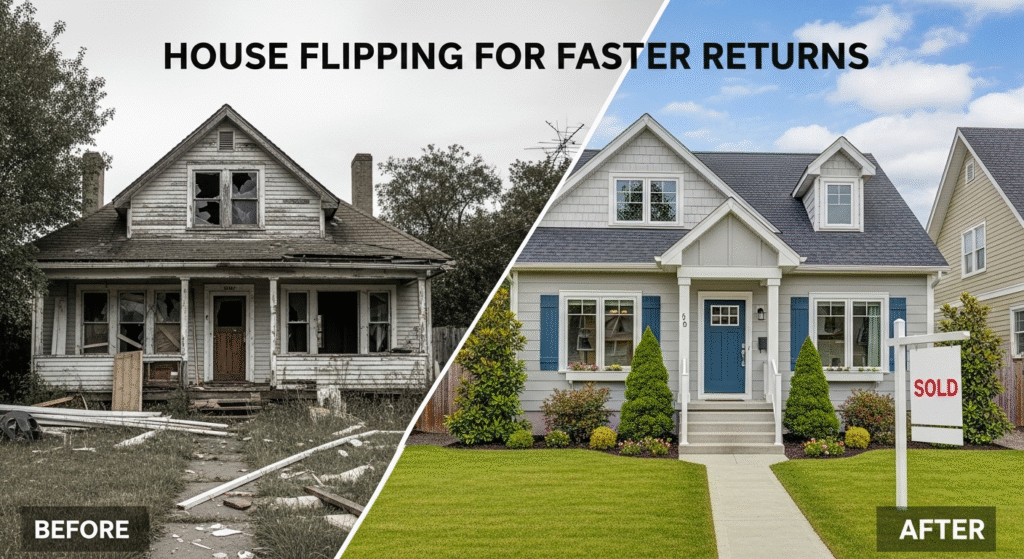

House Flipping for Faster Returns

House flipping is a real estate strategy focused on buying undervalued properties, renovating them, and selling them at a higher price. It attracts investors who want faster returns compared to long-term rentals. The key to success is finding properties that are priced below market value due to poor condition, urgent sales, or outdated interiors.

Finding undervalued properties requires research and patience. Foreclosures, distressed sales, auctions, and older neighborhoods often offer good opportunities. Investors should focus on locations with strong demand, good schools, and rising property values. Buying the right property at the right price is more important than expensive renovations.

Renovation strategies should focus on improvements that add the most value. Kitchens, bathrooms, flooring, lighting, and curb appeal usually provide the highest return on investment. Simple upgrades, neutral colors, and modern finishes can significantly increase buyer interest. Over-renovating should be avoided, as it can reduce profit margins.

Risk management and market timing are critical in house flipping. Unexpected repair costs, delays, or market slowdowns can impact profits. Investors should always keep a budget buffer and timeline flexibility. Understanding local property trends helps determine the best time to sell. In 2026, house flipping remains profitable in growing markets, but success depends on accurate cost estimation, smart renovation choices, and disciplined project management.

Commercial Real Estate Opportunities

Commercial real estate includes retail spaces, office buildings, industrial units, and warehouses. These properties are used for business purposes and often generate higher rental income than residential real estate. In 2026, commercial real estate continues to evolve as businesses adapt to new working and shopping patterns.

Retail properties in busy locations, office spaces designed for flexible work, and industrial warehouses for logistics and e-commerce are in strong demand. Warehouses and distribution centers, in particular, benefit from the growth of online shopping and supply chain expansion. Location and accessibility are key factors in commercial property success.

One major advantage of commercial real estate is long-term leases. Tenants often sign multi-year contracts, which provides stable and predictable income for property owners. Businesses are also more likely to handle maintenance and operational costs, reducing owner responsibilities. This makes commercial real estate attractive for investors seeking steady cash flow.

The role of commercial real estate in 2026 is shaped by technology, remote work trends, and global trade. Smart offices, energy-efficient buildings, and logistics hubs are gaining importance. While commercial properties usually require higher initial investment, they offer strong income potential and portfolio diversification.

Land Investment and Future Development

Land investment is one of the oldest and most powerful real estate ideas for long-term wealth creation. Unlike buildings, land does not depreciate in value, and its value often increases as cities expand. Buying land in growth corridors, areas expected to develop due to population growth or government planning, can generate significant returns over time. These corridors are usually located near highways, new housing projects, or upcoming commercial zones.

Infrastructure and urban expansion play a major role in land value appreciation. New roads, public transport systems, airports, schools, and hospitals can quickly increase demand for nearby land. When development moves outward from city centers, previously low-cost land becomes highly valuable. Investors who identify these trends early can benefit from substantial price appreciation without needing construction or rental management.

Land also offers flexibility. Investors can hold it for long-term appreciation, sell it to developers, or develop it themselves in the future. Maintenance costs are low compared to rental properties, and there are no tenants to manage. However, land investment requires patience, as returns usually come over several years rather than immediately.

The long-term wealth creation potential of land investment is strong in 2026 due to continued urbanization and population growth.

Real Estate Crowdfunding and Fractional Ownership

Real estate crowdfunding and fractional ownership allow investors to enter the property market with smaller capital. Instead of buying an entire property, investors contribute a portion of the total investment and receive proportional returns. This model has become popular due to digital platforms that connect investors with real estate developers and projects.

Investing with smaller capital makes real estate accessible to more people. Investors can start with limited funds and still benefit from rental income and property appreciation. Fractional ownership also allows diversification, as investors can spread their money across multiple projects instead of putting everything into one property.

One major advantage is access to premium real estate projects. Crowdfunding platforms often offer opportunities in commercial buildings, luxury apartments, hotels, and large residential developments that would normally require high capital. Professional management handles property operations, making this a passive investment option.

Affordable Housing Investments

Affordable housing investments focus on providing budget-friendly homes for low- and middle-income families. Rising living costs and rapid urban migration have increased demand for affordable housing in many cities. This makes it a strong real estate idea with both financial and social benefits.

The demand for affordable housing remains high because people always need basic, secure places to live. These properties often experience lower vacancy rates compared to luxury housing. Rent may be lower, but consistent occupancy provides stable and predictable income over time.

Government incentives play an important role in affordable housing investments. Many governments offer tax benefits, subsidies, and financing support to encourage developers and investors. These incentives can improve profitability while supporting social development. Investors also benefit from positive social impact by helping communities access safe and affordable living spaces.

Student Housing and Co-Living Spaces

Student housing and co-living spaces are growing rapidly due to increasing student populations and urban migration. More students are moving to cities for education, creating strong demand for safe and affordable accommodation near universities and colleges. This trend makes student housing a reliable real estate investment.

Higher rental yields are possible because multiple tenants share one property. Co-living models maximize space usage by offering private rooms with shared kitchens and common areas. This setup allows owners to earn more rent compared to traditional single-family rentals.

Shared living models also reduce vacancy risk. Even if one tenant leaves, the property continues generating income from others. Furnished units, flexible lease terms, and included utilities attract students and young professionals who value convenience and affordability.

Co-living works well in 2026 because lifestyle preferences are changing. Young people prefer community living, lower costs, and flexible contracts. With proper management and location selection, student housing and co-living spaces offer strong cash flow, high demand, and long-term growth potential for real estate investors.

Conclusion

Real estate offers many powerful ways to build wealth in 2026, whether through rentals, land, REITs, or modern living solutions like co-living and affordable housing. Each strategy has its own benefits, risks, and income potential, making it important to choose options that match your budget and long-term goals. Market trends, urban growth, and changing lifestyles continue to create new opportunities for smart investors. With proper research, patience, and diversification, real estate can provide steady income, long-term value growth, and financial security in the years ahead.

FAQs

How much money do I need to start investing in real estate?

The amount needed to start investing in real estate depends on the strategy you choose. Buying rental property usually requires a down payment and additional costs like taxes and maintenance. However, options such as REITs, crowdfunding, or fractional ownership allow investors to start with much smaller amounts. These choices make real estate accessible to beginners while still offering income and growth opportunities over time.

Is real estate a good investment during economic uncertainty?

Real estate is often considered a stable investment during uncertain economic times because people always need places to live and work. Rental income can provide regular cash flow, while property values tend to recover over time. Affordable housing and long-term rentals usually perform well during slow markets. Investors who focus on strong locations and manage debt carefully can reduce risk and maintain steady returns.

What skills are important for successful real estate investing?

Successful real estate investing requires basic financial planning, market research, and decision-making skills. Understanding property values, rental demand, and maintenance costs helps avoid mistakes. Communication and negotiation skills are also important when dealing with agents, tenants, or partners. While professional help is available, informed investors make better choices and manage risks more effectively in the long run.

Can real estate investing be passive?

Yes, real estate investing can be passive depending on the strategy you choose. REITs, crowdfunding, and professionally managed properties require little daily involvement. Even rental properties can be passive with the help of property managers. Passive investing allows individuals to earn income and grow wealth without handling repairs, tenants, or daily operations, making it suitable for busy investors.

How does inflation affect real estate investments?

Inflation often increases property values and rental income over time. As prices rise, rents can be adjusted, helping investors maintain purchasing power. Fixed-rate loans become easier to manage because income grows while loan payments stay the same. This makes real estate a useful hedge against inflation when compared to cash or low-return savings options.